HSBC 2014 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Report of the Directors: Risk (continued)

83

or property valuation indices and, where relevant,

desired levels of out-performance. The benchmarks are

reviewed at least triennially within 18 months of the

date at which an actuarial valuation is made, or more

frequently if required by local legislation or

circumstances. The process generally involves an

extensive asset and liability review.

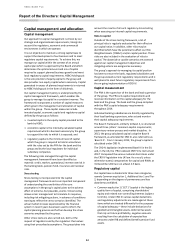

Ultimate responsibility for investment strategy rests with

either the trustees or, in certain circumstances, a

management committee. The degree of independence of

the trustees from the group varies in different

jurisdictions. The HSBC Bank (UK) Pension Scheme (the

principal plan) has both defined benefit and defined

contribution sections. For example, the principal plan,

which accounts for approximately 97 per cent of the

obligations of the group’s defined benefit pension plans,

is overseen by a corporate trustee who regularly

monitors the market risks inherent in the scheme.

The defined benefit section was closed to new entrants

in 1996 and from 1 July 2015 it will be closed to further

accrual for current employees who are in that section,

who will join the defined contribution section for future

pensions. All new employees have joined the defined

contribution section since 1996. The principal plan is

overseen by an independent corporate trustee who has

a fiduciary responsibility for the operation of the pension

plan. The trustee is responsible for monitoring and

managing the investment strategy and administration of

scheme benefits. The principal plan holds a diversified

portfolio of investments to meet future cash flow

liabilities arising from accrued benefits as they fall due to

be paid. The trustee of the principal plan is required to

produce a written Statement of Investment Principles

which governs decision-making about how investments

are made and the need for adequate diversification is

taken into account in the choice of asset allocation and

manager structure in the defined benefit section.

Longevity risk in the principal plan is assessed as part of

the measurement of the pension liability and managed

through the funding process of the plan.

The investment strategy of the principal plan is to hold

the majority of assets in bonds, with the remainder in

a more diverse range of investments, and includes a

portfolio of interest rate and inflation swaps in order to

reduce interest rate risk and inflation risk.

Sustainability risk

Sustainability risks arise from the provision of financial

services to companies or projects which run counter to

the needs of sustainable development; in effect this risk

arises when the environmental and social effects

outweigh economic benefits. Within Group Head Office,

a separate function, Global Corporate Sustainability, is

mandated to manage these risks globally working

through local offices as appropriate. Sustainability Risk

Managers have regional or national responsibilities for

advising on and managing environmental and social risks.