HSBC 2014 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Notes on the Financial Statements (continued)

150

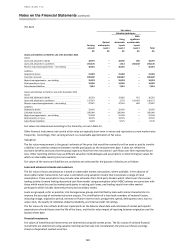

Deposits by banks and customer accounts

Fair values are estimated using discounted cash flows, applying current rates offered for deposits of similar remaining

maturities. The fair value of a deposit repayable on demand is approximated by its carrying value.

Debt securities in issue and subordinated liabilities

Fair values are determined using quoted market prices at the balance sheet date where available, or by reference to

quoted market prices for similar instruments.

Repurchase and reverse repurchase agreements – non-trading

Fair values are estimated using discounted cash flows, applying current rates. Fair values approximate carrying amounts as

their balances are generally short dated.

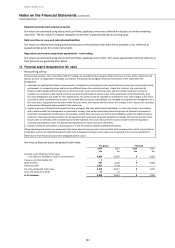

14 Financial assets designated at fair value

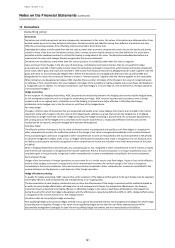

Accounting policy

Financial instruments, other than those held for trading, are classified in this category if they meet one or more of the criteria set out

below, and are so designated irrevocably at inception. The group may designate financial instruments at fair value when the

designation:

• eliminates or significantly reduces measurement or recognition inconsistencies that would otherwise arise from measuring financial

instruments, or recognising gains and losses on different bases from related positions. Under this criterion, the main class of

financial assets designated by the group are financial assets under unit-linked insurance and unit-linked investment contracts.

Liabilities to customers under linked contracts are determined based on the fair value of the assets held in the linked funds. If no

fair value designation was made for the related assets, the assets would be classified as available for sale, with changes in fair value

recorded in other comprehensive income. The related financial assets and liabilities are managed and reported to management on a

fair value basis. Designation at fair value of the financial assets and related liabilities allows the changes in fair values to be recorded

in the income statement and presented in the same line;

• applies to groups of financial instruments that are managed, and their performance evaluated, on a fair value basis in accordance

with a documented risk management or investment strategy, and where information about the groups of financial instruments is

reported to management on that basis. For example, certain financial assets are held to meet liabilities under non-linked insurance

contracts. The group has documented risk management and investment strategies designed to manage and monitor market risk of

those assets on net basis, after considering non-linked liabilities. Fair value measurement is also consistent with the regulatory

reporting requirements under the appropriate regulations for those insurance operations;

• relates to financial instruments containing one or more non-closely related embedded derivatives.

Designated financial assets are recognised at fair value when the group enters into contracts with counterparties, which is generally on

trade date, and are normally derecognised when sold. Subsequent changes in fair values are recognised in the income statement in

‘Net income from financial instruments designated at fair value’.

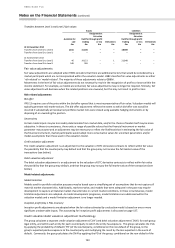

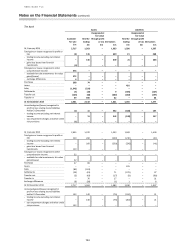

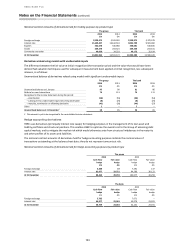

Fair value of financial assets designated at fair value:

The group

The bank

2014

2013

2014

2013

£m

£m

£m

£m

Financial assets designated at fair value:

– not subject to repledge or resale by counterparties

6,899

16,661

9

3,983

Treasury and other eligible bills

3

-

–

-

Debt securities

987

6,903

9

3,983

Equity securities

5,855

9,714

–

-

Securities designated at fair value

6,845

16,617

9

3,983

Loans and advances to banks

54

44

–

-

At 31 December

6,899

16,661

9

3,983