HSBC 2014 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200

|

|

HSBC BANK PLC

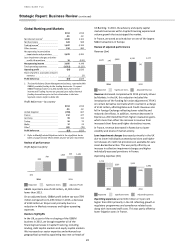

Strategic Report: Business Review (continued)

24

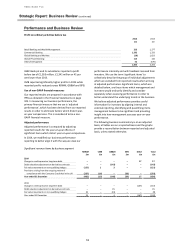

Other

2014

2013

£m

£m

Net interest income

(42)

(73)

Net fee income

2

3

Trading income

24

(22)

Change in credit spread on long

-

term debt

17

(167)

Other income

323

102

Net operating

income before

impairments and provisions

324

(157)

Loan impairment charges and other

credit risk provisions

1

–

Net operating income/(expense)

325

(157)

Total operating expenses

(273)

(222)

Operating (loss)/profit

52

(379)

Share of profit in associates and joint

ventures

–

–

Profit/(loss) before tax

52

(379)

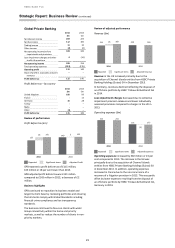

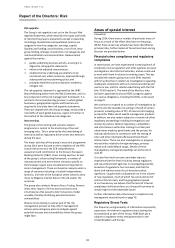

Profit before tax (£m)

Other profit before tax was £52 million compared to a

loss of £379 million in 2013, an increase of £431 million.

Other adjusted profit before tax was £70 million

compared to a loss of £182 million in 2013, an increase

of £252 million.

Review of adjusted performance

Revenue (£m)

Revenue increased primarily due to gain arising from

external hedging of an intra-group financing transaction

of £114 million and favourable fair value movements of

£25 million from interest and exchange rate

ineffectiveness in the hedging of long-term debt issued

principally by the group in 2014 compared to adverse

movements of £46 million in 2013.

In addition, other operating income and other operating

expenses increased as a result of higher intra-group

recharges in line with the increase in costs from

centralised activities.

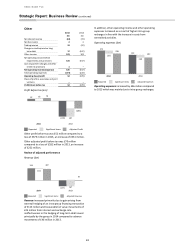

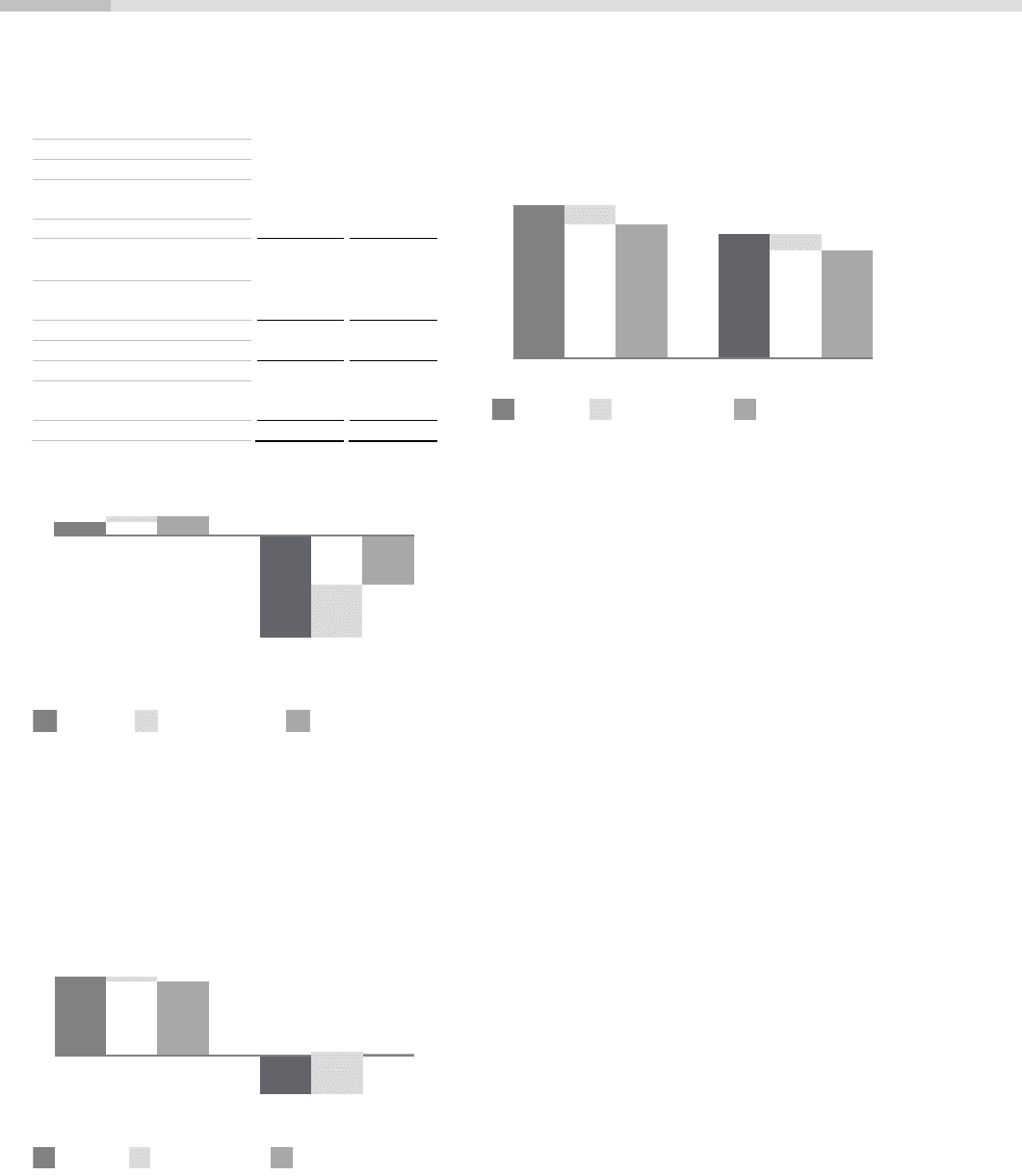

Operating expenses (£m)

Operating expenses increased by £46 million compared

to 2013 which was mainly due to intra-group recharges.

52

(379)

18 70

197

(182)

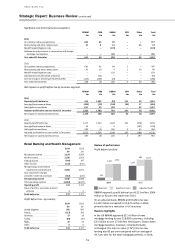

2014

2013

Adjusted Profit

Reported

Significant items

324

(157)

(17)

307

167

10

2014

2013

Adjusted RevenueReported

Significant items

273

222

(35)

238

(30)

192

2014

2013

Adjusted ExpensesReported

Significant items