HSBC 2014 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Strategic Report: Business Review (continued)

20

the business expanded its mortgage distribution

channels to include a specific intermediary, in order to

reach the growing percentage of the mortgage finance

market in the UK who wish to source their finance

through intermediaries

In France, RBWM continued to experience strong growth

in home loans. In Turkey, interest rate caps imposed on

credit cards and overdrafts by the regulator resulted in a

reduction in revenue.

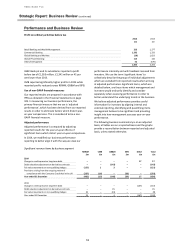

Review of adjusted performance

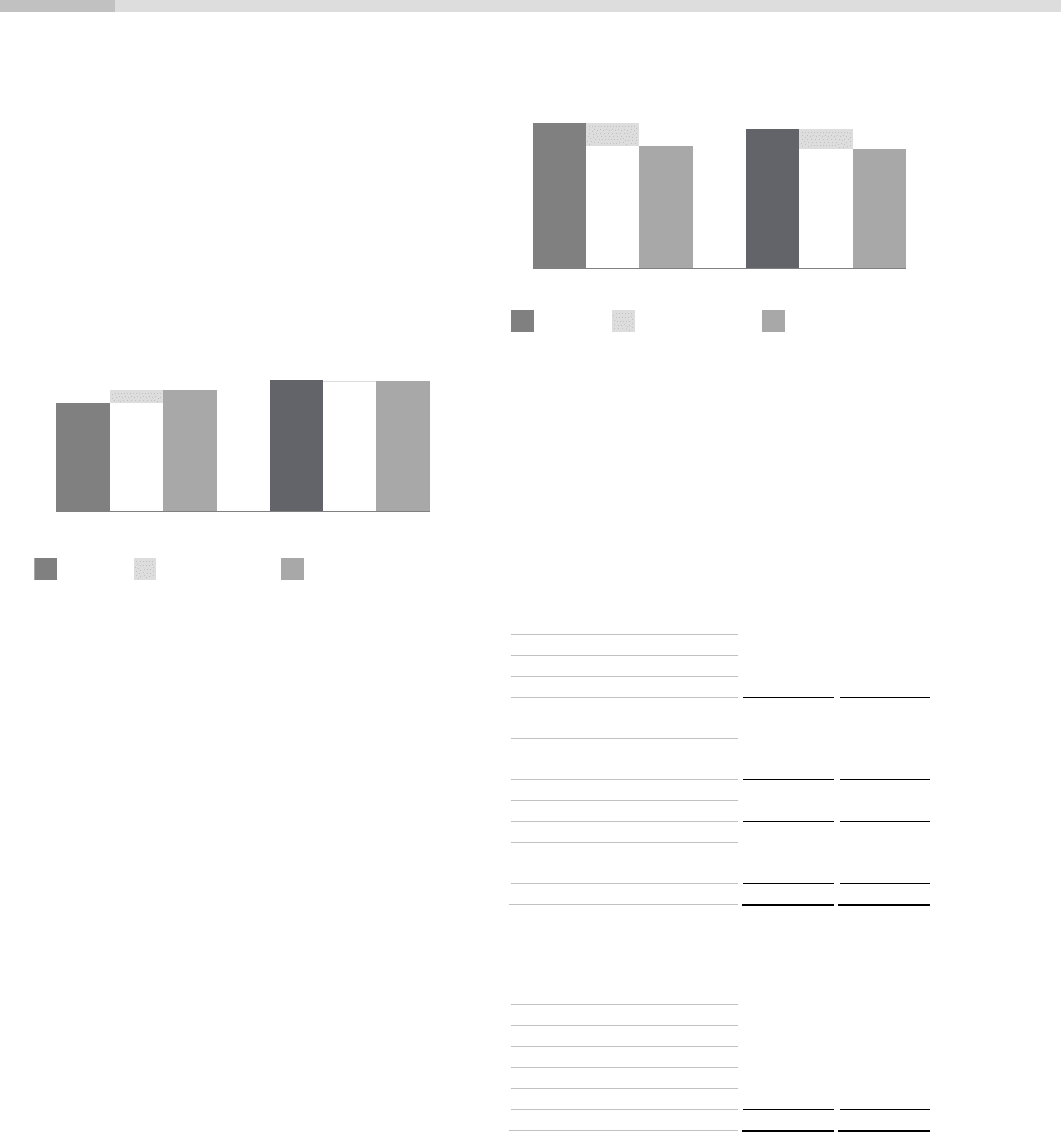

Revenue (£m)

Revenue decreased by £338 million mainly in the UK and

to a lesser extent in France and Turkey.

UK revenue reduced marginally due to spread

compression, primarily on mortgages. In addition, fee

income fell as a result of higher fees payable under

partnership agreements and lower fee income from

investment products and overdrafts. These factors were

partly offset by improved spreads on savings products

and higher current account balances.

In France, revenues were lower primarily in the

insurance business due to adverse movements in the

Present Value of In-Force (‘PVIF’) business, reflecting a

fall in yields which increased the costs of guarantees on

the savings business, compared to favourable

movements in 2013. In addition, revenues in Turkey

were adversely affected by a reduction in net interest

income primarily due to interest rate caps on cards and

overdrafts imposed by the local regulator, partly offset

by an increase in card fees.

Loan impairment charges decreased in the UK due to

lower delinquency levels in the improved economic

environment and as customers continued to reduce

outstanding credit card and loan balances. This was

partly offset by an increase in Turkey due to regulatory

changes adversely impacting the card portfolio.

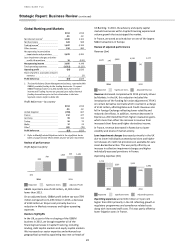

Operating expenses (£m)

Operating expenses were £72 million or 2 per cent

higher than 2013. In the UK this reflected the timing of

the recognition of the Financial Services Compensation

Scheme (‘FSCS’) levy and an increase in compliance and

regulatory programme expenses in line with the

implementation of Global Standards. This was partly

offset by sustainable cost savings.

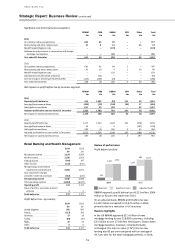

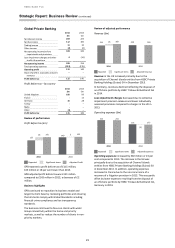

Commercial Banking

2014

2013

£m

£m

Net interest income

2,195

2,144

Net fee income

1,153

1,143

Trading income

21

23

Other income

65

60

Net operating income before

impairments and provisions

3,434

3,370

Loan impairment charges and other

credit risk provisions

(308)

(601)

Net operating income

3,126

2,769

Total operating expenses

(1,535)

(1,437)

Operating profit

1,591

1,332

Share of profit in associates and joint

ventures

1

1

Profit before tax

1,592

1,333

Profit before tax – by country

2014

2013

£m

£m

United Kingdom

1,377

1,075

France

146

163

Germany

43

45

Turkey

2

24

Malta

10

33

Other

14

(7)

Profit before tax

1,592

1,333

4,208

5,071

492 4,700

(33)

5,038

2014

2013

Adjusted RevenueReported

Significant items

3,834 3,673

(617)

3,217

(528)

3,145

2014

2013

Adjusted ExpensesReported

Significant items