HSBC 2014 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Report of the Directors: Risk (continued)

39

exchange for a commitment to repay the remaining

balance.

In the event of bankruptcy or analogous proceedings,

write-off for both personal and wholesale lending may

occur earlier than at the periods stated above.

Collections procedures may continue after write-off.

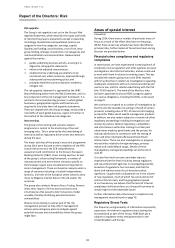

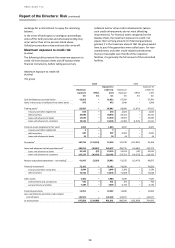

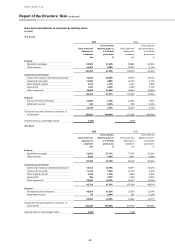

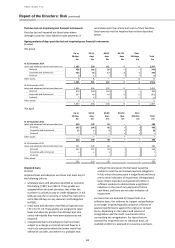

Maximum exposure to credit risk

(Audited)

The following table presents the maximum exposure to

credit risk from balance sheet and off-balance sheet

financial instruments, before taking account any

collateral held or other credit enhancements (where

such credit enhancements do not meet offsetting

requirements). For financial assets recognised on the

balance sheet, the maximum exposure to credit risk

equals their carrying amount; for financial guarantees

granted, it is the maximum amount that the group would

have to pay if the guarantees were called upon. For loan

commitments and other credit-related commitments

that are irrevocable over the life of the respective

facilities, it is generally the full amount of the committed

facilities.

Maximum exposure to credit risk

(Audited)

The group

2014

2013

Maximum

exposure

Offset

Exposure to

credit risk

(net)

Maximum

exposure

Offset

Exposure to

credit risk

(net)

£m

£m

£m

£m

£m

£m

Cash and balances at central banks

42,853

–

42,853

67,584

–

67,584

Items in the course of collection from other banks

973

–

973

1,948

–

1,948

Trading assets1

85,885

–

85,885

98,090

(1,075)

97,015

treasury and other eligible bills

653

–

653

2,623

–

2,623

debt securities

49,996

–

49,996

56,414

–

56,414

loans and advances to banks

15,640

–

15,640

16,067

–

16,067

loans and advances to customers

19,596

–

19,596

22,986

(1,075)

21,911

Financial assets designated at fair value1

1,044

–

1,044

6,947

–

6,947

treasury and other eligible bills

3

–

3

–

–

–

debt securities

987

–

987

6,903

–

6,903

loans and advances to banks

54

–

54

44

–

44

Derivatives2

187,736

(174,118)

13,618

137,239

(112,931)

24,308

Loans and advances held at amortised cost3

282,514

(36,687)

245,827

296,735

(54,462)

242,273

loans and advances to banks

25,262

(37)

25,225

23,013

(92)

22,921

loans and advances to customers

257,252

(36,650)

220,602

273,722

(54,370)

219,352

Reverse repurchase agreements – non-trading3

41,945

(3,283)

38,662

61,525

(13,470)

48,055

Financial investments1

75,185

–

75,185

74,024

–

74,024

treasury and other similar bills

2,849

–

2,849

2,196

–

2,196

debt securities

72,336

–

72,336

71,828

–

71,828

Other assets

7,980

–

7,980

7,439

–

7,439

endorsements and acceptances

591

–

591

703

–

703

accrued income and other

7,389

–

7,389

6,736

–

6,736

Financial guarantees

13,452

–

13,452

11,846

–

11,846

Loan commitments and other credit

-related

commitments

135,522

–

135,522

123,017

–

123,017

At 31 December

875,089

(214,088)

661,001

886,394

(181,938)

704,456