HSBC 2014 Annual Report Download - page 188

Download and view the complete annual report

Please find page 188 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Notes on the Financial Statements (continued)

186

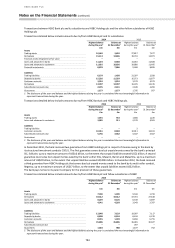

37 Legal proceedings and regulatory matters

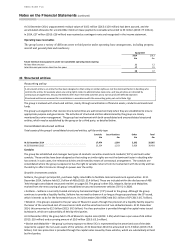

The group is party to legal proceedings, investigations and regulatory matters in a number of jurisdictions arising out of its

normal business operations. Apart from the matters described below, the group considers that none of these matters are

material. The recognition of provisions is determined in accordance with the accounting policies set out in Note 27. While

the outcome of legal proceedings and regulatory matters is inherently uncertain, management believes that, based on the

information available to it, appropriate provisions have been made in respect of these matters as at 31 December 2014.

Where an individual provision is material, the fact that a provision has been made is stated and quantified. Any provision

recognised does not constitute an admission of wrongdoing or legal liability. It is not practicable to provide an aggregate

estimate of the potential liability for our legal proceedings and regulatory matters as a class of contingent liabilities.

Bernard L. Madoff Investment Securities LLC

Bernard L. Madoff (‘Madoff’) was arrested in December 2008, and ultimately pleaded guilty to running a Ponzi scheme. He

has acknowledged, in essence, that while purporting to invest his customers’ money in securities, he in fact never invested

in securities and used other customers’ money to fulfil requests to return investments. His firm, Bernard L. Madoff

Investment Securities LLC (‘Madoff Securities’), is being liquidated by a trustee (the ‘Trustee’).

Various non-US HSBC companies provided custodial, administration and similar services to a number of funds

incorporated outside the US whose assets were invested with Madoff Securities. Based on information provided by

Madoff Securities, as at 30 November 2008, the purported aggregate value of these funds was US$8.4 billion, an amount

that includes fictitious profits reported by Madoff. Based on information available to HSBC, we have estimated that the

funds’ actual transfers to Madoff Securities minus their actual withdrawals from Madoff Securities during the time that

HSBC serviced the funds totalled approximately US$4 billion. Various HSBC companies have been named as defendants in

lawsuits arising out of Madoff Securities’ fraud.

US/UK Litigation: The Trustee has brought suits against various HSBC companies in the US Bankruptcy Court and in the

English High Court. The Trustee’s US actions included common law claims, alleging that HSBC aided and abetted Madoff’s

fraud and breach of fiduciary duty. Those claims were dismissed on grounds of lack of standing. The Trustee’s remaining

US claims seek recovery of prepetition transfers pursuant to US bankruptcy law. The amount of these remaining claims

has not been pleaded or determined as against HSBC.

Alpha Prime Fund Ltd (‘Alpha Prime’) and Senator Fund SPC, co-defendants in the Trustee’s US actions, have brought

cross-claims against HSBC. These funds have also sued HSBC in Luxembourg (discussed below).

The Trustee’s English action seeks recovery of unspecified transfers from Madoff Securities to or through HSBC. HSBC has

not yet been served with the Trustee’s English action. The Trustee’s deadline for serving the claim has been extended

through the third quarter of 2015.

Fairfield Sentry Limited, Fairfield Sigma Limited, and Fairfield Lambda Limited (collectively ‘Fairfield’), funds whose assets

were invested with Madoff Securities, commenced multiple suits in the US and the British Virgin Islands (the ‘BVI’) against

fund shareholders, including various HSBC companies that acted as nominees for HSBC clients, seeking restitution of

payments made in connection with share redemptions. The US actions brought by Fairfield are stayed pending the

outcome of the Fairfield cases in the BVI (discussed below).

In September 2013, the US Court of Appeals for the Second Circuit affirmed the dismissal of purported class action claims

against HSBC and others brought by investors in three Madoff-invested funds on grounds of forum non conveniens. The

plaintiffs’ petitions for certiorari to the US Supreme Court were filed in December 2014. The Supreme Court’s decision on

whether to grant certiorari review is expected in the first half of 2015.

In December 2014, three new Madoff-related actions were filed. The first is a purported class action brought by direct

investors in Madoff Securities who were holding their investments as of December 2008, asserting various common law

claims and seeking to recover damages lost to Madoff Securities’ fraud on account of HSBC’s purported knowledge and

alleged furtherance of the fraud. The other two actions were filed by SPV Optimal SUS Ltd (‘SPV Optimal’), the purported

assignee of the Madoff Securities-invested company, Optimal Strategic US Equity Ltd. One of these actions was filed in

New York state court and the other in US federal district court. In January 2015, SPV Optimal dismissed its federal lawsuit

against HSBC. The state court action against HSBC remains pending.

BVI Litigation: Beginning in October 2009, the Fairfield funds whose assets were directly or indirectly invested with

Madoff Securities, commenced multiple suits in the BVI against numerous fund shareholders, including various HSBC

companies that acted as nominees for clients of HSBC’s private banking business and other clients who invested in the

Fairfield funds. The Fairfield funds are seeking restitution of redemption payments made by the funds to defendants on

the grounds that they were mistakenly based on inflated net asset values. In April 2014, the UK Privy Council issued a

ruling on two preliminary issues in favour of other defendants in the BVI actions, and issued its order in October 2014.

There is also a pending motion brought by other defendants before the BVI court challenging the Fairfield liquidator’s

authorisation to pursue its claims in the US. The BVI court has adjourned the hearing on that pending motion until March

2015.

Bermuda Litigation: Thema Fund Limited (‘Thema’) and Hermes International Fund Limited (‘Hermes’), funds invested

with Madoff Securities, each also brought three actions in Bermuda in 2009. The first set of actions were brought against