HSBC 2014 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

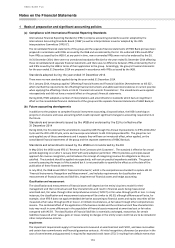

Notes on the Financial Statements (continued)

119

– management’s judgment as to whether current economic and credit conditions are such that the actual level of

inherent losses at the balance sheet date is likely to be greater or less than that suggested by historical

experience.

The period between a loss occurring and its identification is estimated by local management for each identified

portfolio based on economic and market conditions, customer behaviour, portfolio management information, credit

management techniques and collection and recovery experiences in the market. As it is assessed empirically on a

periodic basis the estimated period may vary over time as these factors change.

Homogeneous groups of loans and advances

Statistical methods are used to determine collective impairment losses for homogeneous groups of loans not

considered individually significant. Losses in these groups of loans are recorded individually when individual loans are

removed from the group and written off. The methods that are used to calculate collective allowances are:

– When appropriate empirical information is available, the group utilises roll-rate methodology, which employs

statistical analyses of historical data and experience of delinquency and default to reliably estimate the amount of

the loans that will eventually be written off as a result of the events occurring before the balance sheet date but

which the group is not able to identify individually. Individual loans are grouped using ranges of past due days;

statistical analysis is then used to estimate the likelihood that loans in each range will progress through the various

stages of delinquency and become irrecoverable. Additionally, individual loans are segmented based on their

credit characteristics as described above. In applying this methodology, adjustments are made to estimate the

periods of time between a loss event occurring and its discovery, for example through a missed payment, (known

as the emergence period) and the period of time between discovery and write-off (known as the outcome period).

Current economic conditions are also evaluated when calculating the appropriate level of allowance required to

cover inherent loss. In certain highly developed markets, sophisticated models also take into account behavioural

and account management trends as revealed in, for example, bankruptcy and rescheduling statistics.

– When the portfolio size is small or when information is insufficient or not reliable enough to adopt a roll-rate

methodology, the group adopts a basic formulaic approach based on historical loss rate experience, or a

discounted cash flow model. Where a basic formulaic approach is undertaken, the period between a loss event

occurring and its identification is explicitly estimated by local management and it is typically between six and

twelve months.

The inherent loss within each portfolio is assessed on the basis of statistical models using historical data observations,

which are updated periodically to reflect recent portfolio and economic trends. When the most recent trends arising

from changes in economic, regulatory or behavioural conditions are not fully reflected in the statistical models, they

are taken into account by adjusting the impairment allowances derived from the statistical models to reflect these

changes as at the balance sheet date.

Write-off of loans and advances

Loans (and the related impairment allowance accounts) are normally written off, either partially or in full, when there

is no realistic prospect of recovery. Where loans are secured, this is generally after receipt of any proceeds from the

realisation of security. In circumstances where the net realisable value of any collateral has been determined and

there is no reasonable expectation of further recovery, write-off may be earlier.

Reversals of impairment

If the amount of an impairment loss decreases in a subsequent period, and the decrease can be related objectively to

an event occurring after the impairment was recognised, the excess is written back by reducing the loan impairment

allowance account accordingly. The write-back is recognised in the income statement.

Assets acquired in exchange for loans

Non-financial assets acquired in exchange for loans as part of an orderly realisation are recorded as ‘Assets held for

sale’ and reported in ‘Other assets’ if those assets are classified as held for sale. The asset acquired is recorded at the

lower of its fair value less costs to sell and the carrying amount of the loan (net of impairment allowance) at the date

of exchange. No depreciation is charged in respect of assets held for sale. Impairments and reversal of previous

impairments are recognised in the income statement, in ‘Other operating income’, together with any realised gains or

losses on disposal.

Renegotiated loans

Loans subject to collective impairment assessment whose terms have been renegotiated are no longer considered

past due, but are treated as up to date loans for measurement purposes once a minimum number of payments

required have been received. They are segregated from other parts of the loan portfolio for the purposes of

collective impairment assessment, to reflect their risk profile. Loans subject to individual impairment assessment,

whose terms have been renegotiated, are subject to ongoing review to determine whether they remain impaired.

The carrying amounts of loans that have been classified as renegotiated retain this classification until maturity or

derecognition.

A loan that is renegotiated is derecognised if the existing agreement is cancelled and a new agreement made on

substantially different terms, or if the terms of an existing agreement are modified, such that the renegotiated loan is