HSBC 2014 Annual Report Download - page 175

Download and view the complete annual report

Please find page 175 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Notes on the Financial Statements (continued)

173

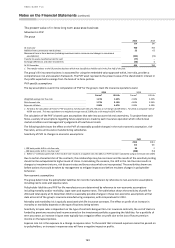

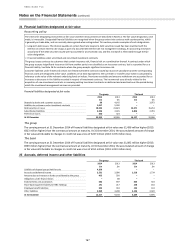

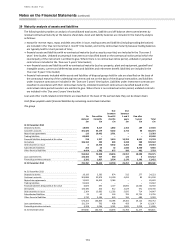

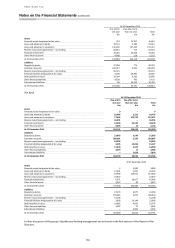

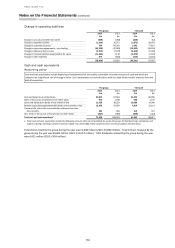

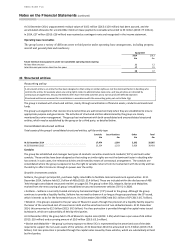

29 Maturity analysis of assets and liabilities

The following table provides an analysis of consolidated total assets, liabilities and off-balance sheet commitments by

residual contractual maturity at the balance sheet date. Asset and liability balances are included in the maturity analysis

as follows:

• except for reverse repos, repos and debt securities in issue, trading assets and liabilities (including trading derivatives)

are included in the ‘Due not more than 1 month’ time bucket, and not by contractual maturity because trading balances

are typically held for short periods of time;

• financial assets and liabilities with no contractual maturity (such as equity securities) are included in the ‘Due over 5

years’ time bucket. Undated or perpetual instruments are classified based on the contractual notice period which the

counterparty of the instrument is entitled to give. Where there is no contractual notice period, undated or perpetual

contracts are included in the ‘Due over 5 years’ time bucket;

• non-financial assets and liabilities with no contractual maturity (such as property, plant and equipment, goodwill and

intangible assets, current and deferred tax assets and liabilities and retirement benefit liabilities) are included in the

‘Due over 5 years’ time bucket;

• financial instruments included within assets and liabilities of disposal groups held for sale are classified on the basis of

the contractual maturity of the underlying instruments and not on the basis of the disposal transaction; and liabilities

under insurance contracts are included in the ‘Due over 5 years’ time bucket. Liabilities under investment contracts are

classified in accordance with their contractual maturity. Undated investment contracts are classified based on the

contractual notice period investors are entitled to give. Where there is no contractual notice period, undated contracts

are included in the ‘Due over 5 years’ time bucket.

Loan and other credit-related commitments are classified on the basis of the earliest date they can be drawn down.

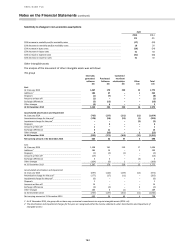

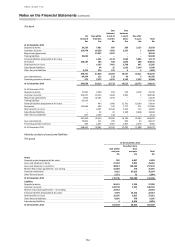

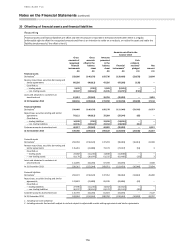

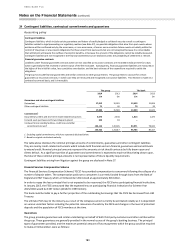

Cash flows payable under financial liabilities by remaining contractual maturities

The group

On

demand

Due within

3 months

Due

between

3 and 12

months

Due

between

1 and 5

years

Due after

5 years

Total

£m

£m

£m

£m

£m

£m

At 31 December 2014

Deposits by banks

18,890

6,217

1,062

1,352

109

27,630

Customer accounts

301,426

33,179

9,262

2,710

98

346,675

Repurchase agreements

110

19,492

3,781

–

–

23,383

Trading liabilities

82,600

–

–

–

–

82,600

Financial liabilities designated at fair value

218

1,257

3,419

10,204

8,651

23,749

Derivatives

186,160

183

683

2,248

268

189,542

Debt securities in issue

3

13,753

9,542

5,203

852

29,353

Subordinated liabilities

203

45

32

1,040

8,530

9,850

Other financial liabilities

4,454

1,782

875

200

482

7,793

594,064

75,908

28,656

22,957

18,990

740,575

Loan commitments

134,306

707

380

124

5

135,522

Financial guarantee contracts

3,392

1,827

3,754

2,176

2,303

13,452

At 31 December 2014

731,762

78,442

32,790

25,257

21,298

889,549

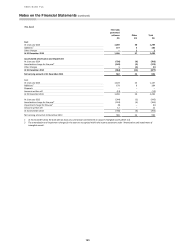

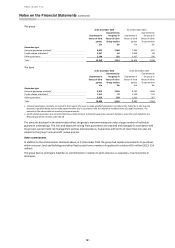

At 31 December 2013

Deposits by banks

19,193

3,365

874

512

277

24,221

Customer accounts

303,886

32,870

10,290

4,059

85

351,190

Repurchase agreements

11,841

44,695

9,084

–

–

65,620

Trading liabilities

91,842

–

–

–

–

91,842

Financial liabilities designated at fair value

6,825

493

1,477

15,692

14,063

38,550

Derivatives

135,490

204

912

2,529

571

139,706

Debt securities in issue

2,364

13,682

12,392

5,695

714

34,847

Subordinated liabilities

33

62

144

783

12,734

13,756

Other financial liabilities

1,730

5,494

922

194

680

9,020

573,204

100,865

36,095

29,464

29,124

768,752

Loan commitments

121,324

792

408

459

34

123,017

Financial guarantee contracts

3,328

1,066

3,591

1,842

2,019

11,846

At 31 December 2013

697,856

102,723

40,094

31,765

31,177

903,615