HSBC 2014 Annual Report Download - page 194

Download and view the complete annual report

Please find page 194 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Notes on the Financial Statements (continued)

192

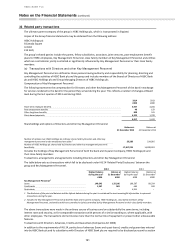

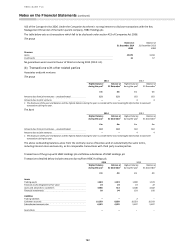

413 of the Companies Act 2006. Under the Companies Act there is no requirement to disclose transactions with the Key

Management Personnel of the bank’s parent company, HSBC Holdings plc.

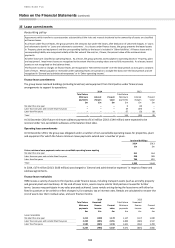

The table below sets out transactions which fall to be disclosed under section 413 of Companies Act 2006.

The group

Balance at

31 December 2014

Balance at

31 December 2013

£000

£000

Directors

Loans

12,975

3,493

Credit cards

61

57

No guarantees were issued in favour of Directors during 2014 (2013: nil).

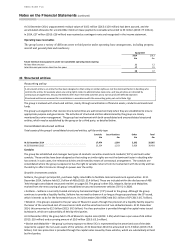

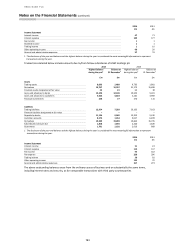

(b) Transactions with other related parties

Associates and joint ventures

The group

2014

2013

Highest balance

during the year1

Balance at

31 December1

Highest balance

during the year1

Balance at

31 December1

£m

£m

£m

£m

Amounts due from joint ventures – unsubordinated

132

132

182

182

Amounts due to joint ventures

–

–

4

4

1 The disclosure of the year-end balance and the highest balance during the year is considered the most meaningful information to represent

transactions during the year.

The bank

2014

2013

Highest balance

during the year1

Balance at

31 December1

Highest balance

during the year1

Balance at

31 December1

£m

£m

£m

£m

Amounts due from joint ventures – unsubordinated

132

132

182

182

Amounts due to joint ventures

–

–

4

4

1 The disclosure of the year-end balance and the highest balance during the year is considered the most meaningful information to represent

transactions during the year.

The above outstanding balances arose from the ordinary course of business and on substantially the same terms,

including interest rates and security, as for comparable transactions with third party counterparties.

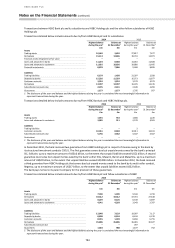

Transactions of the group with HSBC Holdings plc and fellow subsidiaries of HSBC Holdings plc

Transactions detailed below include amounts due to/from HSBC Holdings plc.

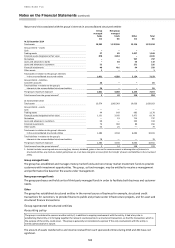

2014

2013

Highest balance

during the year1

Balance at

31 December1

Highest balance

during the year1

Balance at

31 December1

£m

£m

£m

£m

Assets

Trading assets

1,824

1,319

1,982

1,574

Financial assets designated at fair value

23

23

23

22

Loans and advances to customers

3,966

513

4,580

3,582

Financial investments

99

94

103

100

Liabilities

Trading liabilities

–

–

2

–

Customer accounts

10,993

8,689

10,033

10,033

Subordinated amounts due

6,025

4,035

5,827

5,827

Guarantees

–

–

–

–