HSBC 2014 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Report of the Directors

31

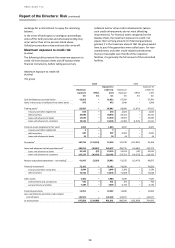

Results for 2014

The consolidated profit for the year attributable to the

shareholders of the bank was £1,354 million.

Interim dividends of £630 million, in lieu of a final

dividend in respect of the previous financial year, and

£600 million were paid on the ordinary share capital

during the year.

A second interim dividend, in lieu of a final dividend, of

£315 million was declared after 31 December 2014,

payable on 25 February 2015.

Further information about the results is given in the

consolidated income statement on page 105.

Information about future developments likely to affect

the group is given in the Strategic Report.

Risk Management

As a provider of banking and financial services, the group

actively manages risk as a core part of its day-to-day

activities. The growth in the group’s business during

2014 was achieved while risks were assumed in a

measured manner in line with the risk appetite and risks,

particularly reputational and operational, were mitigated

when they exceeded the group’s risk appetite.

The group continues to maintain a very strong liquidity

position and is well positioned for the changing

regulatory landscape.

The group maintained its conservative risk profile by

reducing exposure to the most likely areas of stress:

• the group selectively managed its exposure to

sovereign debt and bank counterparties to ensure

that the overall quality of the portfolio remained

strong;

• the group regularly assessed higher risk countries

and adjusted its risk appetite and exposures

accordingly;

• the group repositioned certain portfolios and, in

addition, made its client selection filters more

robust in managing the risk of financial crime; and

• the group mitigated risks, for example reputational

and operational, when they were forecast to exceed

its risk appetite.

Managing Risk

(Unaudited)

All the group’s activities involve, to varying degrees, the

analysis, evaluation, acceptance and management of

risks or combinations of risks.

An established risk governance framework and

ownership structure ensures oversight of and

accountability for the effective management of risk. The

group’s risk management framework fosters the

continuous monitoring of the risk environment and an

integrated evaluation of risks and their interactions.

Integral to the group’s risk management framework are

risk appetite, stress testing and the identification of

emerging risks.

The group’s risk management framework is designed to

provide appropriate risk monitoring and assessment. The

bank's Risk Committee focuses on risk governance and

provides a forward-looking view of risks and their

mitigation.

The Risk Committee is a committee of the Board and has

responsibility for oversight and advice to the Board on,

inter alia, the bank’s risk appetite, tolerance and

strategy, systems of risk management, internal control

and compliance. Additionally, members of the Risk

Committee attend meetings of the Chairman’s

Nominations and Remuneration Committee at which the

alignment of the reward structures to risk appetite is

considered. The Risk Committee maintains and develops

a supportive culture in relation to the management of

risk, appropriately embedded by executive management

through procedures, training and leadership actions.

In carrying out its responsibilities, the Risk Committee is

closely supported by the Chief Risk Officer, the Chief

Financial Officer, the Head of Internal Audit and the

Head of Compliance, together with other business

functions on risks within their respective areas of

responsibility.

Risk culture

All employees are required to identify, assess and

manage risk within the scope of their assigned

responsibilities. Global Standards set the tone from the

top and are central to the group’s approach to balancing

risk and reward. Personal accountability is reinforced by

the HSBC Values, with employees expected to act with

courageous integrity in conducting their duties.

Employees are supported by a disclosure line which

enables them to raise concerns in a confidential manner.

The group also has in place a suite of mandatory training

to ensure a clear and consistent attitude is

communicated to staff; mandatory training not only

focuses on the technical aspects of risk but also on the

group’s attitude towards risk and the behaviours

expected by its policies.

The risk culture is reinforced by the Group’s approach to

remuneration; individual awards are based on the

achievement of both financial and non-financial (relating

to the HSBC Values) objectives which are aligned to the

global strategy.

Risk profile

Risks are assumed by the Global Businesses in

accordance with their risk appetite and managed at

global business and regional levels. Risks are identified

through the group’s risk map process which sets out the

group’s risk profile in relation to key risk categories in

the regional and global businesses. Risks are regularly

assessed through the group’s risk appetite framework,

stress testing process and in terms of emerging risks.

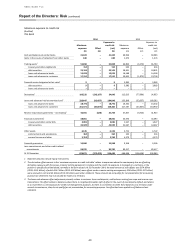

Credit, market and operational risk are measured using

the Basel 2 Pillar 1 framework for regulatory capital

through the allocation of risk-weighted assets

Other risks are also measured through the group’s

economic capital model under Pillar 2.