HSBC 2014 Annual Report Download - page 154

Download and view the complete annual report

Please find page 154 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Notes on the Financial Statements (continued)

152

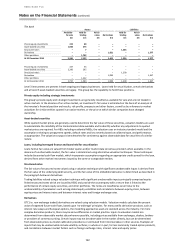

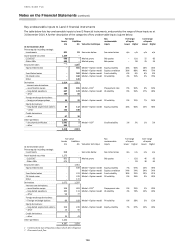

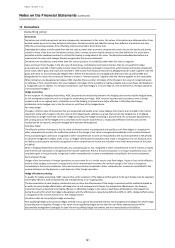

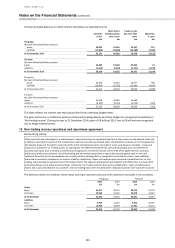

Fair values of derivatives by product contract type held by

The group

Assets

Liabilities

Trading

Hedging

Total

Trading

Hedging

Total

£m

£m

£m

£m

£m

£m

Foreign exchange

43,265

378

43,643

(44,754)

(53)

(44,807)

Interest rate

275,371

1,037

276,408

(271,602)

(2,068)

(273,670)

Equities

7,379

–

7,379

(8,916)

–

(8,916)

Credit

4,650

–

4,650

(5,214)

–

(5,214)

Commodity and other

1,826

–

1,826

(1,841)

–

(1,841)

Gross total fair values

332,491

1,415

333,906

(332,327)

(2,121)

(334,448)

Offset

(146,170)

146,170

At 31 December 2014

187,736

(188,278)

Foreign exchange

32,851

245

33,096

(33,644)

(159)

(33,803)

Interest rate

244,392

997

245,389

(240,448)

(1,809)

(242,257)

Equities

10,296

–

10,296

(13,001)

–

(13,001)

Credit

3,713

–

3,713

(3,582)

–

(3,582)

Commodity and other

865

–

865

(829)

–

(829)

Gross total fair values

292,117

1,242

293,359

(291,504)

(1,968)

(293,472)

Offset

(156,120)

156,120

At 31 December 2013

137,239

(137,352)

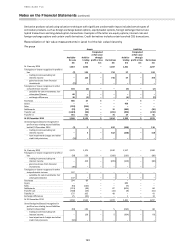

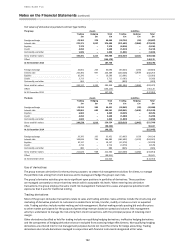

The bank

Assets

Liabilities

Trading

Hedging

Total

Trading

Hedging

Total

£m

£m

£m

£m

£m

£m

Foreign exchange

43,315

336

43,651

(44,865)

(43)

(44,908)

Interest rate

192,861

680

193,541

(189,841)

(1,402)

(191,243)

Equities

6,869

–

6,869

(8,545)

–

(8,545)

Credit

4,650

–

4,650

(5,209)

–

(5,209)

Commodity and other

1,843

–

1,843

(1,859)

–

(1,859)

Gross total fair values

249,538

1,016

250,554

(250,319)

(1,445)

(251,764)

Offset

(90,322)

90,322

At 31 December 2014

160,232

(161,442)

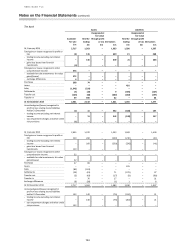

Foreign exchange

33,260

192

33,452

(33,965)

(159)

(34,124)

Interest rate

163,636

746

164,382

(162,402)

(1,123)

(163,525)

Equities

10,137

–

10,137

(12,578)

–

(12,578)

Credit

3,713

–

3,713

(3,579)

–

(3,579)

Commodity and other

880

–

880

(845)

–

(845)

Gross total fair values

211,626

938

212,564

(213,369)

(1,282)

(214,651)

Offset

(99,941)

99,941

At 31 December 2013

112,623

(114,710)

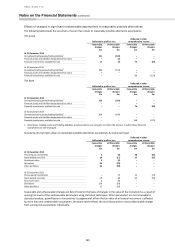

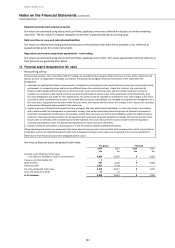

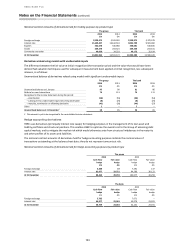

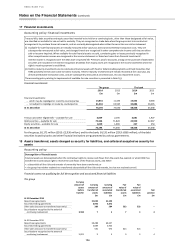

Use of derivatives

The group transacts derivatives for three primary purposes: to create risk management solutions for clients, to manage

the portfolio risks arising from client business and to manage and hedge the group’s own risks.

The group’s derivative activities give rise to significant open positions in portfolios of derivatives. These positions

are managed constantly to ensure that they remain within acceptable risk levels. When entering into derivative

transactions, the group employs the same credit risk management framework to assess and approve potential credit

exposures that it uses for traditional lending.

Trading derivatives

Most of the group’s derivative transactions relate to sales and trading activities. Sales activities include the structuring and

marketing of derivative products to customers to enable them to take, transfer, modify or reduce current or expected

risks. Trading activities include market-making and risk management. Market-making entails quoting bid and offer prices

to other market participants for the purpose of generating revenues based on spread and volume. Risk management

activity is undertaken to manage the risk arising from client transactions, with the principal purpose of retaining client

margin.

Other derivatives classified as held for trading include non-qualifying hedging derivatives, ineffective hedging derivatives

and the components of hedging derivatives that are excluded from assessing hedge effectiveness. Non-qualifying hedging

derivatives are entered into for risk management purposes but do not meet the criteria for hedge accounting. Trading

derivatives also include derivatives managed in conjunction with financial instruments designated at fair value.