HSBC 2014 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Report of the Directors: Risk (continued)

60

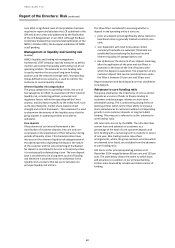

June 2014. A significant level of interpretation has been

required to report and calculate the LCR as defined in the

CRR text due to areas only addressed by the finalisation

of the LCR delegated act in Jan 2015. Although the Basel

Committee finalised the recommended calibration of the

NSFR in October 2014, the European calibration of NSFR

is still pending.

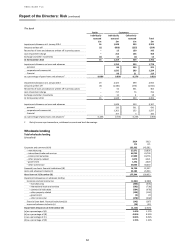

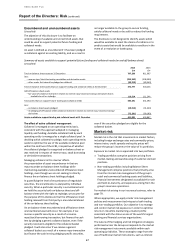

Management of liquidity and funding risk

(Audited)

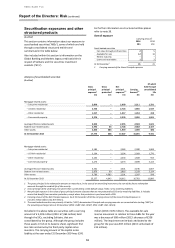

HSBC’s liquidity and funding risk management

framework (‘LFRF’) employs two key measures to define,

monitor and control the liquidity and funding risk of our

operating entities. The advances to core funding ratio

is used to monitor the structural long-term funding

position, and the stressed coverage ratio, incorporating

Group-defined stress scenarios, is used to monitor the

resilience to severe liquidity stresses.

Inherent liquidity risk categorisation

The group categorises its operating entities into one of

two categories to reflect its assessment of their inherent

liquidity risk, considering political, economic and

regulatory factors within the operating entities’ host

country, and also factors specific to the entity itself, such

as the local footprint, market share, balance sheet

strength and control framework. This assessment is used

to determine the severity of the liquidity stress that the

group expects its operating entities to be able to

withstand.

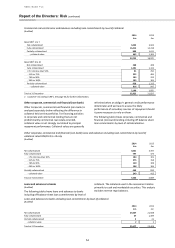

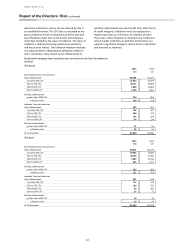

Core deposits

A key element of our internal framework is the

classification of customer deposits into core and non-

core based on the expectation of their behaviour during

periods of liquidity stress. This characterisation takes

into account the inherent liquidity risk categorisation of

the operating entity originating the deposit, the nature

of the customer and the size and pricing of the deposit.

No deposit is considered to be core in its entirety unless

it is contractually collateralising a loan. The core deposit

base is considered to be a long-term source of funding

and therefore is assumed not to be withdrawn in the

liquidity stress scenario that we use to calculate our

principal liquidity risk metrics.

The three filters considered in assessing whether a

deposit in any operating entity is core are:

• price: any deposit priced significantly above market or

benchmark rates is generally treated as entirely non-

core;

• size: depositors with total funds above certain

monetary thresholds are excluded. Thresholds are

established by considering the business line and

inherent liquidity risk categorisation; and

• line of business: the element of any deposit remaining

after the application of the price and size filters is

assessed on the basis of the line of business with

which the deposit is associated. The proportion of any

customer deposit that can be considered core under

this filter is between 35 per cent and 90 per cent.

Repo transactions and bank deposits are not classified as

core deposits.

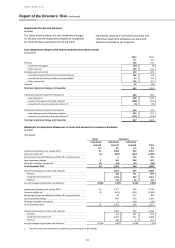

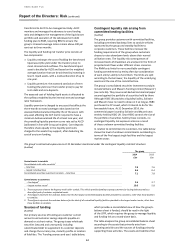

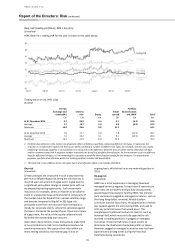

Advances to core funding ratio

The group emphasises the importance of core customer

deposits as a source of funds to finance lending to

customers and discourages reliance on short-term

wholesale funding. This is achieved by placing limits on

banking entities which restrict their ability to increase

loans and advances to customers without corresponding

growth in core customer deposits or long term debt

funding. This measure is referred to as the ‘advances to

core funding’ ratio.

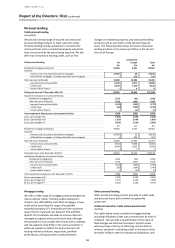

ACF ratio limits are set by the RMM. The ratio describes

current loans and advances to customers as a

percentage of the total of core customer deposits and

term funding with a remaining term to maturity in excess

of one year. Non-trading reverse repurchase

arrangements, where the group receives securities which

are deemed to be liquid, are excluded from the advances

to core funding ratio.

ACF limits set for principal operating entities at 31

December 2014 ranged between 80 per cent and 120 per

cent. The table below shows the extent to which loans

and advances to customers in our principal banking

entities were financed by reliable and stable sources of

funding.