HSBC 2014 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Report of the Directors: Risk (continued)

79

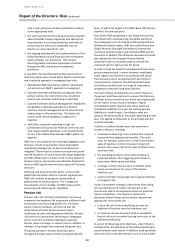

Approximately 60 per cent of financial assets were

invested in debt securities at 31 December 2014 (2013:

54 per cent), with 30 per cent (2013: 38 per cent)

invested in equity securities.

Under unit-linked insurance contracts, premium income

less charges levied is invested in a portfolio of assets. The

group manages the financial risks of this product on

behalf of the policyholders by holding appropriate assets

in segregated funds or portfolios to which the liabilities

are linked. These assets represented 10 per cent of the

total financial assets of the group’s insurance

manufacturing companies at the end of 2014 (2013: 31

per cent).

The reduction of £6 billion in the value of assets backing

unit-linked contracts is largely due to the classification of

£3.8 billion of assets relating to the UK pension business

as held for sale (see page 78) and the transfer of £1.8

billion assets backing other unit-linked investment

contracts to a third party during the year.

The remaining financial risks are managed either solely

on behalf of the shareholder, or jointly on behalf of the

shareholder and policyholders where discretionary

participation features exist.

Market risk of insurance operations

Market risk arises when mismatches occur between

product liabilities and the investment assets which back

them. For example, mismatches between asset and

liability yields and maturities give rise to interest rate

risk.

The main features of products manufactured by the

group’s insurance manufacturing companies which

generate market risk, and the market risk to which these

features expose the companies, are discussed below.

Long-term insurance or investment products may

incorporate benefits that are guaranteed. Interest rate

risk arises to the extent that yields on the assets

supporting guaranteed investment returns are lower

than the investment returns implied by the guarantees

payable to policyholders.

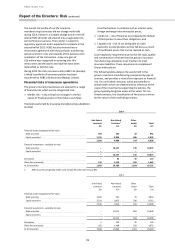

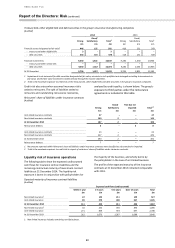

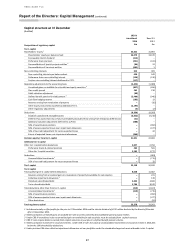

The following table illustrates the effect of selected

interest rates and equity price scenarios on the profits

for the year and total equity of insurance manufacturing

subsidiaries.

Where appropriate, the impact of the stress on the

present value of the in-force long-term insurance

business asset (‘PVIF’) is included in the results of the

sensitivity tests. The relationship between the profit and

total equity and the risk factors is non-linear and,

therefore, the results disclosed should not be

extrapolated to measure sensitivities to different levels

of stress. The sensitivities are stated before allowance

for the effect of management actions which may

mitigate the effect of changes in market rates, and for

any factors such as policyholder behaviour that may

change in response to changes in market risk.

The effects of +/-100 basis points parallel shifts in yield

curves have increased from 2013 to 2014, driven mainly

by falling yields and a flattening of the yield curve in

France during 2014. In the low yield environment the

projected costs of options and guarantees described

above is particularly sensitive to yield curve movements.

The market value of available-for-sale bonds is also

sensitive to yield curve movements hence the larger

opposite stresses on equity.

Sensitivity of the group’s insurance companies to market risk factors

(Audited)

2014

2013

Effect on profit

after tax

Effect on total

equity

Effect on profit

after tax

Effect on total

equity

£m

£m

£m

£m

+ 100 basis points parallel shift in yield curves

62

52

(1)

(12)

– 100 basis points parallel shift in yield curves

1

(205)

(196)

(30)

(19)

10 per cent increase in equity prices

18

18

16

16

10 per cent decrease in equity prices

(20)

(20)

(17)

(17)

1 Where a 100 basis point parallel shift in the weighted average risk free rate would result in a negative rate, the effect on profit before tax and

total equity has been calculated using a minimum rate of 0 per cent.

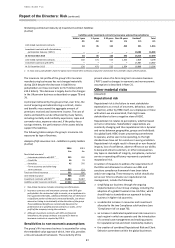

Credit quality

The following table presents an analysis of treasury bills,

other eligible bills and debt securities within the group’s

insurance business by measures of credit quality. The

five credit quality classifications are defined on page 43.

Only assets supporting liabilities under non-linked

insurance, investment contracts and shareholders’ funds

are included in the table, as financial risk on assets

supporting unit-linked liabilities is predominantly borne

by the policyholder; 86 per cent (2013: 84 per cent) of

the assets included in the table are invested in

investments rated as ‘Strong’.