HSBC 2014 Annual Report Download - page 191

Download and view the complete annual report

Please find page 191 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Notes on the Financial Statements (continued)

189

In March 2013, the New York District Court overseeing the consolidated proceedings related to US dollar Libor issued a

decision in the six oldest actions, dismissing the plaintiffs’ federal and state antitrust claims, racketeering claims and

unjust enrichment claims in their entirety, but allowing certain of their CEA claims that were not barred by the applicable

statute of limitations to proceed. Some of those plaintiffs appealed the New York District Court’s decision to the US Court

of Appeals for the Second Circuit, which later dismissed those appeals. In January 2015, the US Supreme Court reversed

the Court of Appeals’ decision and remanded the case to the Court of Appeals for consideration of the merits of the

plaintiffs’ appeal.

Other plaintiffs sought to file amended complaints in the New York District Court to assert additional allegations. In June

2014, the New York District Court issued a decision that, amongst other things, denied the plaintiffs’ request for leave to

amend their complaints to assert additional theories of Libor manipulation against HSBC and certain non-HSBC banks, but

granted leave to assert such manipulation claims against two other banks; and granted defendants’ motion to dismiss

certain additional claims under the CEA as barred by the applicable statute of limitations. Proceedings with respect to all

other actions in the consolidated proceedings were stayed pending this decision. The stay was lifted in September 2014.

Amended complaints were filed in previously stayed non-class actions in October 2014; and amended complaints were

filed in several of the previously stayed class actions in November 2014. Motions to dismiss were filed in November 2014

and January 2015, respectively, and remain pending.

Separately, HSBC and other panel banks have also been named as defendants in a putative class action filed in the New

York District Court on behalf of persons who transacted in euroyen futures and options contracts related to the euroyen

Tokyo interbank offered rate (‘Tibor’). The complaint alleges, amongst other things, misconduct related to euroyen Tibor,

although HSBC is not a member of the Japanese Bankers Association’s euroyen Tibor panel, as well as Japanese yen Libor,

in violation of US antitrust laws, the CEA, and state law. In March 2014, the New York District Court issued an opinion

dismissing the plaintiffs’ claims under US antitrust law and state law, but sustaining their claims under the CEA. In June

2014, the plaintiffs moved for leave to file a third amended complaint. HSBC has opposed that motion which remains

pending.

In November 2013, HSBC and other panel banks were also named as defendants in a putative class action filed in the New

York District Court on behalf of persons who transacted in euro futures contracts and other financial instruments related

to Euribor. The complaint alleges, amongst other things, misconduct related to Euribor in violation of US antitrust laws,

the CEA, and state law. The plaintiffs filed a second and later third amended complaint in May 2014 and October 2014,

respectively. HSBC intends to respond to the third amended complaint once a court ordered stay expires, currently set for

May 2015.

In September and October 2014, HSBC Bank plc and other panel banks were named as defendants in a number of putative

class actions that were filed and consolidated in the New York District Court on behalf of persons who transacted in

interest rate derivative transactions or purchased or sold financial instruments that were either tied to USD ISDAfix rates

or were executed shortly before, during, or after the time of the daily ISDAfix setting window. The complaint alleges,

amongst other things, misconduct related to these activities in violation of US antitrust laws, the CEA, and state law. In

October 2014 the plaintiffs filed a consolidated amended complaint. A motion to dismiss that complaint was filed in

December 2014 and remains pending. In February 2015, plaintiffs filed a second consolidated amended complaint,

replacing HSBC Bank plc with HSBC Bank USA.

Based on the facts currently known, it is not practicable at this time for HSBC to predict the resolution of these private

lawsuits, including the timing or any possible impact on HSBC.

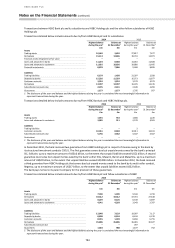

Foreign exchange rate investigations and litigation

Various regulators and competition and law enforcement authorities around the world including in the UK, the US, the EU

and elsewhere, are conducting investigations and reviews into a number of firms, including HSBC, related to trading on

the foreign exchange markets.

In November 2014, HSBC Bank plc entered into regulatory settlements with the FCA and the US Commodity Futures

Trading Commission (‘CFTC’) in connection with their respective investigations of HSBC’s trading and other conduct

involving foreign exchange benchmark rates. Under the terms of those settlements, HSBC Bank plc agreed to pay a

financial penalty of £216 million to the FCA and a civil monetary penalty of £176 million to the CFTC, and to undertake

various remedial actions.

The remaining investigations and reviews in the UK, the US and elsewhere are ongoing. Based on the facts currently

known there is a high degree of uncertainty as to the terms on which they will be resolved and the timing of such

resolutions, including the amounts of fines and/or penalties, which could be significant. As at 31 December 2014, HSBC

has recognised a provision in the amount of £353 million in respect of these matters.

In addition, in late 2013 and early 2014, HSBC Holdings, HSBC Bank plc, HNAH and HSBC Bank USA were named as

defendants, among other banks, in various putative class actions filed in the New York District Court. In March 2014, the

plaintiffs filed a consolidated amended complaint alleging, among other things, that defendants conspired to manipulate

the WM/Reuters foreign exchange benchmark rates by sharing customers’ confidential order flow information, thereby

injuring plaintiffs and others by forcing them to pay artificial and non-competitive prices for products based on these

foreign currency rates (‘the Consolidated Action’). Separate putative class actions were also brought on behalf of non-US