HSBC 2014 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Notes on the Financial Statements (continued)

163

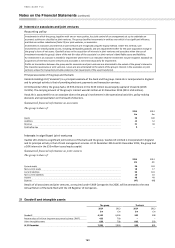

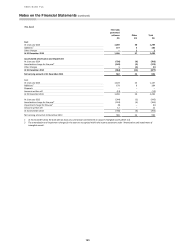

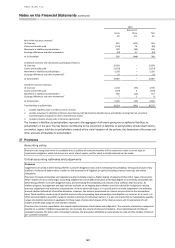

The present value of in-force long-term assurance business

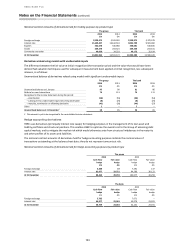

Movement in PVIF

The group

2014

2013

£m

£m

At 1 January

700

705

Addition from current year new business

55

65

Movement from in-force business (including investment return variances and changes in investment

assumptions)

(192)

(76)

Transfer to assets classified as held for sale1

(77)

–

Exchange differences and other movements

(30)

6

At 31 December

456

700

1 The transfer relates to the UK pensions business which was classified as held for sale in the first half of the year.

The group’s life insurance business is accounted for using the embedded value approach which, inter alia, provides a

comprehensive risk and valuation framework. The PVIF asset represents the present value of the shareholders’ interest in

the profits expected to emerge from the book of in-force policies.

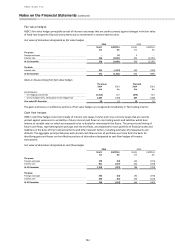

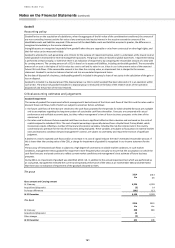

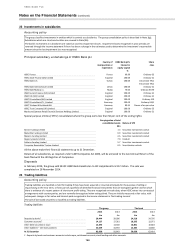

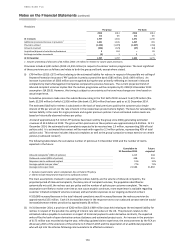

PVIF-specific assumptions

The key assumptions used in the computation of PVIF for the group’s main life insurance operations were:

2014

2013

France1

UK Life

France1

UK Life

Weighted average risk free rate

1.21%

1.65%

2.38%

2.45%

Risk discount rate

1.73%

2.15%

4.69%

2.95%

Expenses inflation

2.00%

4.67%

2.00%

3.39%

1 For 2014, the calculation of France’s PVIF assumes a risk discount rate of 1.73% plus a risk margin of £38 million. For 2013, a composite rate of

4.69% was used. This was equivalent to a weighted average rate of 3.08% plus a risk margin of £41 million.

The calculation of the PVIF is based upon assumptions that take into account risk and uncertainty. To project these cash

flows, a variety of assumptions regarding future experience is made by each insurance operation which reflects local

market conditions and management’s judgement of local future trends.

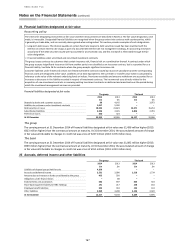

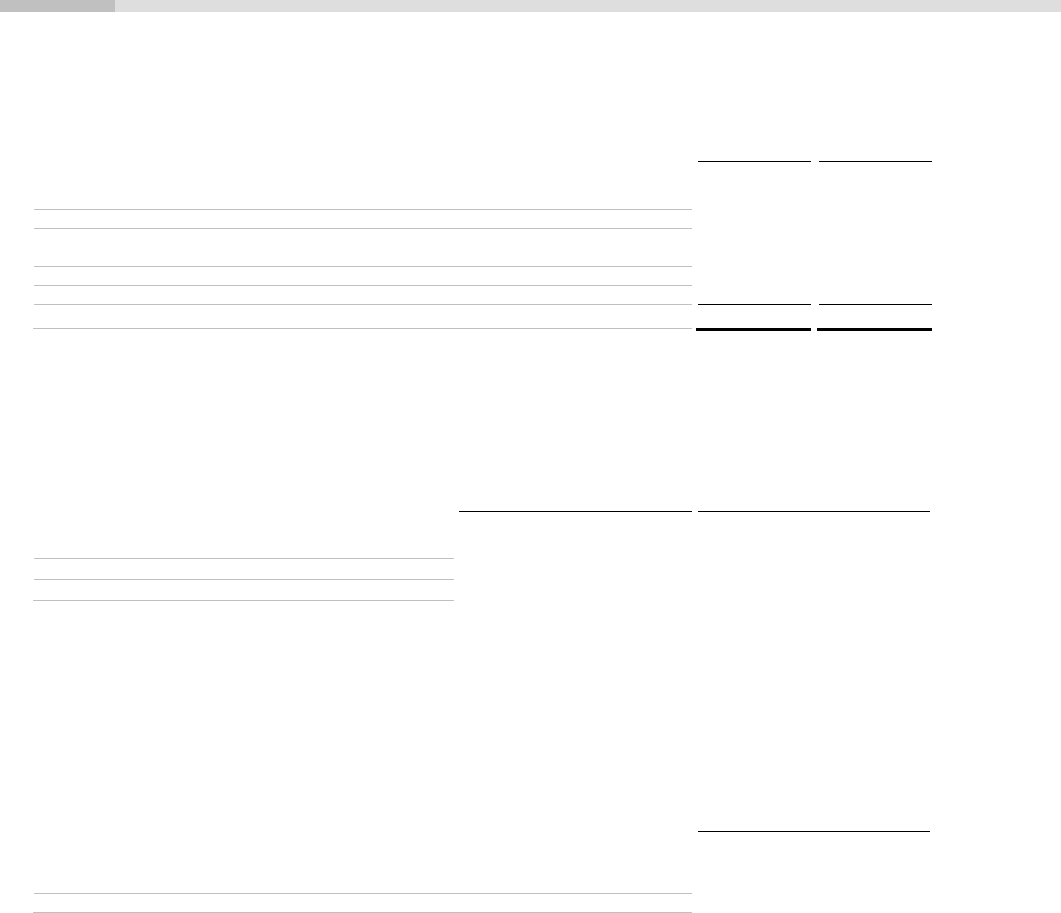

The following table shows the effect on the PVIF of reasonably possible changes in the main economic assumption, risk-

free rates, across all insurance manufacturing subsidiaries.

Sensitivity of PVIF to changes in economic assumptions

PVIF

2014

2013

£m

£m

+ 100 basis points shift in risk-free rate

84

2

– 100 basis points shift in risk-free rate1

(298)

(51)

1 Where a – 100 basis point shift in the risk free rate results in a negative rate, the effect on PVIF has been calculated using a minimum rate of 0%.

Due to certain characteristics of the contracts, the relationships may be non-linear and the results of the sensitivity-testing

should not be extrapolated to higher levels of stress. In calculating the scenario, the shift in the risk-free rate results in

changes to investment returns, risk discount rates and bonus rates which are incorporated. The sensitivities shown are

before actions that could be taken by management to mitigate impacts and before resultant changes in policyholder

behaviour.

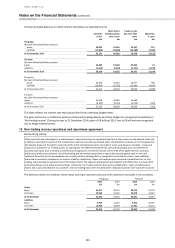

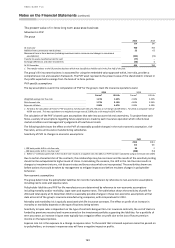

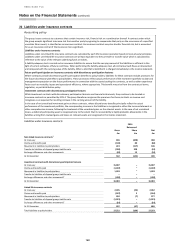

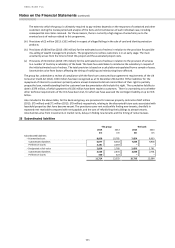

Non-economic assumptions

The group determines the policyholder liabilities for non-life manufacturers by reference to non-economic assumptions

including claims costs and expense rates.

Policyholder liabilities and PVIF for life manufacturers are determined by reference to non-economic assumptions

including mortality and/or morbidity, lapse rates and expense rates. The table below shows the sensitivity of profit for

2014 and total equity at 31 December 2014 to reasonably possible changes in these non-economic assumptions at that

date across all of the group’s insurance manufacturing companies, with comparatives for 2013.

Mortality and morbidity risk is typically associated with life insurance contracts. The effect on profit of an increase in

mortality or morbidity depends on the type of business being written.

Sensitivity to lapse rates is dependent on the type of contracts being written. For insurance contracts, the cost of claims is

funded by premiums received and income earned on the investment portfolio supporting the liabilities. For a portfolio of

term assurance, an increase in lapse rates typically has a negative effect on profit due to the loss of future premium

income on the lapsed policies.

Expense rate risk is the exposure to a change in expense rates. To the extent that increased expenses cannot be passed on

to policyholders, an increase in expense rates will have a negative impact on profits.