HSBC 2014 Annual Report Download - page 190

Download and view the complete annual report

Please find page 190 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Notes on the Financial Statements (continued)

188

agreement with the New York County District Attorney (the ‘DANY DPA’); and HSBC Holdings consented to a cease and

desist order and HSBC Holdings and HNAH consented to a civil money penalty order with the FRB. In addition, HSBC Bank

USA entered into a civil money penalty order with FinCEN and a separate civil money penalty order with the OCC. HSBC

Holdings also entered into an agreement with the Office of Foreign Assets Control (‘OFAC’) regarding historical

transactions involving parties subject to OFAC sanctions and an undertaking with the UK Financial Conduct Authority (the

‘FCA’), to comply with certain forward-looking AML and sanctions-related obligations.

Under these agreements, HSBC Holdings and HSBC Bank USA made payments totalling US$1.9 billion to US authorities and

are continuing to comply with ongoing obligations. In July 2013, the US District Court for the Eastern District of New York

approved the US DPA and retained authority to oversee implementation of that agreement. Under the agreements with

the DoJ, FCA, and FRB, an independent monitor (who is, for FCA purposes, a ‘skilled person’ under Section 166 of the

Financial Services and Markets Act) is evaluating and regularly assessing the effectiveness of HSBC’s AML and sanctions

compliance function and HSBC’s progress in implementing its remedial obligations under the agreements.

HSBC Holdings has fulfilled all of the requirements imposed by the DANY DPA, which expired by its terms at the end of the

two year period of that agreement in December 2014. If HSBC Holdings and HSBC Bank USA fulfil all of the requirements

imposed by the US DPA, the DoJ charges against those entities will be dismissed at the end of the five-year period of that

agreement. The DoJ may prosecute HSBC Holdings or HSBC Bank USA in relation to any matters that are the subject of the

US DPA if HSBC Holdings or HSBC Bank USA breaches the terms of the US DPA.

HSBC Bank USA entered into a separate consent order with the OCC requiring it to correct the circumstances and

conditions as noted in the OCC’s then most recent report of examination, and imposing certain restrictions on HSBC Bank

USA directly or indirectly acquiring control of, or holding an interest in, any new financial subsidiary, or commencing a

new activity in its existing financial subsidiary, unless it receives prior approval from the OCC. HSBC Bank USA also entered

into a separate consent order with the OCC requiring it to adopt an enterprise-wide compliance programme.

The settlement with US and UK authorities has resulted in private litigation, and does not preclude further private

litigation relating to HSBC’s compliance with applicable AML, BSA and sanctions laws or other regulatory or law

enforcement actions for AML, BSA or sanctions matters not covered by the various agreements.

In November 2014, a complaint was filed in the US District Court for the Eastern District of New York on behalf of

representatives of US persons killed or injured in Iraq between April 2004 and November 2011. The complaint was filed

against HSBC Holdings, HSBC Bank plc, HSBC Bank USA and HSBC Bank Middle East, as well as other non-HSBC banks and

the Islamic Republic of Iran (together, the ‘Defendants’). The plaintiffs allege that defendants conspired to violate the US

Anti-Terrorism Act, by altering or falsifying payment messages involving Iran, Iranian parties and Iranian banks for

transactions processed through the US. Defendants’ motion to dismiss is due to be filed in March 2015.

These private lawsuits are at an early stage. Based on the facts currently known, it is not practicable at this time for HSBC

to predict the resolution of these private lawsuits, including the timing or any possible impact on HSBC.

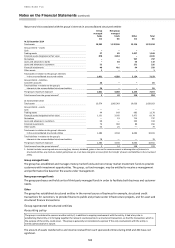

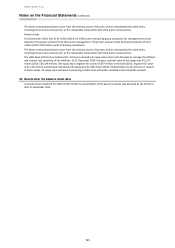

London interbank offered rates, European interbank offered rates and other benchmark interest rate

investigations and litigation

Various regulators and competition and law enforcement authorities around the world including in the UK, the US, the EU,

Switzerland and elsewhere, are conducting investigations and reviews related to certain past submissions made by panel

banks and the processes for making submissions in connection with the setting of London interbank offered rates (‘Libor’),

European interbank offered rates (‘Euribor’) and other benchmark interest rates. As certain HSBC companies are members

of such panels, HSBC has been the subject of regulatory demands for information and is cooperating with those

investigations and reviews.

In December 2013, the European Commission (the ‘Commission’) announced that it had imposed fines on eight financial

institutions under its cartel settlement procedure for their participation in illegal activity related to euro interest rate

derivatives and/or yen interest rate derivatives. Although HSBC was not one of the financial institutions fined, the

Commission announced that it had opened proceedings against HSBC in connection with its Euribor-related investigation

of euro interest rate derivatives only. This investigation will continue under the standard Commission cartel procedure. In

May 2014, HSBC received a Statement of Objections from the Commission alleging anti-competitive practices in

connection with the pricing of euro interest rate derivatives. The Statement of Objections sets out the Commission’s

preliminary views and does not prejudge the final outcome of its investigation. HSBC responded partially to the

Commission’s Statement of Objections in November 2014, and will have the opportunity to complete its response on a

date to be decided by the Commission, once various procedural issues are resolved.

Based on the facts currently known, with respect to each of these ongoing investigations, there is a high degree of

uncertainty as to the terms on which they will be resolved and the timing of such resolution, including the amounts of

fines and/or penalties, which could be significant.

In addition, HSBC and other US dollar Libor panel banks have been named as defendants in a number of private lawsuits

filed in the US with respect to the setting of US dollar Libor. The complaints assert claims under various US laws, including

US antitrust and racketeering laws, the US Commodity Exchange Act (‘CEA’), and state law. The lawsuits include individual

and putative class actions, most of which have been transferred and/or consolidated for pre-trial purposes before the

New York District Court.