HSBC 2014 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Notes on the Financial Statements (continued)

157

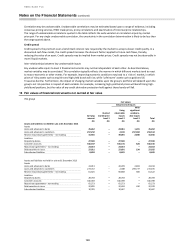

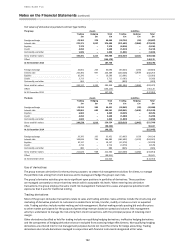

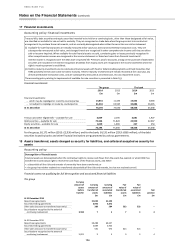

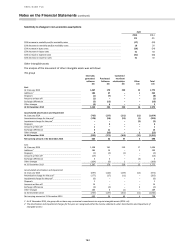

The bank

Carrying

amount of

assets

before

transfer

Carrying

amount of

transferred

assets

Carrying

amount of

associated

liabilities

Fair

value of

transferred

assets

Fair

value of

associated

liabilities

Net

position

£m

£m

£m

£m

£m

At 31 December 2014

Repurchase agreements

16,073

16,674

Securities lending agreements

6,963

5,863

Other sales (recourse to transferred asset only)

389

564

533

533

–

Securitisations recognised to the extent of

continuing involvement

3,590

7

3

7

3

4

At 31 December 2013

Repurchase agreements

34,869

35,676

Securities lending agreements

4,945

4,945

Other sales (recourse to transferred asset only)

581

674

624

624

–

Securitisations recognised to the extent of

continuing involvement

5,021

9

5

9

5

4

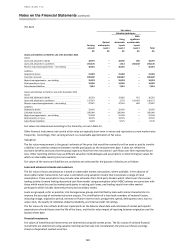

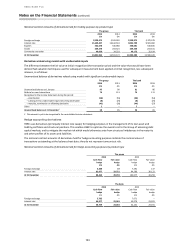

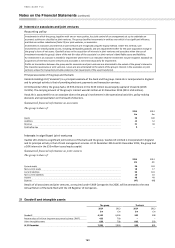

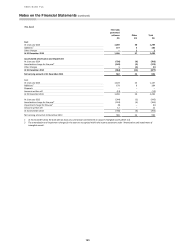

Continuing involvement in financial assets and associated financial liabilities qualifying for full derecognition

The group and the bank

At 31 December

For the year

Carrying amount of

continuing involvement in

statement of financial

position

Fair value of continuing

involvement

Maximum

exposure

to loss

Gain or loss

recognised

at transfer

date

Income/

(expenses)

recognised

in reporting

period

Income/

(expenses)

recognised

cumu

-

latively

Assets

Liabilities

Assets

Liabilities

£m

£m

£m

£m

£m

£m

£m

£m

Interest in SPEs

31 December 2014

98

–

98

–

98

–

–

43

31 December 2013

184

–

186

–

184

6

5

41

The assets in the table above represent our continuing involvement in securitisations where HSBC has transferred assets

to an unconsolidated SPE, but has retained some of the notes issued by the SPE. These notes are reported in loans and

advances to customers. The maximum exposure to loss is the carrying amount of the notes.

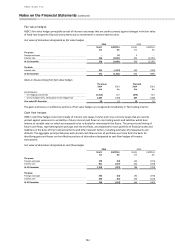

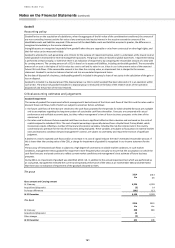

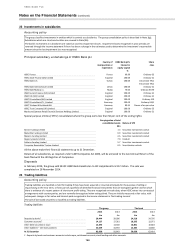

Financial assets pledged to secure liabilities

Group assets pledged at

31 December

Bank assets pledged at

31 December

2014

2013

2014

2013

£m

£m

£m

£m

Treasury bills and other eligible securities

160

1,331

–

–

Loans and advances to banks

9,608

8,309

6,240

5,244

Loans and advances to customers

35,972

44,293

15,061

19,022

Debt securities

53,978

90,675

27,694

51,181

Equity shares

7,051

5,070

6,963

4,945

Other

3,264

72

3,247

–

Assets pledged at 31 December

110,033

149,750

59,205

80,392

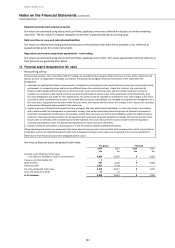

The table above shows assets where a charge has been granted to secure liabilities on a legal and contractual basis. The

amount of such assets may be greater than the book value of assets utilised as collateral for funding purposes or to cover

liabilities. This is the case for securitisations and covered bonds where the amount of liabilities issued, plus any mandatory

over-collateralisation, is less than the book value of financial assets available for funding or collateral purposes in the

relevant pool of assets. This is also the case where financial assets are placed with a custodian or settlement agent which

has a floating charge over all the financial assets placed to secure any liabilities under settlement accounts.

These transactions are conducted under terms that are usual and customary to collateralised transactions including,

where relevant, standard securities lending and repurchase agreements.

The financial assets shown above include amounts transferred to third parties that do not qualify for derecognition,

notably debt securities held by counterparties as collateral under repurchase agreements and equity securities lent under

securities lending agreements. As the substance of these transactions is secured borrowings the asset collateral continues

to be recognised in full and the related liability reflecting the Group’s obligation to repurchase the transferred assets for