HSBC 2014 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Report of the Directors: Risk (continued)

35

The draft proposals contain a provision which would

permit derogation by member states which have

implemented their own structural reform legislation,

subject to meeting certain conditions. This derogation

may benefit the UK in view of the Banking Reform Act.

The proposals are currently subject to discussion in the

European Parliament and the Council. The

implementation date for any separation under the final

rules would depend upon the date on which any final

legislation is agreed.

Russia

During March 2014, tensions rose between the Russian

Federation (‘Russia’) and western countries (‘the West’)

in respect of the Ukraine. The West’s response, led by

the US and EU plus other countries, was to impose

sanctions on a selected list of Russian individuals, banks

and corporates, the scope of which was expanded during

the course of 2014. In response, Russia imposed

restrictions on the import of food and related produce

from those countries that have introduced sanctions and

restricted measures against Russia. Monitoring and

action in response to the sanctions requirements is

ongoing and will impose some restrictions on the

business in Russia, although the impact on the group has

not been significant. Group exposures to counterparties

incorporated or domiciled in the Ukraine are not

considered material.

The resolution of issues affecting the Ukraine and

Russia’s relations with the West will take time.

Potentially additional sanctions could, if the environment

deteriorated, be imposed and reciprocal actions taken by

Russia, which may impact upon the activities of the

group in Russia and with Russian counterparties.

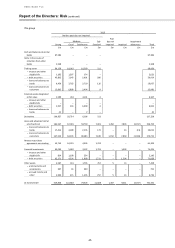

The fourth quarter of 2014 saw significant falls in the

value of the Russian Rouble and the price of crude oil,

and multiple interest rate rises implemented by Russia’s

Central Bank. The impact of these developments is being

monitored by management and, combined with the

sanctions, mean the outlook for Russia remains highly

uncertain and with the economy anticipated to contract

in 2015.The group’s Russian on-balance sheet exposures

within loans and advances to banks was £0.5 billion

(31 December 2013: £0.8 billion) and loans and advances

to customers was £2.2 billion (31 December 2013:

£3.0 billion).

In addition to the above, a number of the group's

multinational clients have indirect exposure to Russia

through majority or minority stakes in Russia-based

entities, via dependency of supply, or from reliance on

exports. The operations and businesses of such clients

may be negatively impacted should the scope and nature

of sanctions and other actions be widened or the Russian

economy deteriorate. The group also runs operations in

neighbouring countries where the strength of the

financial system has strong links to the Russian economy.

Management is monitoring the quantum and potential

severity of such risks.

Eurozone

In recent years the EU has introduced a series of

legislative changes designed to better equip the EU to

deal with a financial crisis and to reduce the risks of

contagion in the event of an EU member country

experiencing financial difficulties.

The final outcome of negotiations on the terms of the

Greek bail out is uncertain. The debt may be rescheduled

or Greece may default on its debt and there is the

possibility that Greece may exit the Euro. We continue to

closely monitor the situation.

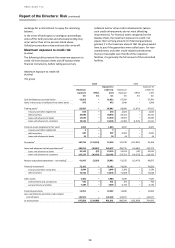

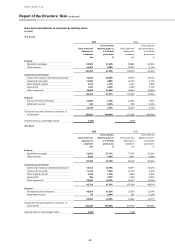

Overall we have limited exposure to Eurozone countries

at highest risk of experiencing financial difficulties. Our

exposures to Greece were predominantly in loans and

advances and reverse repos. At 31 December 2014, this

amounted to £2.3 billion and £1.0 billion respectively.

Included in loans and advances is £1.2 billion relating to

the shipping industry, denominated in US dollars and

booked in the UK. We believe the shipping industry to be

less sensitive to the Greek economy as it is mainly

dependent on international trade. Our Greece in-country

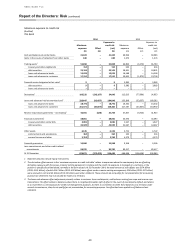

funding exposure is negligible and is set out in the table

below.

Exposures to Spain, Ireland, Italy, Portugal and Cyprus

were also limited. At 31 December 2014, the group’s

loans and advances in these countries amounted to less

than £7.5 billion, and were principally to multinational

corporates. The group’s aggregate exposure to debt

issuance across these countries was £5 billion,

predominantly in Spanish and Italian sovereign debt held

by the Group’s balance sheet management, market-

making and insurance operations. Net exposure to

derivatives was less than £2 billion and related

principally to derivatives exposures with the Republic of

Italy.

Risk Management and Contingency planning

The group has a well-developed framework for dealing

with counterparty and systemic crisis situations, both

country specific and regionally, which is complemented

by regular specific and enterprise-wide stress testing and

scenario planning. The framework functions before,

during and after crises and ensures that the group has

detailed and evolving operational plans in the event of

an adverse situation materialising. Management

continues to closely monitor and manage eurozone

exposures in the higher risk eurozone countries including

Greece, and is cautious in lending to this sector. The

group regularly updates its assessment of higher risk

eurozone banks and adjusts its risk appetite accordingly.

Where possible, the group also seeks to play a positive

role in maintaining credit and liquidity supply.

Redenomination risk

There is no established legal framework within the

European treaties to facilitate a member state exiting

from the eurozone. Consequently, it is not possible to

predict accurately the course of events and legal

consequences that would ensue.