HSBC 2014 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Notes on the Financial Statements (continued)

149

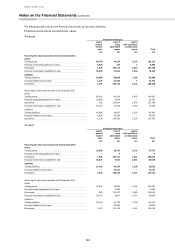

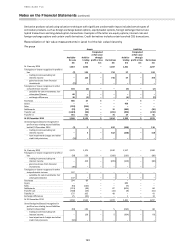

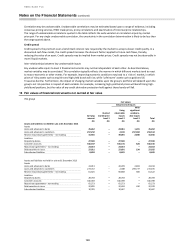

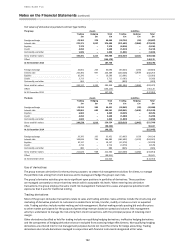

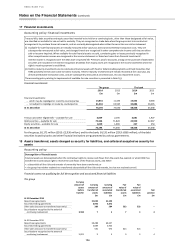

The bank

Fair values

Valuation techniques

Carrying

amount

Quoted

market price

Level 1

Using

observable

inputs

Level 2

With

significant

unobservable

inputs

Level 3

Total

£m

£m

£m

£m

£m

Assets and liabilities not held for sale at 31 December 2014

Assets

Loans and advances to banks

18,776

–

18,536

240

18,776

Loans and advances to customers

201,671

–

1,513

202,632

204,145

Reverse repurchase agreements – non-trading

36,391

–

36,391

–

36,391

Liabilities

Deposits by banks

31,383

–

31,383

–

31,383

Customer accounts

282,687

–

282,687

–

282,687

Repurchase agreements – non-trading

18,293

–

18,293

–

18,293

Debt securities in issue

14,950

–

14,950

–

14,950

Subordinated liabilities

7,854

–

7,654

–

7,654

Assets and liabilities not held for sale at 31 December 2013

Assets

Loans and advances to banks

16,332

–

15,881

451

16,332

Loans and advances to customers

217,567

–

1,732

214,439

216,171

Reverse repurchase agreements – non-trading

47,847

–

47,163

684

47,847

Liabilities

Deposits by banks

32,456

–

32,456

–

32,456

Customer accounts

280,940

–

280,940

–

280,940

Repurchase agreements – non-trading

51,198

–

51,198

–

51,198

Debt securities in issue

19,576

–

19,576

–

19,576

Subordinated liabilities

9,903

–

9,575

–

9,575

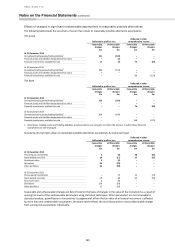

Fair values are determined according to the hierarchy set out in Note 12.

Other financial instruments not carried at fair value are typically short-term in nature and repriced to current market rates

frequently. Accordingly, their carrying amount is a reasonable approximation of fair value.

Valuation

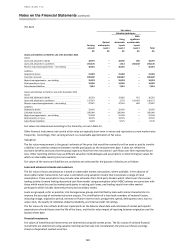

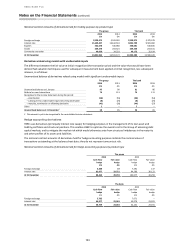

The fair value measurement is the group’s estimate of the price that would be received to sell an asset or paid to transfer

a liability in an orderly transaction between market participants at the measurement date. It does not reflect the

economic benefits and costs that the group expects to flow from the instruments’ cash flows over their expected future

lives. Other reporting entities may use different valuation methodologies and assumptions in determining fair values for

which no observable market prices are available.

Fair values of the assets and liabilities set out below are estimated for the purpose of disclosure as follows:

Loans and advances to banks and customers

The fair value of loans and advances is based on observable market transactions, where available. In the absence of

observable market transactions, fair value is estimated using valuation models that incorporate a range of input

assumptions. These assumptions may include value estimates from third party brokers which reflect over-the-counter

trading activity; forward looking discounted cash flow models using assumptions which HSBC believes are consistent with

those which would be used by market participants in valuing such loans; and trading inputs from other market

participants which includes observed primary and secondary trades.

Loans are grouped, as far as possible, into homogeneous groups and stratified by loans with similar characteristics to

improve the accuracy of estimated valuation outputs. The stratification of a loan book considers all material factors,

including vintage, origination period, estimates of future interest rates, prepayment speeds, delinquency rates, loan-to-

value ratios, the quality of collateral, default probability, and internal credit risk ratings.

The fair value of a loan reflects both loan impairments at the balance sheet date and estimates of market participants’

expectations of credit losses over the life of the loans, and the fair value impact of repricing between origination and the

balance sheet date.

Financial investments

Fair values of listed financial investments are determined using bid market prices. The fair values of unlisted financial

investments are determined using valuation techniques that take into consideration the prices and future earnings

streams of equivalent quoted securities.