HSBC 2014 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

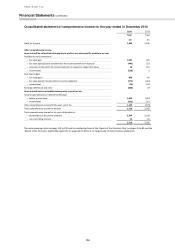

HSBC BANK PLC

Financial Statements (continued)

110

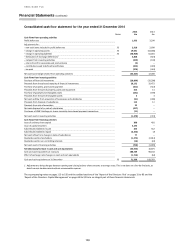

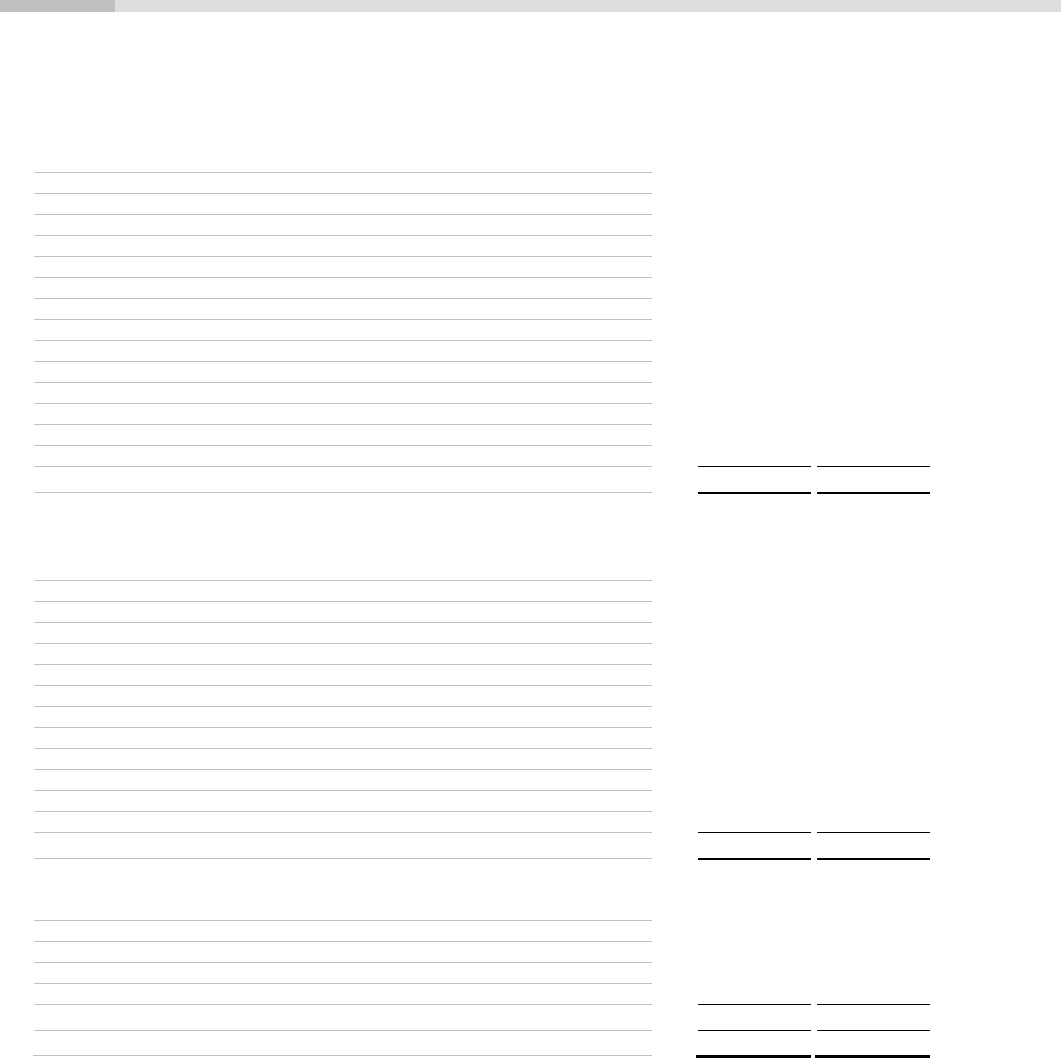

HSBC Bank plc statement of financial position at 31 December 2014

2014

2013

Notes

£m

£m

Assets

Cash and balances at central banks

41,424

60,996

Items in the course of collection from other banks

630

1,374

Trading assets

11

97,757

101,287

Financial assets designated at fair value

14

9

3,983

Derivatives

15

160,232

112,623

Loans and advances to banks

29

18,776

16,332

Loans and advances to customers

29

201,671

217,567

Reverse repurchase agreements – non-trading

16

36,391

47,847

Financial investments

17

48,438

45,048

Prepayments, accrued income and other assets

19

12,908

8,201

Current tax assets

125

424

Interests in associates and joint ventures

20

62

62

Investments in subsidiary undertakings

22

11,339

11,206

Goodwill and intangible assets

21

948

891

Deferred tax assets

8

5

88

Total assets

630,715

627,929

Liabilities and equity

Liabilities

Deposits by banks

29

31,383

32,456

Customer accounts

29

282,687

280,940

Repurchase agreements – non-trading

16

18,293

51,198

Items in the course of transmission to other banks

336

422

Trading liabilities

23

59,039

62,414

Financial liabilities designated at fair value

24

16,127

22,006

Derivatives

15

161,442

114,710

Debt securities in issue

29

14,950

19,576

Accruals, deferred income and other liabilities

25

5,289

5,695

Current tax liabilities

160

142

Provisions

27

1,345

1,271

Deferred tax liabilities

8

345

2

Subordinated liabilities

28

7,854

9,903

Total liabilities

599,250

600,735

Equity

Called up share capital

32

797

797

Share premium account

20,733

20,427

Other equity instruments

32

2,196

-

Other reserves

389

(372)

Retained earnings

7,350

6,342

Total equity

31,465

27,194

Total equity and liabilities

630,715

627,929

The accompanying notes on pages 113 to 195 and the audited sections of the ‘Report of the Directors: Risk’ on pages 31 to 83 and the

‘Report of the Directors: Capital Management’ on pages 84 to 93 form an integral part of these financial statements.

A P S Simoes, Director 23 February 2015