HSBC 2014 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Report of the Directors: Risk (continued)

43

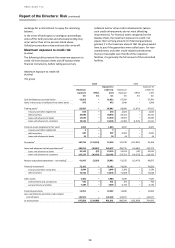

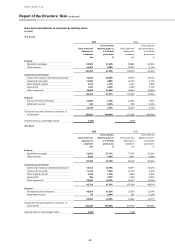

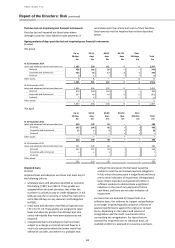

Credit quality of financial instruments

(Audited)

The five credit quality classifications defined below each

encompass a range of more granular, internal credit

rating grades assigned to wholesale and retail lending

business, as well as the external rating,

attributed by external agencies to debt securities. There

is no direct correlation between the internal and external

ratings at granular level, except to the extent each falls

within a single quality classification.

Credit quality

Debt securities

and other bills

Wholesale lending and derivatives Retail lending

Quality classification

External credit

rating

Internal credit

rating

Probability of

default %

Internal credit rating

Expected loss %

Strong

A- and above

CRR1 to CRR2

0 – 0.169

EL1 to EL2

0 – 0.999

Good

BBB+ to BBB-

CRR3

0.170 – 0.740

EL3

1.000 – 4.999

Satisfactory

BB+ to B and unrated

CRR4 to CRR5

0.741 – 4.914

EL4 to EL5

5.000 – 19.999

Sub – standard

B- and below

CRR6 to CRR8

4.915 – 99.999

EL6 to EL8

20.000 – 99.999

Impaired

Impaired

CRR9 to CRR10

100

EL9 to EL10

100+ or defaulted1

1 The EL percentage is derived through a combination of Probability of Default (‘PD’) and Loss Given Default (‘LGD’) and may exceed 100 per cent

in circumstances where the LGD is above 100 per cent reflecting the cost of recoveries.

Quality classification definitions

(Audited)

‘Strong’: Exposures demonstrate a strong capacity to

meet financial commitments, with negligible or low

probability of default and/or low levels of expected loss.

Retail accounts operate within product parameters and

only exceptionally show any period of delinquency.

‘Good’: Exposures require closer monitoring and

demonstrate a good capacity to meet financial

commitments, with low default risk. Retail accounts

typically show only short periods of delinquency, with

any losses expected to be minimal following the

adoption of recovery processes.

‘Satisfactory’: Exposures require closer monitoring and

demonstrate an average to fair capacity to meet financial

commitments, with moderate default risk. Retail

accounts typically show only short periods of

delinquency, with any losses expected to be minor

following the adoption of recovery processes.

‘Sub-standard’: Exposures require varying degrees of

special attention and default risk is of greater concern.

Retail portfolio segments show longer delinquency

periods of generally up to 90 days past due and/or

expected losses are higher due to a reduced ability to

mitigate these through security realisation or other

recovery processes.

‘Impaired’: Exposures have been assessed, individually or

collectively, as impaired.

Risk rating scales

(Audited)

The Customer Risk Rating (‘CRR’) 10-grade scale above

summarises a more granular underlying 23-grade scale

of obligor probability of default (‘PD’).

All distinct HSBC customers are rated using one of these

two PD scales, depending on the degree of sophistication

of the Basel II approach adopted for the exposure.

Each CRR band is associated with an external rating

grade by reference to long-run default rates for that

grade, represented by the average of issuer-weighted

historical default rates. This mapping between internal

and external ratings is indicative and may vary over time.

The Expected Loss (‘EL’) 10-grade scale for retail business

summarises a more granular underlying EL scale for

these customer segments; this combines obligor and

facility/product risk factors in a composite measure.

For debt securities and certain other financial

instruments, external ratings have been aligned to the

five quality classifications. The most recent mapping

review resulted in ‘B‘ being mapped to CRR5. Accordingly

‘B‘ ratings are now mapped to ‘Satisfactory’. This

represents a changes in disclosure mapping unrelated to

changes in counterparty creditworthiness.

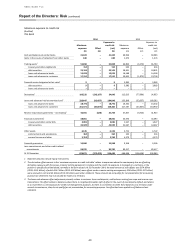

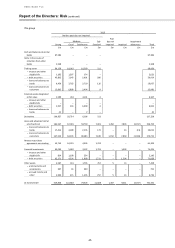

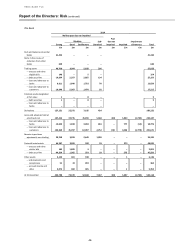

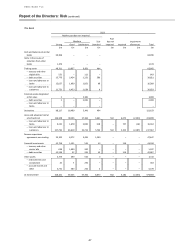

For the purpose of the following disclosure, retail loans

which are past due up to 89 days and are not otherwise

classified as EL9 or EL10, are not disclosed within the EL

grade to which they relate, but are separately classified

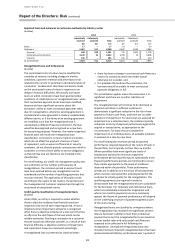

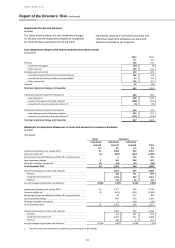

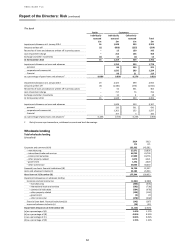

as past due but not impaired. The following tables set

out the group’s distribution of financial instruments by

measures of credit quality.