HSBC 2014 Annual Report Download - page 166

Download and view the complete annual report

Please find page 166 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Notes on the Financial Statements (continued)

164

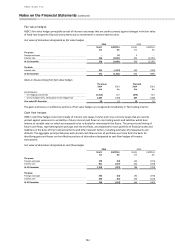

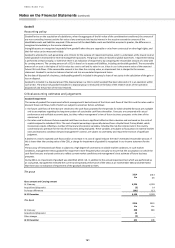

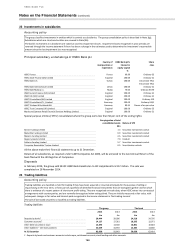

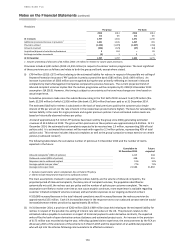

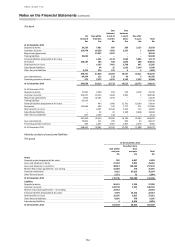

Sensitivity to changes in non-economic assumptions

PVIF

2014

2013

£m

£m

10% increase in mortality and/or morbidity rates

(17)

(20)

10% decrease in mortality and/or morbidity rates

18

20

10% increase in lapse rates

(29)

(34)

10% decrease in lapse rates

31

38

10% increase in expense rates

(31)

(30)

10% decrease in expense rates

31

30

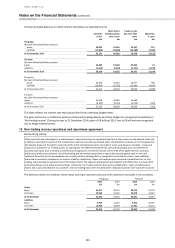

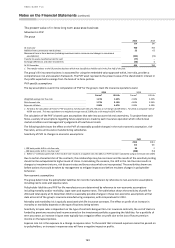

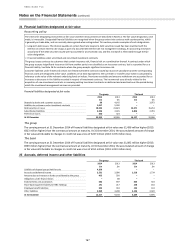

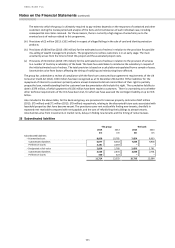

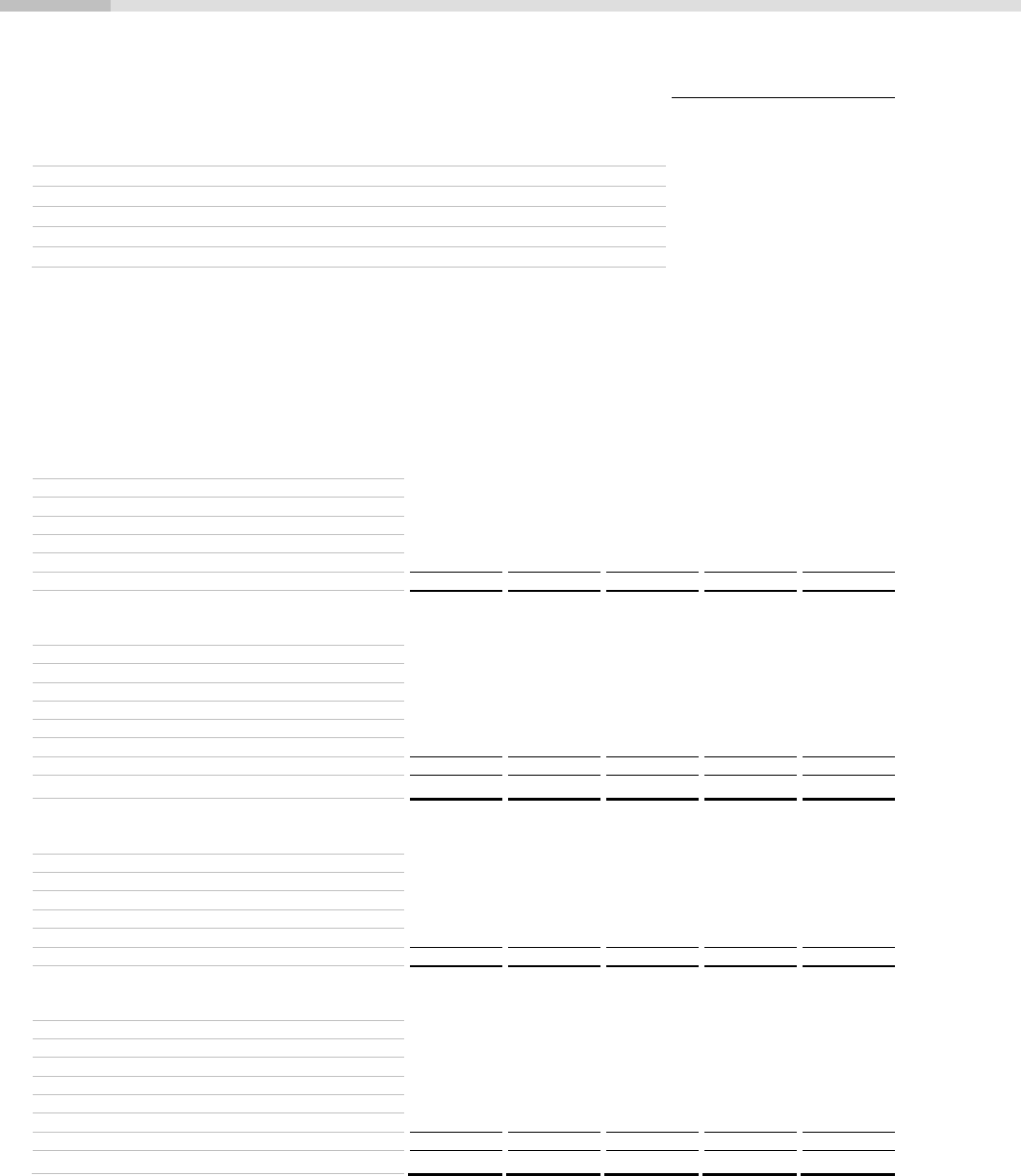

Other intangible assets

The analysis of the movement of other intangible assets was as follows:

The group

Internally

generated

software

Purchased

Software

Customer/

merchant

relationships

Other

Total

£m

£m

£m

£m

£m

Cost

At 1 January 2014

1,367

170

220

15

1,772

Additions1

184

47

–

1

232

Disposals

(1)

(7)

–

–

(8)

Amounts written off

(1)

–

–

–

(1)

Exchange differences

(5)

(13)

–

–

(18)

Other changes

(4)

6

–

–

2

At 31 December 2014

1,540

203

220

16

1,979

Accumulated amortisation and impairment

At 1 January 2014

(765)

(137)

(151)

(11)

(1,064)

Amortisation charge for the year2

(178)

(18)

(12)

(1)

(209)

Impairment charge for the year2

–

–

–

(2)

(2)

Disposals

–

6

–

–

6

Amounts written off

1

–

–

–

1

Exchange differences

3

11

–

–

14

Other changes

4

(33)

–

2

(27)

At 31 December 2014

(935)

(171)

(163)

(12)

(1,281)

Net carrying amount at 31 December 2014

605

32

57

4

698

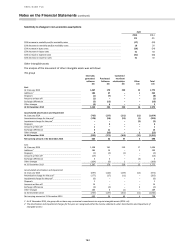

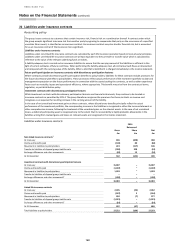

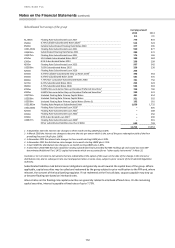

Cost

At 1 January 2013

1,298

161

220

17

1,696

Additions1

184

14

–

1

199

Disposals

(1)

(2)

(1)

–

(4)

Amounts written off

(13)

–

–

–

(13)

Exchange differences

3

3

–

(3)

3

Other changes

(104)

(6)

1

–

(109)

At 31 December 2013

1,367

170

220

15

1,772

Accumulated amortisation and impairment

At 1 January 2013

(697)

(124)

(139)

(14)

(974)

Amortisation charge for the year2

(177)

(17)

(11)

–

(205)

Impairment charge for the year2

(6)

–

–

–

(6)

Disposals

1

–

–

–

1

Amounts written off

13

–

–

–

13

Exchange differences

(3)

(2)

–

3

(2)

Other changes

104

6

(1)

–

109

At 31 December 2013

(765)

(137)

(151)

(11)

(1,064)

Net carrying amount at 31 December 2013

602

33

69

4

708

1 At 31 December 2014, the group did not have any contractual commitments to acquire intangible assets (2013: nil).

2 The amortisation and impairment charges for the year are recognised within the income statement under ‘Amortisation and impairment of

intangible assets’.