HSBC 2014 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Report of the Directors: Risk (continued)

55

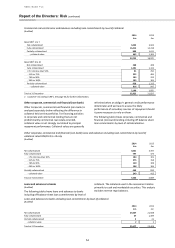

Other credit risk exposures

In addition to collateralised lending, other credit

enhancements are employed and methods used to

mitigate credit risk arising from financial assets. These

are described in more detail below:

• some securities issued by governments, banks and

other financial institutions benefit from additional

credit enhancement provided by government

guarantees that cover the assets;

• debt securities issued by corporates are primarily

unsecured;

• debt securities issued by banks and financial

institutions include ABSs and similar instruments

which are supported by underlying pools of financial

assets. Credit risk associated with ABSs is reduced

through the purchase of CDS protection;

• trading assets include loans and advances held with

trading intent. These mainly consist of cash collateral

posted to satisfy margin requirements on derivatives,

settlement accounts, reverse repos and stock

borrowing. There is limited credit risk on cash

collateral posted since in the event of default of the

counterparty these would be set off against the

related liability. Reverse repos and stock borrowing

are by their nature collateralised; and

• The group’s maximum exposure to credit risk includes

financial guarantees and similar arrangements that

we issue or enter into, and loan commitments that

we are irrevocably committed to. Depending on the

terms of the arrangement, we may have recourse to

additional credit mitigation in the event that a

guarantee is called upon or a loan commitment is

drawn and subsequently defaults.

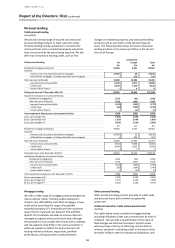

Derivatives

HSBC participates in transactions exposing it to

counterparty credit risk. Counterparty credit risk is the

risk of financial loss if the counterparty to a transaction

defaults before completing the satisfactory settlement of

the transaction, which varies in value by reference to a

market factor such as interest rate, exchange rate or

asset price. It arises principally from OTC derivatives and

SFTs and is calculated in both the trading and non-

trading books. Transactions vary in value by reference to

a market factor such as interest rate, exchange rate or

asset price. The counterparty risk from derivative

transactions is taken into account when reporting the

fair value of derivative positions. The adjustment to the

fair value is known as the credit value adjustment

(‘CVA’).

The International Swaps and Derivatives Association

(‘ISDA’) Master Agreement is the group’s preferred

agreement for documenting derivatives activity. It

provides the contractual framework within which dealing

activity across a full range of over-the-counter products

is conducted, and contractually binds both parties to

apply close-out netting across all outstanding

transactions covered by an agreement if either party

defaults or other pre-agreed termination events occur. It

is common, and the group’s preferred practice, for the

parties to execute a Credit Support Annex (‘CSA’) in

conjunction with the ISDA Master Agreement. Under a

CSA, collateral is passed between the parties to mitigate

the market-contingent counterparty risk inherent in the

outstanding positions.

We manage the counterparty exposure arising from

market risk on our OTC derivative contracts by using

collateral agreements with counterparties and netting

agreements. Currently, we do not actively manage our

general OTC derivative counterparty exposure in the

credit markets, although we may manage individual

exposures in certain circumstances.

HSBC has historically placed strict policy restrictions on

collateral types and as a consequence the types of

collateral received and pledged are, by value, highly

liquid and of a strong quality, being predominantly cash.

Where a collateral type is required to be approved

outside the collateral policy (which includes collateral

that includes wrong way risks), a submission to the

Documentation Approval Committee (‘DAC’) for approval

is required. The DAC requires the participation and sign-

off of senior representatives from the Global Markets

Chief Operating Officer, Legal and Risk.

The majority of the counterparties with whom we have a

collateral agreement are European. The majority of the

group’s CSAs are with financial institutional clients.

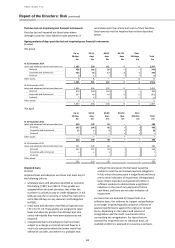

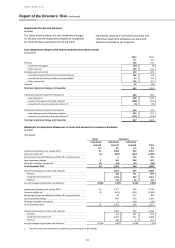

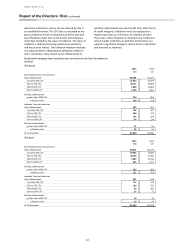

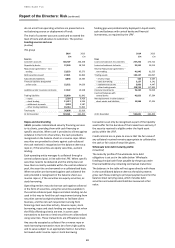

Reverse repos – non trading

Following the change in balance sheet presentation

explained on page 155, non-trading reverse repos are

presented separately on the face of the balance sheet

and are no longer included in ‘Loans and advances to

customers’ and ‘Loans and advances to banks’.

Comparative data have been re-presented accordingly.

As a result, any analysis in the Credit Risk section that

references loans and advances to customers or banks

excludes non-trading reverse repos to customers or

banks, respectively. For reference, the amount of non-

trading reverse repos to customers and banks is set out

below.

Reverse repos – non trading

(Audited)

2014

2013

£m

£m

With customers

19,468

31,310

With banks

22,477

30,215

31 December

41,945

61,525