HSBC 2014 Annual Report Download - page 187

Download and view the complete annual report

Please find page 187 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Notes on the Financial Statements (continued)

185

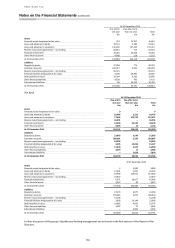

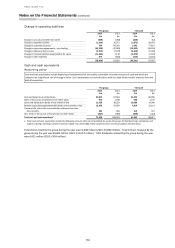

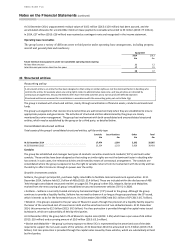

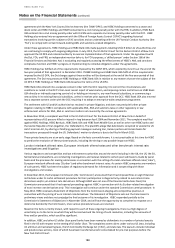

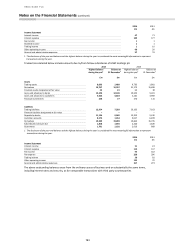

Nature and risks associated with the group’s interests in unconsolidated structured entities

Group

managed

funds

Non-group

managed

funds

Other

Total

£m

£m

£m

£m

At 31 December 2014

Total assets

10,582

1,132,196

13,156

1,155,934

Group interest – assets

Cash

–

–

–

–

Trading assets

27

85

1,057

1,169

Financial assets designated at fair value

878

3,453

–

4,331

Derivatives

–

–

797

797

Loans and advances to banks

–

84

35

119

Loans and advances to customers

55

–

171

226

Financial investments

40

416

94

550

Other assets

1

–

–

1

Total assets in relation to the group’s interests

in the unconsolidated structured entities

1,001

4,038

2,154

7,193

Group interest – liabilities

Customer accounts

26

–

–

26

Total liabilities in relation to the group’s

interests in the unconsolidated structured entities

26

–

–

26

The group’s maximum exposure

1,001

4,038

2,154

7,193

Total income from the group interests1

3

42

159

204

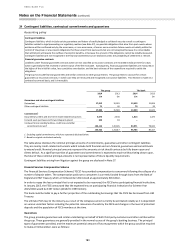

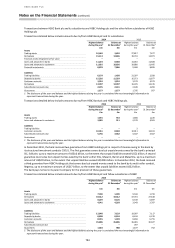

At 31 December 2013

Total assets

13,674

1,005,343

10,036

1,029,053

Group interest – assets

Cash

—

—

—

—

Trading assets

44

149

985

1,178

Financial assets designated at fair value

1,151

3,055

3,972

8,178

Derivatives

—

23

714

737

Loans and advances to customers

60

—

253

313

Financial investments

74

302

80

456

Other assets

54

25

—-

79

Total assets in relation to the group’s interests

in the unconsolidated structured entities

1,383

3,554

6,004

10,941

Total liabilities in relation to the group’s

interests in the unconsolidated structured entities

78

—

—

78

The group’s maximum exposure

1,383

3,554

6,004

10,941

Total income from the group interests1

2

14

358

374

1. Income includes recurring and non-recurring fees, interest, dividends, gains or loss on the remeasurement or derecognition of interests in

structured entities, any mark-to-market gains/losses on a net basis and gains or losses from the transfer of assets and liabilities to the structured

entity.

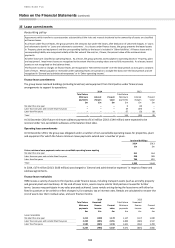

Group managed funds

The group has established and manages money market funds and non-money market investment funds to provide

customers with investment opportunities. The group, as fund manager, may be entitled to receive a management

and performance fee based on the assets under management.

Non-group managed funds

The group purchases and holds units of third party managed funds in order to facilitate both business and customer

needs.

Other

The group has established structured entities in the normal course of business for example, structured credit

transactions for customers, to provide finance to public and private sector infrastructure projects, and for asset and

structured finance transactions.

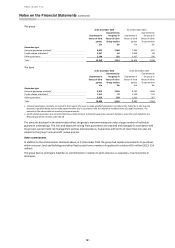

Group sponsored structured entities

Accounting policy

The group is considered to sponsor another entity if, in addition to ongoing involvement with the entity, it had a key role in

establishing that entity or in bringing together the relevant counterparties to a structured transaction, so that the transaction, which is

the purpose of the entity, could occur. The group is generally not considered a sponsor if the only involvement with the entity is

merely administrative in nature.

The amount of assets transferred to and income received from such sponsored entities during 2014 and 2013 was not

significant.