Volvo 2009 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2009 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

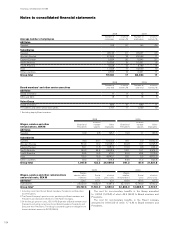

Notes to consolidated financial statements

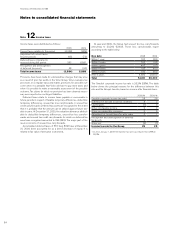

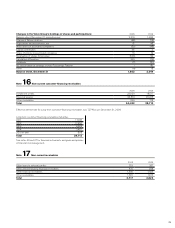

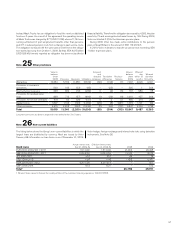

Pension costs 2008 2009

Current year service costs 864 969

Interest costs 1,557 1,684

Expected return on plan assets (1,655) (1,362)

Actuarial gains and losses181 504

Past service costs

– Unvested 14 18

– Vested 39 (314)

whereof effect of agreement with UAW in Mack Trucks –(317)

Curtailments and settlements 167 36

Termination benefits 21 40

Pension costs for defined benefit plans 1,088 1,575

Pension costs for defined contribution plans 3,462 3 ,116

Total pension costs 4,550 4,691

1 For each plan, actuarial gains and losses are reported as income or expenses, when the accumulated amount exceeds the so called corridor. The income or

expenses are then recognized over the expected average remaining service period of the employees.

Costs for post-employment benefits other than pensions 2008 2009

Current year service costs 284 270

Interest costs 336 334

Expected return on plan assets (3) (1)

Actuarial gains and losses11 4

Past service costs

– Unvested (1) 7

– Vested 1 0

Curtailments and settlements 01,124

whereof effect of agreement with UAW in Mack Trucks –1,194

Termination benefits 020

Total costs for post-employment benefits other than pensions 618 1,758

1 For each plan, actuarial gains and losses are reported as income or expenses, when the accumulated amount exceed the so called corridor. The income or

expenses are then recognized over the expected average remaining service period of the employees.

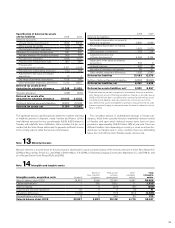

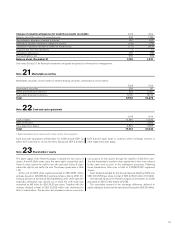

An increase of one percentage point per year in healthcare costs

would change the accumulated post-employment benefit obligation

as of December 31, 2009 by approximately 169, and the post-employ-

ment benefit expense by approximately 12. A decrease of one per-

centage point would decrease the accumulated value of obligations

by about 144 and reduce costs by approximately 10. Calculations

made as of December 31, 2009 show an annual increase of 9% in the

weighted average per capita costs of covered health care benefits; It

is assumed that the percentage will decline gradually to 5% and then

remain at that level.

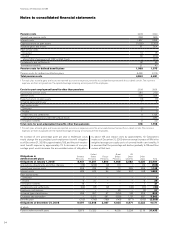

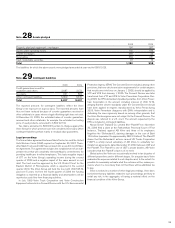

Obligations in

defined benefit plans Sweden

Pensions

United

States

Pensions France

Pensions

Great

Britain

Pensions

US

Other

benefits Other

plans Total

Obligations at January 1, 2008 8,451 11,207 1,800 4,608 5,582 4,336 35,984

Acquisitions, divestments and other changes (13) (226) (2) 116 –22 (103)

Current year service costs 265 224 55 72 269 263 1,148

Interest costs 383 672 93 250 327 168 1,893

Past service costs

– Unvested 1 – – – – – 1

– Vested 627 – – – 6 39

Termination benefits 14 ––––721

Curtailments and settlements (34) 65 (2) –(42) (11) (24)

Employee contributions –––29 –(2) 27

Actuarial (gains) and losses 336 257 47 (304) 261 205 802

Exchange rate translation –2,212 281 (593) 1,151 891 3,942

Benefits paid (312) (790) (185) (143) (577) (552) (2,559)

Obligations at December 31, 2008 9,097 13,648 2,087 4,035 6,971 5,333 41,171

of which

Funded defined benefit plans 8,675 13,322 – 4,035 3,224 2,179 31,435

FINANCIAL INFORMATION 2009

94