Volvo 2009 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2009 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

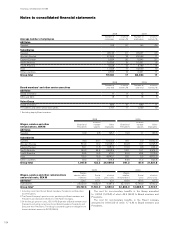

Notes to consolidated financial statements

also assumes a parallel shift in the yield curve and an identical effect

of changed market interest rates on the interest-rates of both assets

and liabilities. Consequently, the effect of actual interest-rate changes

may deviate from the above analysis. Volvo uses derivatives to hedge

currency and interest rate risks.

Currency risks

The content of the reported balance sheet may be affected by changes

in different exchange rates. Currency risks in Volvo’s operations are

related to changes in the value of contracted and expected future

payment flows (commercial currency exposure), changes in the value

of loans and investments (financial currency exposure) and changes

in the value of assets and liabilities in foreign subsidiaries (currency

exposure of shareholders’ equity). The aim of Volvo’s currency-risk

management is to minimize, over the short term, negative effects on

Volvo’s earnings and financial position stemming from exchange-rate

changes.

Commercial currency exposure

In order to hedge the value of future payment flows in foreign

currencies, Volvo uses forward contracts and currency options. During

2008, 75% of the forecasted net flows for each currency for the coming

six months were hedged and 50% for months seven to twelve. Con-

tracted flows after 12 months were normally hedged. As a conse-

quence of the financial turmoil, Volvo gradually shifted focus in 2009

from hedging forecasted flows to only hedge contracted flows. From

the fourth quarter 2009, Volvo revised its hedging policy in order to

only hedge firm flows, whereof the major part are realised within six

months. Also, from the fourth quarter 2009, hedge accounting was

not applied for new contracts. For details regarding Hedge account-

ing, refer to note 37.

The nominal amount of all outstanding forward and option con-

tracts amounted to SEK 17.2 billion (73.8) at December 31, 2009. On

the same date, the fair value of these contracts was positive in an

amount of SEK 186 million (negative 2,936).

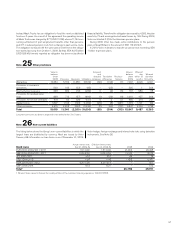

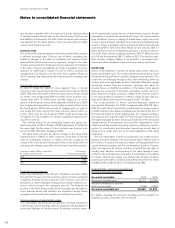

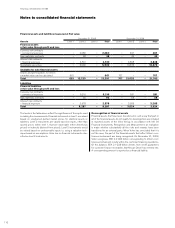

The table below presents the effect a change of the value of the

Swedish krona in relation to other currencies would have on the fair

value of outstanding contracts. In reality, currencies usually do not

change in the same direction at any given time, so the actual effect of

exchange-rate changes may differ from the below sensitivity analysis.

Change in value of SEK in relation to

all foreign currencies, % Fair value of

outstanding contracts

(10) (773)

0186

10 1,145

Financial currency exposure

Loans and investments in the Group’s subsidiaries are done mainly

through Volvo Treasury in local currencies, which minimizes individual

companies’ financial currency exposure. Volvo Treasury uses various

derivatives, in order to facilitate lending and borrowing in different cur-

rencies without increase the company’s own risk. The financial net

position of the Volvo Group is affected by exchange rate fluctuations,

since financial assets and liabilities are distributed among Group

companies that conduct their operations in different currencies.

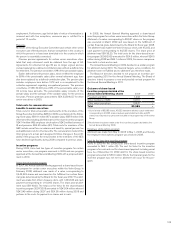

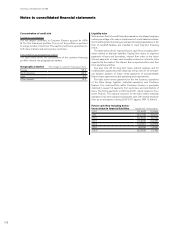

Currency exposure of shareholders’ equity

The consolidated value of assets and liabilities in foreign subsidiaries

is affected by current exchange rates in conjunction with translation of

assets and liabilities to Swedish kronor. To minimize currency expos-

ure of shareholders’ capital, the size of shareholders’ equity in foreign

subsidiaries is continuously optimized with respect to commercial and

legal conditions. Currency hedging of shareholders’ equity may occur

in cases where a foreign subsidiary is considered overcapitalized. Net

assets in foreign subsidiaries and associated companies amounted at

year-end 2009 to SEK 59.4 billion (66.0). Of this amount, SEK 4.1

billion (4.3) was currency-hedged through loans in foreign currencies.

Out of the loans used as hedging instruments SEK 3.1 billion are due

in 2010 and the remaining SEK 1.0 billion in 2011. The need to under-

take currency hedging relating to investments in associated com-

panies and other companies is assessed on a case-by-case basis.

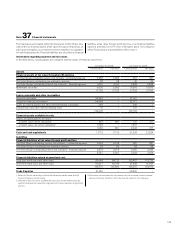

Credit risks

Volvo’s credit granting is steered by Group-wide policies and cus-

tomer-classification rules. The credit portfolio should contain a sound

distribution among different customer categories and industries. The

credit risks are managed through active credit monitoring, follow-up

routines and, where applicable, product reclamation. Moreover, regular

monitoring ensures that the necessary provisions are made for

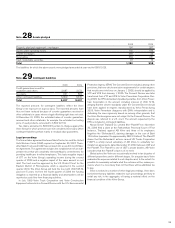

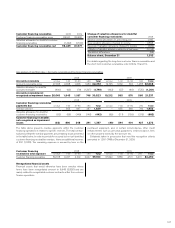

incurred losses on doubtful receivables. In the tables below, ageing

analyses are presented of accounts receivables overdue and cus-

tomer finance receivables overdue in relation to the reserves made. It

is not unusual that a receivable is settled a couple of days after due

date, which affects the extent of the age interval 1–30 days.

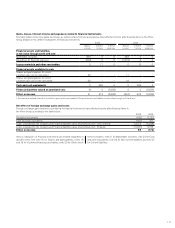

The credit portfolio of Volvo’s customer-financing operations

amounted at December 31, 2009, to approximately SEK 82 billion

(98). The credit risk of this portfolio is distributed over a large number

of retail customers and dealers. Collaterals are provided in the form of

the financed products. Credit granting aims for a balance between

risk exposure and expected yield. The Volvo Group’s financial assets

are largely managed by Volvo Treasury and invested in the money and

capital markets. All investments must meet the requirements of low

credit risk and high liquidity. According to Volvo’s credit policy, counter-

parties for investments and derivative transactions should have a

rating of A or better from one of the well-established credit rating

institutions.

The use of derivatives involves a counterparty risk, in that a poten-

tial gain will not be realized if the counterparty fails to fulfill its part of

the contract. To reduce the exposure, master netting agreements are

signed, wherever possible, with the counterparty in question. Counter-

party risk exposure for futures contracts is limited through daily or

monthly cash transfers corresponding to the value change of open

contracts. The estimated gross exposure to counterparty risk relating

to futures, interest-rate swaps and interest-rate forward contracts,

options and commodities contracts amounted at December 31, 2009,

to 588 (3,798 ), 3.560 (2,763 ), 167 (229) and 42 (38).

Credit portfolio – Accounts receivable and

Customer financing receivables

Accounts receivable 2008 2009

Accounts receivable gross 32,272 22,638

Valuation allowance for doubtful

accounts receivable (1,749) (1,301)

Accounts receivable net 30,523 21,337

For details regarding the accounts receivable and the valuation for

doubtful accounts receivable, refer to note 20.

FINANCIAL INFORMATION 2009

106