Volvo 2009 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2009 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

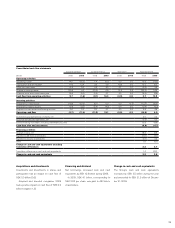

BOARD OF DIRECTORS’ REPORT 2009

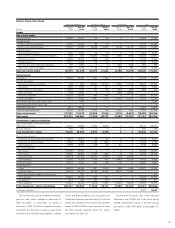

Net financial position

Industrial operations Volvo Group

SEK M Dec 31

2008

Dec 31

2009

Dec 31

2008

Dec 31

2009

Non-current interest-bearing assets

Non-current customer-nancing receivables – – 50,432 39,713

Non-current interest-bearing receivables 149 1,095 694 585

Current interest-bearing assets

Customer-nancing receivables – – 48,057 42,264

Interest-bearing receivables 2,684 1,215 1,965 410

Internal funding 792 3,662 – –

Interest-bearing assets held for sale – 8 – 8

Marketable securities 5,901 16,655 5,902 16,676

Cash and bank 16 ,674 20,749 17,712 21,234

Total financial assets 26,200 43,384 124,762 120,890

Non-current interest-bearing liabilities

Bond loans 35,798 49,191 35,798 49,191

Other loans 39,880 48,684 47,298 56,035

Internal funding (44,934) (30,908) – –

Current interest-bearing liabilities

Loans 56,178 44,196 62,631 51,626

Internal funding (40,173) (32,273) – –

Total financial liabilities 46,749 78,890 145,727 156,852

Net financial position excl.

post employment benefits (20,549) (35,506) (20,965) (35,962)

Provision for post employment benets, net 9,246 5,983 9,263 6,002

Net financial position incl.

post employment benefits (29,795) (41,489) (30,228) (41,964)

Change in net financial position, Industrial operations

SEK bn 2008 2009

Beginning of period (4.3) (29.8)

Cash flow from operating activities 9.7 (1.6)

Investments in xed assets (13.0) (10.5)

Disposals 0.6 0.7

Operating cash-flow (2.7) (11.4)

Investments and divestments of shares 0.0 0.0

Acquired and divested operations, net (1.3) 0.2

Capital injections to/from Customer Finance operations (0.2) 0.4

Currency effect (9.1) 3.0

Payment to AB Volvo shareholders (11.1) (4.1)

Revaluation of loans (0.9) 0.9

Provision UAW agreement – (0.9)

Other (0.2) 0.2

Total change (25.5) (11.7)

Net financial position at end of period (29.8) (41.5)

Volvo Group’s liquid funds, cash and cash

equivalents and marketable securities com-

bined, amounted to SEK 37.9 billion on

December 31, 2009. Of this, SEK 1.2 billion

was restricted for use by the Volvo Group and

SEK 5.3 billion consisted of liquid funds in

countries where exchange controls or other

legal restrictions apply. In addition to this,

granted but unutilized credit facilities amounted

to SEK 33.2 billion.

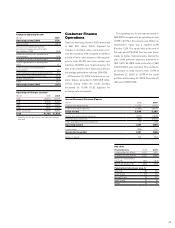

Total assets in the Volvo Group amounted to

SEK 332.3 billion on December 31, 2009, a

decrease of SEK 40.2 billion compared to year-

end 2008. The decrease is mainly the result of

lower working capital due to decreased inven-

tories and accounts receivable, decreased cus-

tomer nancing receivables due to lower levels of

nancial leasing, installment credits and dealer

nancing as well as uctuations in currency. Fluc-

tuations in currency decreased the Volvo Group’s

total assets by SEK 8.3 billion during 2009.

Volvo Group’s intangible assets amounted to

SEK 41.6 billion on December 31, 2009. Invest-

ments in research and development amounted to

SEK 2.6 billion in 2009, resulting in a net value of

development costs of SEK 11.4 billion at the end

of the year. Volvo Group’s total goodwill amounted

to SEK 23.8 billion on December 31, 2009, a

decrease by SEK 1.0 billion compared to year-

end 2008. The decrease is a result of fluctu ations

in currency. The Volvo Group’s tangible assets

decreased by SEK 7.0 billion during 2009, mainly

as a result of decreased assets under operational

leasing.

The value of the Volvo Group’s inventories

decreased by SEK 17.3 billion during 2009. The

decrease is mainly related to nished products

within the Group’s truck brands and construction

equipment. Currency fluctuations only had a

minor impact on the value of inventories at the

end of 2009.

Financial position

– increased debt but continued

strong liquidity position

Net debt in the Volvo Group’s Industrial Operations amounted to SEK 41.5 billion at December

31, 2009, equal to 70.9% of shareholders’ equity. Excluding provisions for post-employment

benets the Volvo Group’s net debt amounted to SEK 35.5 billion, which was equal to 60.7%

of shareholders’ equity.

26