Volvo 2009 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2009 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEGMENTS 2009

2009 was characterized by weak demand for trucks in the Group’s main markets in Europe,

North America and Japan.

Trucks

– low demand in the Group’s main markets

rder intake increased

gradually in Europe and

Japan during the second

half of the year, however,

the increase came from

very low levels. The North

American market weakened further from the

very low levels of the two preceding years. In

some emerging markets, such as Brazil and

China, demand increased during the second

half of the year, to a certain extent as a conse-

quence of governmental stimulus measures.

Total market

The total market for heavy-duty trucks in

2009 in the EU’s 27 countries plus Norway

and Switzerland amounted to 164,000 vehi-

cles, a decline of 49%. The decline was the

result of lower activity in the European econo-

mies with lower freight volumes as a conse-

quence. The truck manufacturers imple-

mented measures to adapt production to the

new, much lower demand level and to reduce

inventories of new trucks.

The continued weak development in the

North American economy affected the market

adversely. The total market declined by 38% to

115,000 trucks, compared with 185,000

trucks in the preceding year.

The total market for heavy-duty trucks in

Japan declined by 46% to 18,700 vehicles

(34,900). Among the major markets in Asia,

China rose with 22% to a record level of about

605,500 trucks (>14 tons), compared with

496,000 a year earlier. The market for heavy-

duty trucks in India amounted to 124,500 vehi-

cles in 2009 (159,600).

In Brazil, the total market declined by 15%

to 67,000 heavy trucks.

63% (67)

Net sales as percentage of

Volvo Group’s sales

1) Years starting 2006 are reported according to a new

reporting structure. See note 7.

2) Excluding adjustment of goodwill in 2006.

The truck operations consist of Volvo Trucks,

Renault Trucks, UD Trucks, Mack Trucks and VECV

in India (50% direct and indirect ownership). The

product offer stretches from heavy-duty trucks for

long-haulage and construction work to light-duty

trucks for distribution.

Number of employees

37,575

Position on world market

In total, the Volvo Group is Europe’s largest and the

world’s second largest manufacturer of heavy trucks.

Brands

Volvo, Renault, UD, Mack and Eicher.

0908070605

(10.8) SEK bn

%

12.2 15.214.811.7

(7.8)6.08.18.77.5

Operating income

1,2

Operating margin

1,2

Operating income and operating margin

1,2

0908070605

138.9 SEK bn203.6187.9171.3155.4

Net sales1

Net sales by market

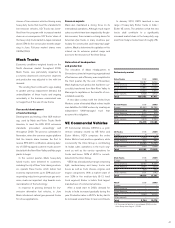

Trucks, SEK M 2008 2009

Europe 111,12 0 65, 874

North America 26,696 21,563

South America 14,732 12,490

Asia 37,540 26,943

Other markets 13,554 12,069

Total 203,642 138,940

Deliveries by market

Trucks 2008 2009

Europe 121,847 49,145

North America 30,146 17, 574

South America 18,092 12,587

Asia 60,725 34,800

Other markets 20,341 13,575

Total 251,151 127,681

09080908

12.0%13.7%5.5%5.9%

Volvo

Trucks Renault

Trucks

09080908

7.4%7.3%7.4%8.9%

Mack

Trucks

Volvo

Trucks

0908

23.5%22.6%

UD

Trucks

09080908

10.6%10.8%13.2%14.8%

Volvo

Trucks Renault

Trucks

Market shares

in Europe,

heavy-duty trucks

Market shares

in Western Europe,

medium-duty trucks

Market shares

in North America,

heavy-duty trucks

Market shares

in Japan,

heavy-duty trucks

O

38