Volvo 2009 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2009 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

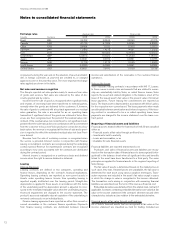

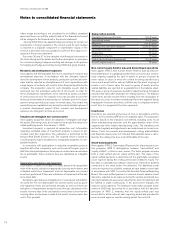

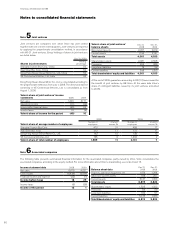

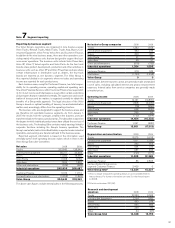

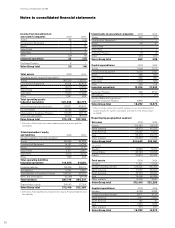

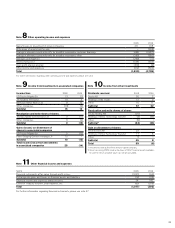

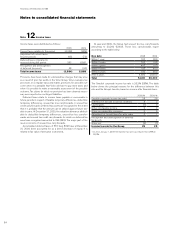

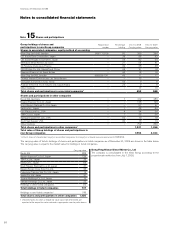

Notes to consolidated financial statements

IAS 23 amendment Borrowing costs

The amendment states that borrowing costs that are directly attribut-

able to the acquisition, construction or production of an asset that

necessarily takes a substantial period of time to get ready for its

intended use or sale, should form part of the cost of that asset.

According to the previous accounting principle applied by Volvo, bor-

rowing costs were expensed. The amendment resulted accordingly in

a change of accounting principle for the Volvo Group, but has not had

a significant impact on the Group’s financial statements in 2009 as

73 is capitalized.

IAS 1 amendment Presentation of financial statements

The amendment concerns the form of presentation of financial pos-

ition, comprehensive income and cash flow and contains a require-

ment for statement of comprehensive income. The Group has included

statements of comprehensive income in the financial statements in

2009. Otherwise, the amendment has not had a significant impact on

the Group’s financial statements.

IFRS 7 amendment Financial instruments: Disclosures

The amendment requires enhanced disclosures about fair value

measurements and liquidity risk. See notes 36 and 37 for the dis-

closures of the Volvo Group.

In addition to the above-mentioned, the below amendments to

standards and new interpretations from IFRIC have been applicable

for the Volvo Group from January 1, 2009, but have not had a signifi-

cant impact on the Group’s financial statements during the year.

– IFRIC 13 Customer Loyalty Programmes

– IFRIC 15 Agreements for the construction of Real Estate

– IFRIC 16 Hedges of a net investment in a foreign operation

– IFRS 2 amendment Share-based payments: Vesting conditions and

cancellations

– IAS 32 and IAS 1 amendment Puttable financial instruments and

obligations arising on liquidation

– IFRS 1 and IAS 27 amendment Cost of an investment in a

subsidiary, jointly-controlled entity or associate

– IFRIC 9 and IAS 39 amendment Embedded derivatives

– Annual improvements

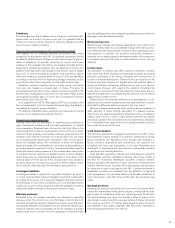

New accounting principles 2010 and later

When preparing the consolidated accounts as of December 31, 2009,

a number of standards and interpretations have been published, but

have not yet become effective. The following is a preliminary assess-

ment of the effect that the implementation of these standards and

statements could have on the Volvo Group’s financial statements.

Revised IFRS 3 Business combinations

The standard becomes effective on July 1, 2009 and applies to fiscal

years beginning on or after that date. The standard entails changes to

*These standards/interpretations have not been adopted by the EU at this time.

Accordingly, stated dates for adoption may change as a consequence of

decisions within the EU endorsement process.

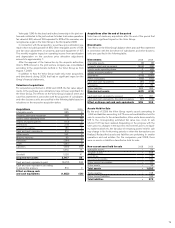

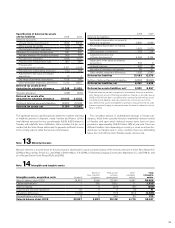

Note 4 Acquisitions and divestments of shares in subsidiaries

AB Volvo’s holding of shares in subsidiaries as of December 31, 2009

is shown in the disclosures of AB Volvo’s holding of shares. Significant

acquisitions, formations and divestments within the Group are listed

below.

Acquisitions in 2009

The Volvo Group has not made any acquisitions during 2009 that have

had a significant impact on the Volvo Group’s financial statements.

the reporting of future acquisitions regarding for example the accounting

of transaction costs, any contingent considerations and step acquisi-

tions. The Group will apply the amendment as of January 1, 2010. The

application will prospectively affect the accounting for business com-

binations made from the application date. Capitalized transaction

costs of 135 relating to ongoing acquisition projects will be trans-

ferred to equity by Volvo.

IAS 27 amendment Consolidated and separate financial statements

The standard becomes effective on July 1, 2009, as a consequence

of the revised IFRS 3, and applies to fiscal years beginning on or after

that date. The amendment brings about changes in IAS 27 regarding

for example how to report changes to the ownership in cases where

the parent company retains or loses the control of the owned entity.

The Group will apply the amendment as of January 1, 2010. The appli-

cation will prospectively affect the accounting for business combin-

ations made from the application date.

IFRS 9 Financial instruments*

IFRS 9 Financial instruments have been published in three parts:

Classification and Measurement , Impairment and Hedge accounting,

which will replace IAS 39 with effective date January 1, 2013. Earlier

adoption is permitted given endorsement.

In addition to the above-mentioned, the below amendments to

standards and interpretations from IFRIC are applicable for the Volvo

Group from January 1, 2010 or later, but are not expected to have a

significant impact on the Group’s financial statements.

– IFRIC 12 Service Concession Arrangements

– IFRIC 17 Distribution of non-cash assets to owners

– IAS 39 amendment Financial instruments: Recognition and

Measurement: Eligible hedge items

– Revised IFRS 1 First time adoption of IFRS

– IFRIC 18 Transfers of assets from customers

– IFRS 1 amendments Additional exemptions for first-time adopters*

– IAS 32 amendment Classification of rights issues

– Annual improvements*

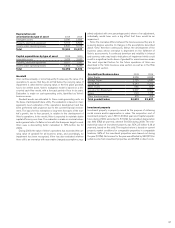

Depreciation period in aircraft engine projects

In connection with its participation in aircraft engine projects with

other companies, Volvo Aero in certain cases pays an entrance fee,

which is capitalized as an intangible asset. Volvo estimates the

expected useful life for existing and future projects to be 35 years and

therefore the depreciation period has been adjusted from today’s 20

to 35 years as from 2010. Volvo estimates the effect during 2010 to

be insignificant.

Acquisitions in 2008

VE Commercial Vehicles Ltd.

The Volvo Group finalized, in the third quarter 2008, the deal with

Eicher Motors for the establishment of a new Indian joint venture, VE

Commercial Vehicles Ltd. The joint venture comprises Eicher Motors’

entire truck and bus operations and the Volvo Group contributed its

Indian truck sales operations and service network for trucks and

buses.

FINANCIAL INFORMATION 2009

78