Volvo 2009 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2009 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

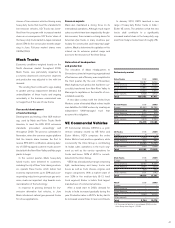

Volvo Trucks 2008 2009

Europe 58,187 19,749

North America 15,887 8,028

South America 12,890 10,349

Asia 13,440 5,573

Other markets 5,548 3,712

Total 105,952 47,411

Mack Trucks 2008 2009

Europe 8 0

North America 12,157 8,235

South America 3,097 1,219

Asia 200 505

Other markets 1,151 1,142

Total 16,613 11,101

Renault Trucks 2008 2009

Europe 63,643 29,396

North America 494 458

South America 1,172 574

Asia 5,252 1,794

Other markets 5,918 5,263

Total 76,479 37,485

chases of low-emission vehicles. Having many

heavy-duty trucks that meet the standards for

low-emission vehicles, UD Trucks has bene-

ted from the program with increased market

share as a consequence. UD Trucks’ share of

the heavy-duty truck market in Japan remained

above 25% for ve consecutive months begin-

ning in June. Full-year market shares were

23.5% (22.6).

Mack Trucks

Economic conditions weighed heavily on the

North American market throughout 2009.

Mack Trucks was particularly impacted by

a severely depressed construction segment,

and production was adjusted in line with low

demand.

The existing fleet continued to age, leading

to greater pent-up replacement demand, but

underutilization of these trucks and ongoing

uncertainty in the business environment was

not supportive of the sale of new trucks.

Successful development

of new technology

Development and testing of the SCR technol-

ogy, used by Mack and Volvo Trucks North

America, to meet the EPA 2010 emissions

standards proceeded exceedingly well

throughout 2009. The process culminated in

November, when the common engine platform

that the brands share became the rst to

receive EPA 2010 certication, allowing deliv-

ery of SCR-equipped customer trucks assem-

bled at both the New River Valley and Macungie

plants to begin.

In the second quarter, Mack heavy-duty

hybrid trucks were delivered to customers,

including the city of New York. Having custom-

ers operate these trucks, which deliver fuel

economy improvements up to 30% and a cor-

responding reduction in greenhouse gas emis-

sions, marks an important step towards com-

mercialization of the technology.

In response to growing demand for low-

emission alternative fuel vehicles, in June

Mack introduced natural gas-powered trucks

for refuse applications.

VECV12008 2009

Europe – –

North America – –

South America – –

Asia 2,744 10,175

Other markets – –

Total 2,744 10,175

1 VE Commercial Vehicles is consolidated (50%) into the

Volvo Group from August 1, 2008.

UD Trucks 2008 2009

Europe 9 0

North America 1,608 853

South America 933 445

Asia 39,089 16,753

Other markets 7,724 3,458

Total 49,363 21,509

Deliveries by market

Focus on exports

Mack also maintained a strong focus on its

international operations. Although truck export

sales as a whole have been impacted by the glo-

bal recession, there remains a strong desire for

American-style trucks in many countries, par-

ticularly for construction and heavy-haul appli-

cations. Mack is determined to capitalize on this

interest via its extensive product range and

access to the resources of the Volvo Group.

Relocation of headquarters

and production

The relocation of Mack Headquarters to

Greensboro, aimed at improving organizational

effectiveness and efciency, was completed in

the third quarter. By the end of November,

Mack highway truck production had been suc-

cessfully transferred from New River Valley to

Macungie to capitalize on the benets of con-

solidated assembly.

A new labor contract with the United Auto

Workers union eliminated Mack retiree health

care liabilities for UAW workers by creating an

independent UAW-managed trust that

assumes this obligation.

VE Commercial Vehicles

VE Commercial Vehicles (VECV) is a joint-

venture company owned by AB Volvo and

Eicher Motors. VECV comprises the entire

Eicher Motors truck and bus operations, while

concurrently the Volvo Group is contributing

its Indian sales operations in the truck seg-

ment as well as the service operations for

trucks and buses. 50% of VECV is consoli-

dated into the Volvo Group.

VECV has a broad product range comprising

light, medium-heavy and heavy trucks and

buses as well as truck chassis, engines and

engine components. With a market share of

over 30% in the medium-duty (5–12 tons)

truck segment, Eicher is India’s third largest

manufacturer of commercial vehicles.

After a weak start to 2009, demand for

trucks in India increased gradually during the

year. Production rates in VECV’s factory had to

be increased several times to new record levels.

In January 2010, VECV launched a new

range of heavy-duty Eicher trucks in India –

Eicher VE series. The ambition is that the new

trucks shall contribute to a signicantly

increased market share in the heavy-duty seg-

ment from today’s modest level of roughly 2%.

41