Volvo 2009 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2009 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEGMENTS 2009

The services offered by its nance operations provide many benets to the Volvo Group,

including strengthening brand recognition, simplifying the product acquisition experience,

enhancing customer loyalty and providing value-added services to customers and dealers.

Financial Services

– adaptations from the downturn

uring the downturn, the activ-

ities of customer nance

have proven critical as Volvo

Financial Services (VFS)

worked even more closely

with buyers of Volvo Group

products to help them through these very dif-

cult times.

Risk mitigation and risk management

The severely depressed global economy con-

tinued to negatively affect the cash flow and

business models of VFS’ customers, compro-

mising VFS’ ability to generate prots in 2009.

However, toward the end of the year there

were signs of improvement in certain areas

The overriding focus throughout the organ-

ization centered on downturn management.

Initiatives were geared toward customer

account and asset management, as VFS

strengthened its collection activities. Accord-

ingly, inventory management and asset remar-

keting took on increased importance.

Rationalization of the cost structure

As the global economies emerge from this

downturn, VFS intends to use the lessons

learned to adapt the business models in order

to secure sustainable protability and strong

returns over future business cycles.

Implementing these changes begins by

identifying those segments and markets which

have not met prot expectations over the cur-

rent business cycle. At the same time, a plan is

developed for achieving even higher penetra-

tion levels in those segments and markets

which have demonstrated acceptable perform-

ance levels throughout the downturn. Priori-

ties and resources are shifted accordingly.

Rationalization of the cost structure is a key

component of the operating strategy, along

with a focus on right sizing the business in

response to current market conditions. Other

initiatives include exploiting organizational and

operational economies of scale, while making

sure that VFS has adequate resources to con-

tinue to handle loss mitigation and recovery

activities.

D

5% (3)

Net sales as percentage of

Volvo Group sales

1) Years starting 2006 are reported according to a new report-

ing structure, in which Volvo Group Real Estate and Volvo

Treasury are not included in VFS. See note 7.

2) Share of business nanced by Financial Services in

markets where nancial services are offered.

Conducts operations in customer and dealer

nancing.

Number of employees

1,234

Position on world market

Volvo Financial Services operates exclusively

to support the sales and leasing of vehicles

and machines which are produced by the other

Business Areas, enhancing their competitiveness.

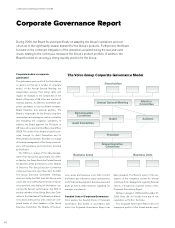

0908070605

(680) SEK M 1,3971,6491,6862,033

Operating income1

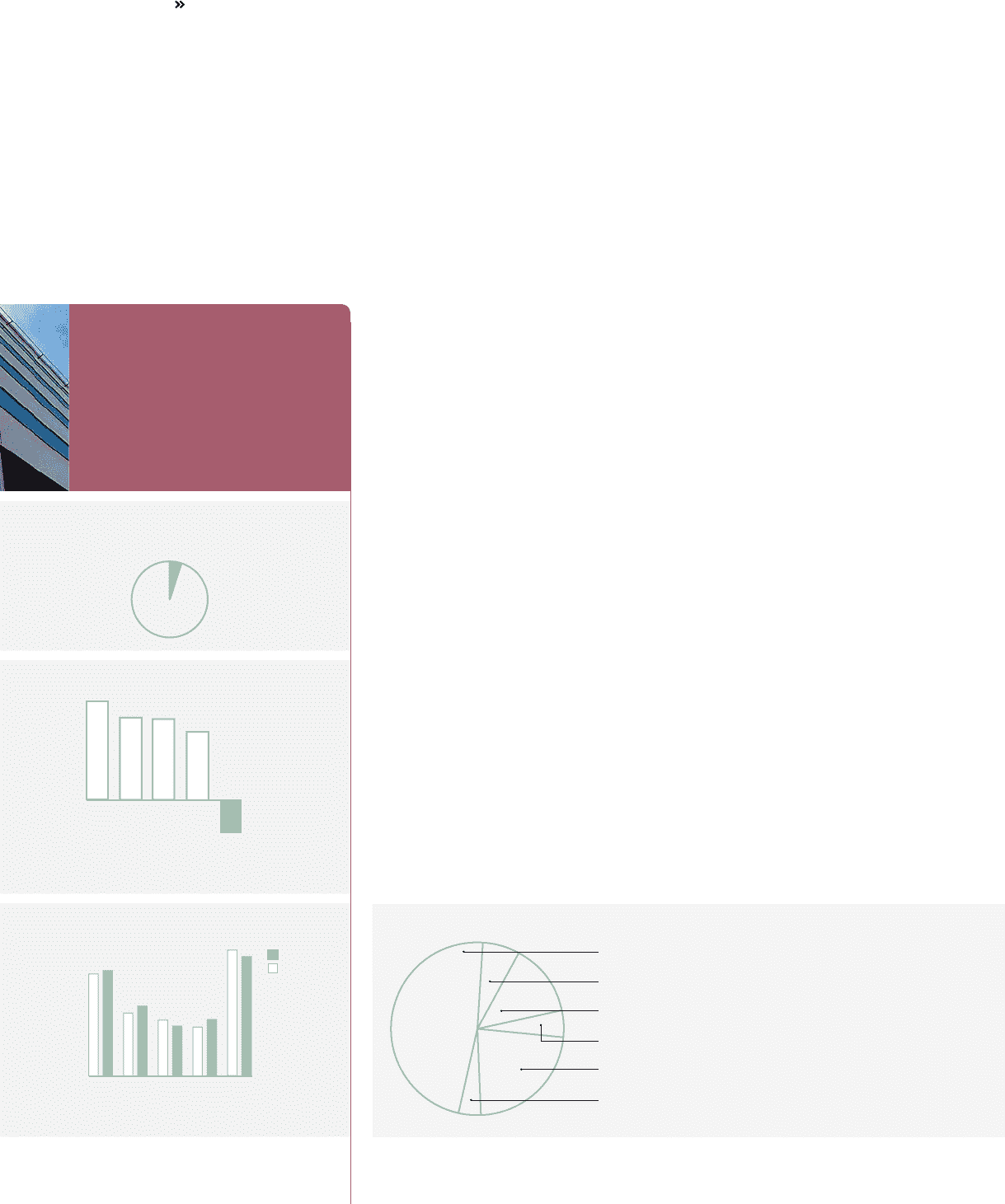

29

Volvo

Trucks Renault

Trucks Mack

Trucks Buses Volvo

CE

30 18 20 1614 14 16 36 34

09

08

%

Penetration by business area2

Volvo Trucks 48%

Mack Trucks 7%

Renault Trucks 14%

Buses 5%

Volvo CE 23%

Other 4%

Credit portfolio by business area

50