Volvo 2009 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2009 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

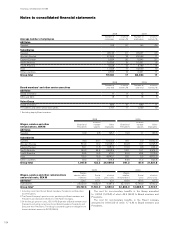

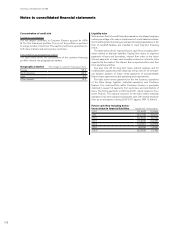

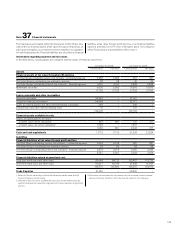

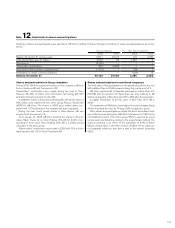

Gains, losses, interest income and expenses related to financial instruments

The table below shows how gains and losses as well as interest income and expense have affected income after financial items in the Volvo

Group divided on the different categories of financial instruments.

2008 2009

Gains/

Losses Interest

income Interest

expenses Gains/

Losses Interest

income Interest

expenses

Financial assets and liabilities

at fair value through profit and loss1

Marketable securities 864 0 0 248 0 0

Derivatives for financial exposure (924) 0 0 (1,272) 0 0

Loans receivable and other receivables 011 0 0 10 0

Financial assets available for sale

Shares and participations for which

a market value can be calculated 42 – – 11 – –

Shares and participations for which

a market value can not be calculated 60 – – 19 – –

Cash and cash equivalents 0362 0 0 299 0

Financial liabilities valued at amortized cost (1) 0(5,083) 0 0 (5,259)

Effect on income 41 373 (5,083) (994) 309 (5,259)

1 Accrued and realized interest is included in gains and losses related to Financial assets and liabilities at fair value through profit and loss.

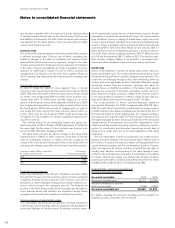

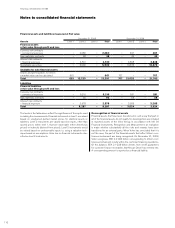

Net effect of foreign exchange gains and losses

Foreign exchange gains and losses pertaining to financial instruments have affected income after financial items in

the Volvo Group according to the table below:

2008 2009

Derivative instruments (812) (1,131)

Cash and cash equivalents (421) 471

Loans originated by the company and Financial liabilities value at amortized cost – Volvo internal 12,373 (5,268)

Loans originated by the company and Financial liabilities value at amortized cost – External (11, 041) 5,755

Effect on income 99 (173)

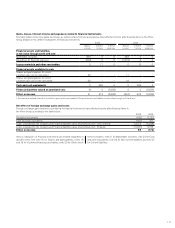

Various categories of financial instruments are treated separately in

specific notes. See note 15 for Shares and participations, notes 16

and 19 for Customer-financing receivables, note 20 for Other short-

term receivables, note 21 for Marketable securities, note 22 for Cash

and cash equivalents, note 26 for Non-current liabilities and note 27

for Current liabilities.

111