Volvo 2009 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2009 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

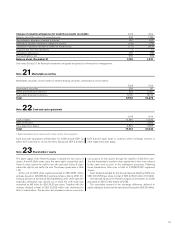

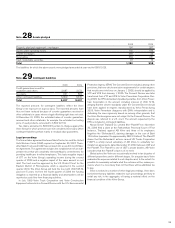

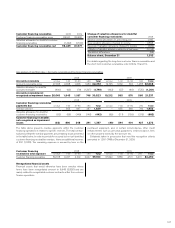

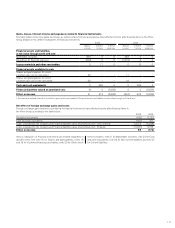

Book value of assets subject to finance lease:

2008 2009

Acquisition costs:

Buildings 131 123

Land and land improvements 65 61

Machinery and equipment 2,609 1,799

Assets under operating lease 392 343

Total 3,197 2,326

Accumulated depreciation:

Buildings (40) (41)

Land and land improvements – 0

Machinery and equipment (1,769) (1,090)

Assets under operating lease (127) (78)

Total (1,936) (1,209)

Book value:

Buildings 91 82

Land and land improvements 65 61

Machinery and equipment 840 709

Assets under operating lease 265 265

Total 1,261 1,117

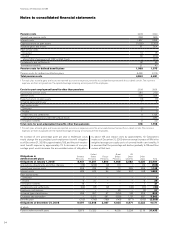

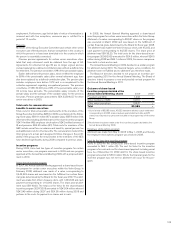

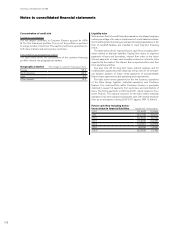

Note 32 Transactions with related parties

The Volvo Group has transactions with some of its associated com-

panies. The transactions consist mainly of sales of vehicles to dealers.

Commercial terms and market prices apply for the supply of goods

and services to/from associated companies.

2008 2009

Sales to associated companies 1,222 529

Purchase from associated companies 116 91

Receivables from associated companies, Dec 31 273 297

Liabilities to associated companies, Dec 31 63 8

Group holdings of shares in associated companies are presented in

note 15, Shares and participations.

The Volvo Group also has transactions with Renault s.a.s. and its sub-

sidiaries. Sales to and purchases from Renault s.a.s. amounted to 85

(113) and 2,110 (2,833). Amounts due from and due to Renault s.a.s.

amounted to 20 (31) and 457 (539) respectively, at December 31,

2009. The sales were mainly from Renault Trucks to Renault s.a.s. and

consisted of components and spare parts. The purchases were mainly

made by Renault Trucks from Renault s.a.s. and consisted mainly of

light trucks. Renault Trucks has a license from Renault s.a.s. for the

use of the trademark Renault.

Note 33 Government grants

During 2009, government grants amounting to 810 (492) have been

received and 567 (465) have been accounted for in the income state-

ment. R&D credits are included with 305 (237). The grants were

mainly received from the European Commission and the Swedish

government. During 2007 Volvo Buses received a grant of 116 from

the Swedish Energy Agency for the development of hybrid technology.

25 (48) of the 116 have been accounted for during 2009.

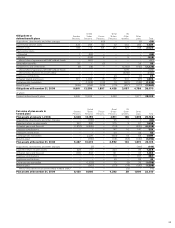

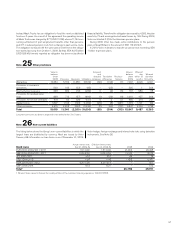

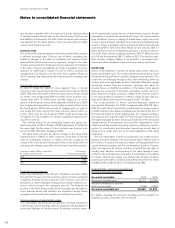

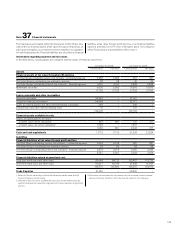

Note 34 Personnel

Remuneration policy decided at

the Annual General Meeting in 2009

The Annual General Meeting of 2009 decided upon principles for

remuneration and other employment terms for the members of Volvo’s

Group Executive Committee (“Remuneration Policy”). The accepted

principles can be summarized as follows:

The guiding principle is that remuneration and other employment

terms for company management, shall be competitive to ensure that

Volvo can attract and retain skilled persons in the Group Executive

Committee. The fixed salary shall be competitive and shall reflect the

individual’s area of responsibility and performance.

In addition to the fixed salary a variable salary may be paid. The

variable salary may for the CEO amount to a maximum of 65% of the

fixed salary and for the other senior executives a maximum of 50% of

the fixed salary. The variable salary shall be based on the Volvo Group’s

and/or the executive’s respective Business Area’s or Business Unit’s

fulfilment of certain financial goals. These goals are decided by the

Board of AB Volvo and may be related, for example, to operating

income and/or cash flow.

In addition to fixed and variable salary, normally other customary

benefits, such as company car and company healthcare are provided.

In individual cases, accommodation benefits and other benefits may

be provided.

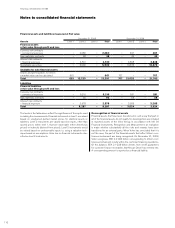

In addition to pension benefits provided by law and collective bargain

agreements, the members of the Group Executive Committee domiciled

in Sweden are offered a defined-contribution pension plan whereby

101