Volvo 2009 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2009 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

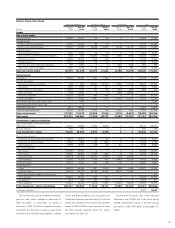

BOARD OF DIRECTORS’ REPORT 2009

Income Statement Volvo Group

SEK M 2008 2009

Net sales Volvo Group 304,642 218,361

Operating Income Volvo Group 15,851 (17,013)

Operating income Industrial operations 14,454 (16,333)

Operating income Customer Finance 1,397 (680)

Interest income and similar credits 1,171 390

Interest expense and similar credits (1,935) (3,559)

Other nancial income and costs (1,077) (392)

Income after financial items 14,010 (20,573)

Income taxes (3,994) 5,889

Income for the period 10,016 (14,685)

Income Statement Industrial operations

SEK M 2008 2009

Net sales 295,836 208,487

Cost of sales (233,514) (179,578)

Gross income 62,322 28,909

Gross margin, % 21.1 13.9

Research and development expenses (14,348) (13,193)

Selling expenses (25,597) (23,752)

Administrative expenses (6,921) (5,838)

Other operating income and expenses (1,094) (2,432)

Income from investments in associated companies 23 (15)

Income from other investments 69 (13)

Operating income Industrial operations 14,454 (16,333)

Operating margin, % 4.9 (7.8)

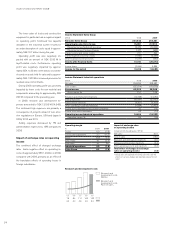

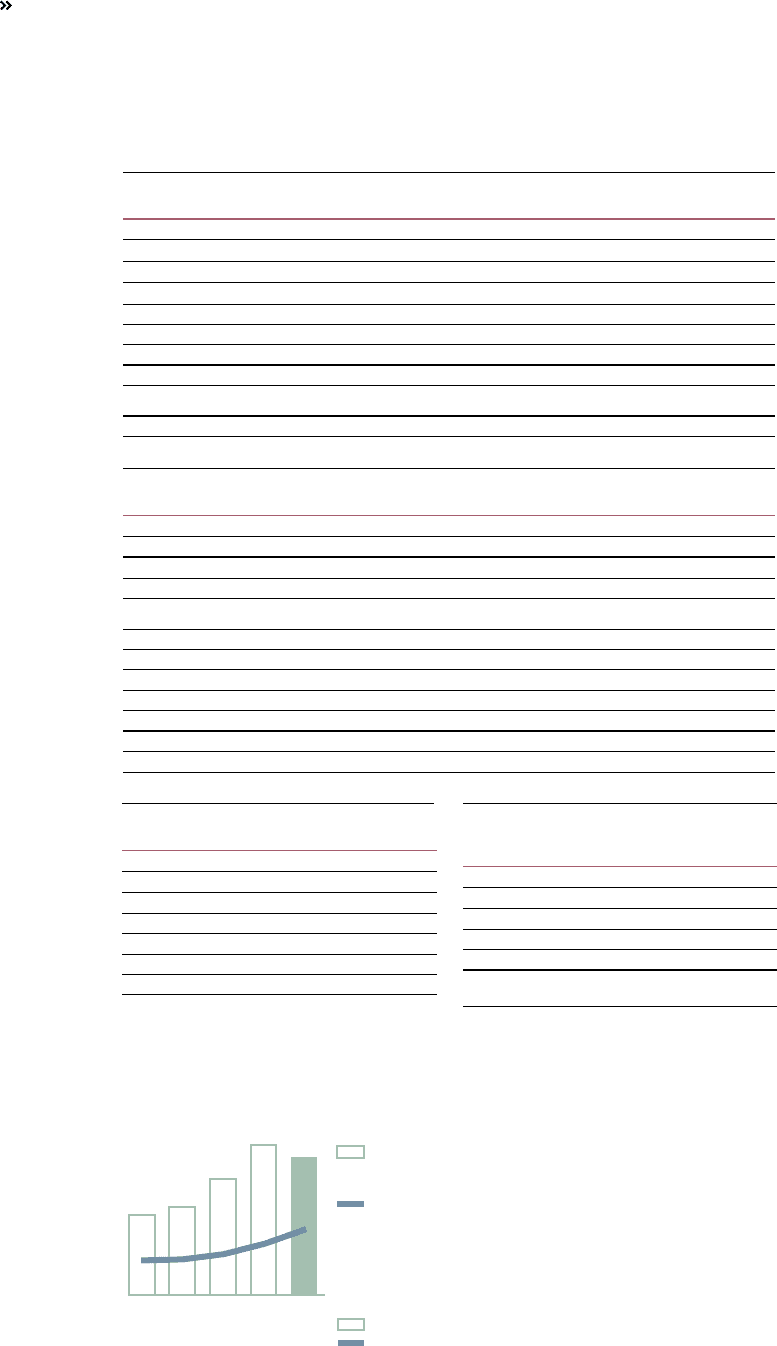

0908070605

13.214.311.18.47.6

6.34.93.93.43.3

Research and

development costs,

SEK bn

Research and

development costs,

% of net sales

Operating margin

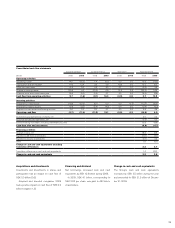

%2008 2009

Trucks 6.0 (7.8)

Construction Equipment 3.2 (11. 2)

Buses (0.4) (1.9)

Volvo Penta 8.1 (2.8)

Volvo Aero 4.7 0.6

Industrial operations 4.9 (7.8)

Volvo Group 5.2 (7.8)

Impact of exchange rates

on operating income

Compared with preceding year, SEK bn

Net sales120.9

Cost of sales (19.5)

Research and development expenses (0.5)

Selling and administrative expenses (2.4)

Other operating income and expenses (0.4)

Total effect of changes in exchange

rates on operating income (1.9)

1 Group sales are reported at monthly spot rates and the

effects of currency hedges are reported among “Cost of

sales”.

The lower sales of trucks and construction

equipment in particular had a negative impact

on operating prot. Continued low capacity

utilization in the industrial system resulted in

an under absorption of costs equal to approxi-

mately SEK 10.7 billion during the year.

Operating prot was also negatively im-

pacted with an amount of SEK 2,150 M in

layoff-related costs. Furthermore, operating

prot was negatively impacted by approxi-

mately SEK 1,120 M in write-downs on invento-

ries and on assets held for sale and by approxi-

mately SEK 1,200 M in increased provisions for

residual value commitments.

During 2009, operating prot was positively

impacted by lower costs for raw material and

components amounting to approximately SEK

200 M compared to the preceding year.

In 2009, research and development ex-

penses amounted to SEK 13,193 M (14,348).

The continued high expenses are primarily a

consequence of projects ahead of new emis-

sion regulations in Europe, USA and Japan in

2009, 2010 and 2011.

Selling expenses decreased by 7% and

administration expenses by 16% compared to

2008.

Impact of exchange rates on operating

income

The combined effect of changed exchange

rates had a negative effect on operating in-

come of approximately SEK 1.9 billion in 2009,

compared with 2008, primarily as an effect of

the translation effects of operating losses in

foreign subsidiaries.

Research and development costs

24