Volvo 2009 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2009 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

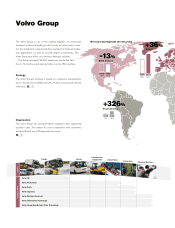

A GLOBAL GROUP 2009

FBased on the Volvo Group’s losses during 2009

and the present nancial position, the Board of

Directors proposes that no dividend is to be distrib-

uted for the year 2009.

Some recovery

In Europe we see a gradual recovery, which is

resulting in an increase in order bookings for trucks

and construction equipment, albeit from very low

levels. In North America, demand remains on a low

level, with a building and construction market that

is still weak.

Our truck operations posted a substantial loss

during 2009, due to signicantly lower sales of

new trucks, low cost coverage in production, write-

downs on inventories, increased costs for residual

value commitments and costs related to workforce

cutbacks. However, the rate of losses decreased

steadily during the second half of the year as the

savings programs started to generate effects.

The sharp downturn in the construction market

also resulted in Volvo Construction Equipment

experiencing a difcult year. However, as a result of

measures to cut costs, Volvo CE reduced its losses

continuously during 2009. Volvo CE also suc-

ceeded in reducing its inventories of unsold equip-

ment, and by the end of the year they were in bal-

ance with demand.

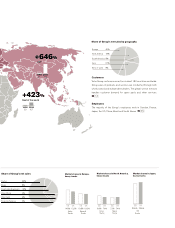

Viewed as a whole, the global market for buses

has stabilized at a low level, but with demand shifting

from Europe, North America and South America to

Asia, where margins are lower. Although Volvo

Buses’ operating loss increased, it left the year with

a healthy level of order bookings and with higher

market shares.

For Volvo Penta, demand for marine and indus-

trial engines was low. Although Volvo Penta

incurred a full-year loss, it reported an operating

ollowing the exceptionally rapid

drop in demand that resulted from

the crisis in the nancial system in

autumn 2008, demand remained

weak in the Group’s main markets

during most of 2009. Toward the

end of the year, an improvement could be discerned

in increasing parts of the world, although the upturn

occurred from low levels in most cases.

Substantial operating loss

During 2009, the Volvo Group’s sales decreased

by approximately SEK 90 billion compared to the

preceding year. The low sales of new vehicles and

machines had a signicant adverse impact on our

protability. As early as autumn 2008, production

cutbacks were initiated to adapt capacity to the

lower demand, to reduce inventories, particularly of

new trucks and construction equipment, and try to

defend the price levels for new products. These

measures continued during the rst half of 2009.

Since it was not possible to reduce costs in the

industrial system sufciently to match the extremely

sharp decline in production volumes, the result was

a considerable surplus of resources in the manu-

facturing process, which meant that the absorption

of xed costs was very low. The manufacturing rate

was reduced to levels that were even lower than

the demand, in order to cut back on inventories of

new products.

In view of the weak demand, substantial actions

were taken to adjust the Group to lower cost levels.

Savings were implemented at all levels and in all

parts of the Group. These savings were designed

to reduce the annual cost level by approximately

SEK 21 billion when their full impact is reached

during 2010. Among other measures, we were

forced to lay off many employees, which is both a

painful and a costly process. Since the middle of

2008, a total of 18.000 regular employees, tempo-

rary employees and consultants have left the

Group.

We focused a great deal on reducing inventories

in order to safeguard the Group’s cash flow, and the

actions that were taken were successful. In total,

the capital tied up in inventories was reduced by

slightly more than SEK 17 billion during the year.

Toward the end of the year, inventories of new

products were essentially in balance with the pre-

vailing demand. As a consequence of the reduced

inventories, we were able to increase the produc-

tion rate somewhat at that point in time, since a

larger part of the incoming orders could be steered

toward production rather than inventory reduction.

However, since uncertainty still prevails concerning

the recovery in the global economy, the increase in

production will be cautious and gradual.

The Group’s aftermarket business is not exposed

to the same fluctuations as sales of new products.

While the Group’s sales of new products declined

by almost 40%, the aftermarket business, with

sales of spare parts, service hours and other

aftermarket services, only declined a few percent

during the year, which is positive from a protability

viewpoint.

In total, the Volvo Group incurred an operating

loss of SEK 17 billion for the year, primarily as an

effect of the sharply reduced sales volumes and

low cost coverage in our production. As a conse-

quence of the nancial crisis and the subsequent

recession, we also had to take considerable costs

for, among other measures, workforce cutbacks,

write-downs on inventories and increased provi-

sions for residual value commitments and expected

credit losses.

CEO comment

– adaptation and alignment

2009 was a very dramatic year – it was characterized by comprehensive measures designed

to rapidly adapt the operations to the exceptionally sharp downturn that occurred in most of

our markets and by an intensive work to reduce the Group’s costs to a new level that matched

lower demand.

2