Volvo 2009 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2009 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

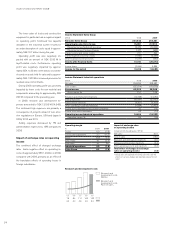

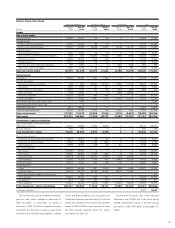

Net sales by business area

SEK M 2008 2009 %

Trucks 203,642 138,940 (32)

Construction

Equipment 56,277 35,658 (37)

Buses 17, 350 18,465 6

Volvo Penta 11, 518 8,159 (29)

Volvo Aero 7,625 7,803 2

Eliminations

and other (576) (538) (7)

Industrial

operations1295,836 208,487 (30)

Customer

Finance 11, 073 11,712 6

Reclassications

and eliminations (2,268) (1,838) –

Volvo Group 304,642 218,361 (28)

1 Adjusted for acquired and divested units and changes in

currency rates, net sales for Industrial operations

decreased by 37%.

Operating income (loss) by business area

SEK M 2008 2009

Trucks 12,167 (10,805)

Construction Equipment 1,808 (4,005)

Buses (76) (350)

Volvo Penta 928 (230)

Volvo Aero 359 50

Eliminations and other (732) (994)

Industrial operations 14,454 (16,333)

Customer Finance 1,397 (680)

Volvo Group 15,851 (17,013)

Net sales by market area

SEK M 2008 2009 %

Western Europe 124,261 84,452 (32)

Eastern Europe 28,212 9,632 (66)

North America 47,746 37,291 (22)

South America 19,613 16,610 (15)

Asia 55,812 44,842 (20)

Other markets 20,192 15,660 (22)

Total Industrial

operations 295,836 208,487 (30)

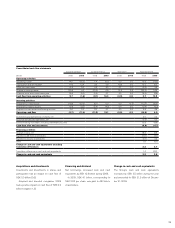

The Volvo Group

Net sales

Net sales for the Volvo Group decreased by

28% to SEK 218,361 M in 2009, compared to

SEK 304,642 M in 2008.

Operating income

Volvo Group operating loss amounted to SEK

17,013 M (income SEK 15,851 M).

Operating loss for the Industrial Operations

amounted to SEK 16,333 M compared to an

operating income of SEK 14,454 M in the pre-

ceding year. The Customer Finance operations

posted an operating loss of SEK 680 M

(income SEK 1,397 M).

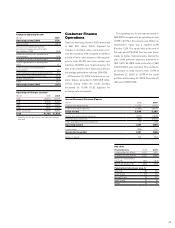

Net financial items

Net interest expense was SEK 3,169 M, com-

pared with SEK 764 M in 2008. The increased

interest expense is mainly attributable to

increased debt level and it was also negatively

impacted by an increased interest expense for

post-employment benets.

During the year, market valuation of deriva-

tives, mainly used for the customer nancing

portfolio, had a negative effect on Other nan-

cial income and expenses in an amount of SEK

90 M (neg. SEK 1,029 M).

Income Taxes

The tax income for the year amounted to SEK

5,889 M. During 2008 the income tax expense

amounted to SEK 3,994 M and a tax rate of

29%.

Income for the period and earnings

per share

The loss for the period amounted to SEK

14,685 M (income SEK 10,016 M), cor-

responding to basic and diluted earnings per

share of a negative SEK 7.26 (positive SEK

4.90). The return of shareholders’ equity was

negative 19.7% (positive 12.1%).

Industrial Operations

In 2009, net sales for the Volvo Group’s Indus-

trial Operations decreased by 30% to SEK

208.487 M (295.836).

The nancial crisis and the downturn in the

global economy that started during the autumn

of 2008 continued to have a signicantly

nega tive impact on most of the Group’s mar-

kets in 2009. The main markets in Europe,

North America and Japan were very weak dur-

ing the rst half of the year. Towards the end of

the year, a modest recovery was noted, but the

markets were still on very low levels from

an historical perspective. China, India and

Brazil recovered relatively rapidly and grew

during the second half of the year, among

other things because of stimulus measures by

the governments.

Operating loss

In 2009, the operating loss for the Volvo

Group’s Industrial Operations amounted to

SEK 16,333 M, compared to an operating

income of SEK 14,454 M in 2008. The operating

margin for the Industrial Operations amounted

to a negative 7.8% (Positive 4.9%).

Net sales decreased by 28% to SEK 218.4 billion, while the operating loss amounted SEK

17.0 billion (Income: SEK 15.9 billion). The loss for the year amounted to SEK 14.7 billion,

compared to an income for the year of SEK 10.0 billion in 2008. Basic and diluted earnings

per share was a negative SEK 7.26 (Positive SEK 4.90).

Financial performance

– low volumes and adjustment of cost

structure weighed on protability

23