Volvo 2009 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2009 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

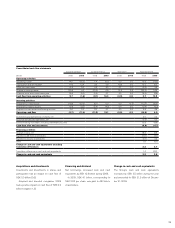

(39.7)

08

(70.9)

09

23.7

05

29.2

06

(5.7)

07

40

10

(20)

(50)

(80)

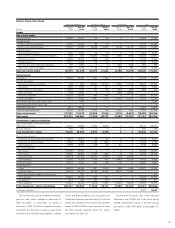

1) Excluding adjustment of goodwill in 2006. A reversal of a valuation reserve for deferred taxes and an adjustment of goodwill is included in 2006. As an effect, operating income in 2006

was negatively affected in the amount of SEK 1,712 M, while income taxes decreased by SEK 2,048 M. The total effect on income for the period was positive in an amount of SEK 336 M.

5.2

08

(7.8)

09

7.9

05

8.9

06 07

7.8

1

(10)

10

0

6

08

(28)

09

14

05

7

06

10

07

(30)

0

10

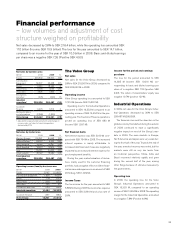

Growth

The growth target is that net sales should

increase by a minimum of 10% annually. During

2009, net sales decreased by 28%. During

1999–2009, the average growth rate was 6%

annually. Excluding the exceptionally weak 2009,

the average growth rate was 10% annually.

Operating margin

The Volvo Group’s protability target is that

operating margin for the Industrial operations

is to exceed an average of 7% annually over a

business cycle. In 2009, the operating margin

amounted to a negative 7.8%. The average

annual operating margin for the Volvo Group

was 3.9% from 1999 to 2009. Excluding the

exceptionally weak 2009, the average operat-

ing margin was 5.1%.

Capital structure

The capital structure target is set to a net

debt including provisions for post-employment

benets for the Industrial operations of a max-

imum of 40% of shareholders’ equity under

normal conditions. As of December 31, 2009,

the Volvo Group’s Industrial operations had a

net nancial debt position corresponding to

70.9% of shareholders’ equity.

Net sales growth, % Operating margin, % Net financial position as percentage

of shareholders’ equity, %

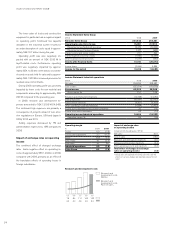

The target for Financial Services is a return on

shareholders’ equity of 12–15% and an equity

ratio above 8%. At the end of 2009, the equity

ratio was 8.7%. The return on shareholders’

equity amounted to a negative 6.2% for

2009.

Financial goals for Financial Services

Financial goals for Industrial Operations

31