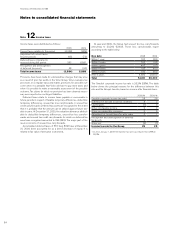

Volvo 2009 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2009 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

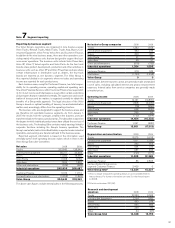

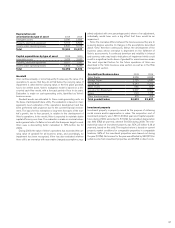

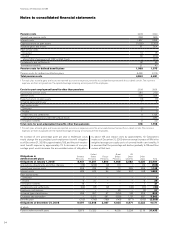

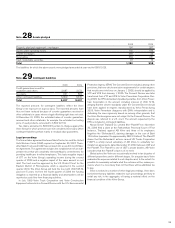

Note 22 Cash and cash equivalents

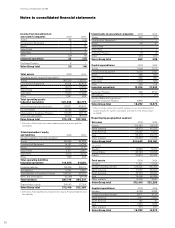

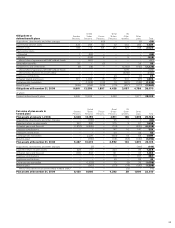

Note 23 Shareholders’ equity

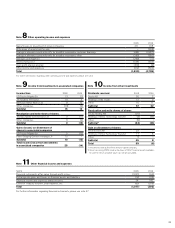

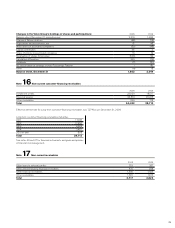

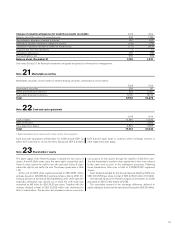

Note 21 Marketable securities

2008 2009

Cash in banks 10,889 13,540

Bank certificates 1 –2,999

Time deposits in banks 6,823 4,695

Total 17,712 21,234

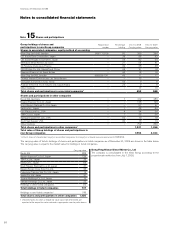

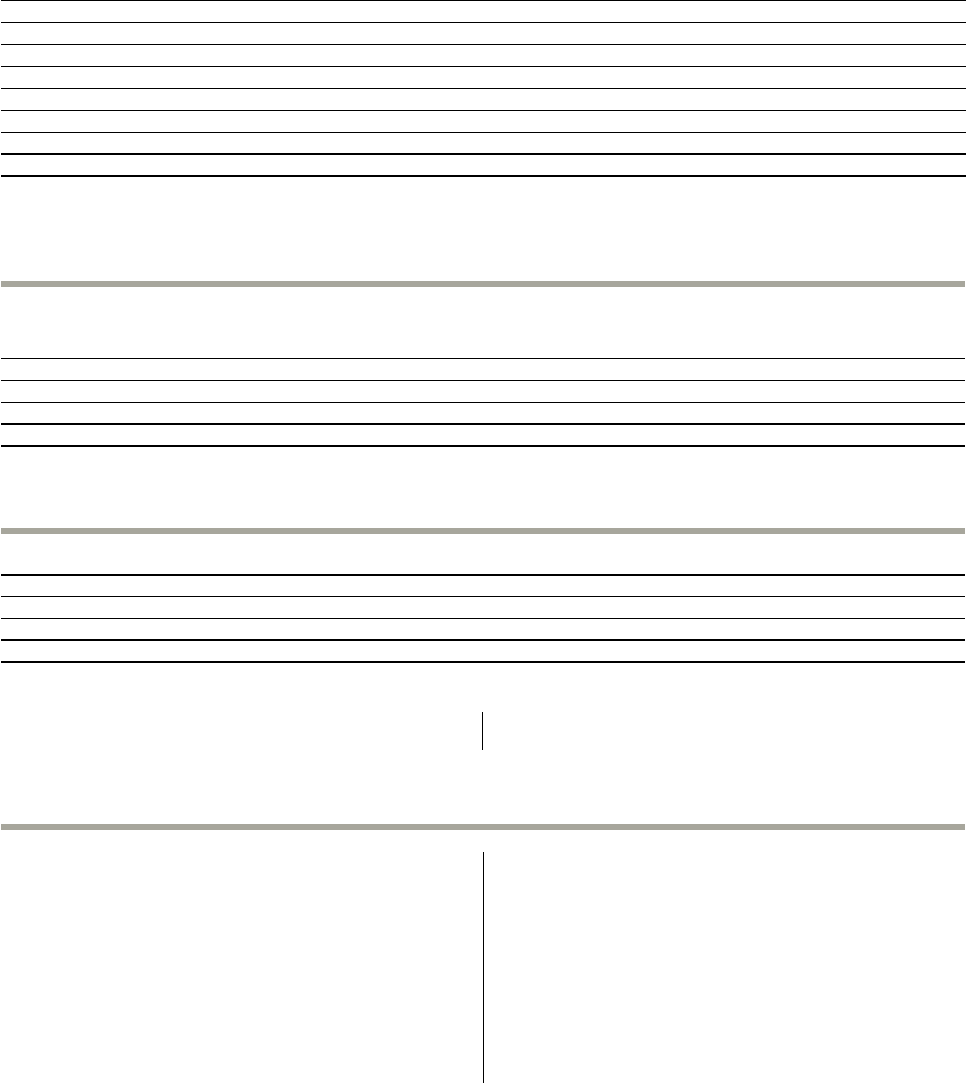

The share capital of the Parent Company is divided into two series of

shares, A and B. Both series carry the same rights, except that each

Series A share carries the right to one vote and each Series B share

carries the right to one tenth of a vote. The shares quota value is SEK

1.20.

At the end of 2006 share capital amounted to SEK 2,554 million

and was based on 425,684,044 registered shares. During 2007, fol-

lowing a decision at the Annual General Meeting, a 6:1 share split with

automatic redemption was carried out, in which the sixth share was

redeemed by AB Volvo for SEK 25.00 per share. Together with the

ordinary dividend a total of SEK 20,255 million was distributed to

Volvo’s shareholders. The decision also included a bonus issue with-

Marketable securities consist mainly of interest-bearing securities, distributed as shown below:

2008 2009

Government securities 298 147

Banks and financial institutions 504 3,387

Real estate financial institutions 5,100 13,142

Total 5,902 16,676

out issuance of new shares through the transfer of 426 from unre-

stricted shareholders’ equity to share capital which then was restored

to the same level as prior to the redemption procedure. Following

these transactions Volvo has a total of 2,128,420,220 registered

shares.

Cash dividend decided by the Annual General Meeting 2009 was

SEK 2.00 (5.50) per share or total of SEK 4,054.8 million (11,149.6).

Unrestricted equity in the Parent Company at December 31, 2009

amounted to SEK 21,462 million (27,678).

The cumulative amount of the exchange difference deferred to

equity relating to assets held for sale amount to positive SEK 60 million.

1 Bank certificates which matures within three months from acquisition.

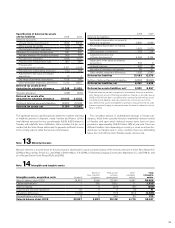

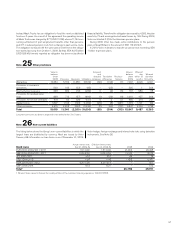

Change of valuation allowances for doubtful accounts receivable 2008 2009

Balance sheet, December 31, preceding year 923 1,749

New valuation allowance charged to income 357 638

Reversal of valuation allowance charged to income (149) (274)

Utilization of valuation allowance related to actual losses (172) (664)

Acquired and divested operations 3(7)

Translation differences 287 (88)

Reclassifications, etc. 500 (53)

Balance sheet, December 31 1,749 1,301

See notes 36 and 37 for financial instruments and goals and policies in financial risk management.

Cash and cash equivalents at December 31, 2009, include SEK 1.2

billion (0,7) restricted for use by the Volvo Group and SEK 5.3 billion

(2,7) that are liquid funds in countries where exchange controls or

other legal restrictions apply.

91