Volvo 2009 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2009 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

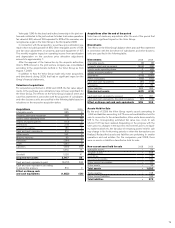

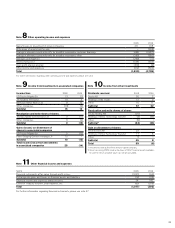

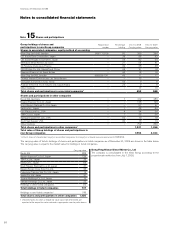

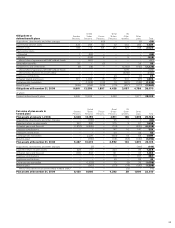

Depreciation and

amortization by type of asset 2008 2009

Intangible assets 3,286 3,589

Property, plant and equipment 5,718 6,562

Assets under operating leases 4,520 5,076

Total 13,524 15,227

Capital expenditures by type of asset 2008 2009

Intangible assets 2,875 2,935

Property, plant and equipment 9,977 7,392

Assets under operating leases 5,440 4,246

Total 18,292 14,573

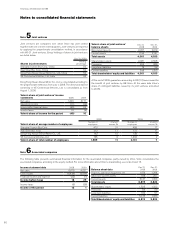

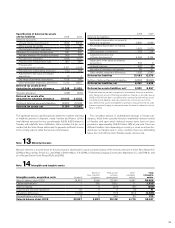

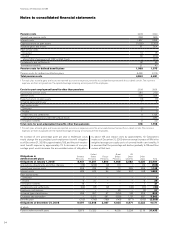

Goodwill

Volvo verifies annually, or more frequently if necessary, the value of its

operations to secure that they do not fall below the carrying value. If

impairment is detected the carrying value, in the first place goodwill,

has to be written down. Volvo’s evaluation model is based on a dis-

counted cash-flow model, with a forecast period of four to six years.

Evaluation is made on cash-generating units, identified as Volvo’s

business areas.

Goodwill assets are allocated to these cash-generating units on

the basis of anticipated future utility. The evaluation is based on man-

agement’s best estimation of the operations’ development and has

been performed with prudence due to the current financial environ-

ment. The basis for this estimation is long-term forecasts of the mar-

ket’s growth, two to four percent, in relation to the development of

Volvo’s operations. In the model, Volvo is expected to maintain stable

capital efficiency over time. The evaluation is made on nominal values

and a general rate of inflation in line with the European target is used.

Volvo uses a discounting factor calculated to 12% before tax for

2009.

During 2009, the value of Volvo’s operations has exceeded the car-

rying value of goodwill for all business areas, and accordingly, no

impairment has been recognized. Volvo has also evaluated whether

there still is an overvalue with reasonable changed assumptions, neg-

atively adjusted with one percentage point, where of no adjustment,

individually, would have such a big effect that there would be an

impairment.

Since the overvalue differs between the business areas they are to

a varying degree sensitive to changes in the assumptions described

above. Volvo therefore continuously follows the development of the

business areas whose overvalue is dependent on the fulfilment of

Volvo’s assessments. A continued downturn and volatility in interest

and currency rates may lead to indications of impairment which could

result in a significant write-down of goodwill for some business areas.

The most important factors for the future operations of Volvo are

described in the Volvo business area section, as well as in the Risk

management section.

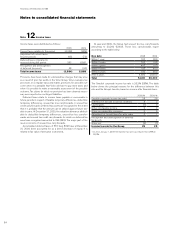

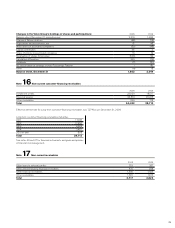

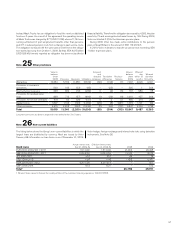

Goodwill per Business Area 2008 2009

Volvo Trucks 4,356 4,368

Renault Trucks 2,723 2,580

Trucks Asia 6,243 5,752

Mack Trucks 985 924

Construction Equipment 9,007 8,607

Buses 1,124 1,178

Other business areas 375 418

Total goodwill value 24,813 23,827

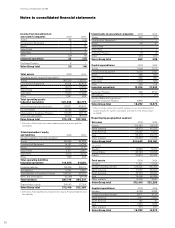

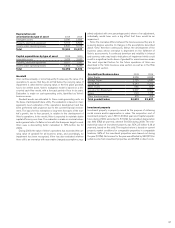

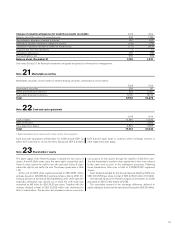

Investment property

Investment property is property owned for the purpose of obtaining

rental income and/or appreciation in value. The acquisition cost of

investment property was 1,681 (1,603) at year-end. Capital expendi-

tures during 2009 amounted to 87 (99). Accumulated depreciation

was 690 (582) at year-end, whereof 54 (50) during 2009. The esti-

mated fair value of investment property was SEK 2.5 billion (1.9) at

year-end, based on the yield. The required return is based on current

property market conditions for comparable properties in comparable

locations. 93% of the investment properties were leased out during

the year (100%). Net income for the year was affected by 268 (275) in

rental income from investment properties and 45 (50) in direct costs.

87