Volvo 2009 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2009 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

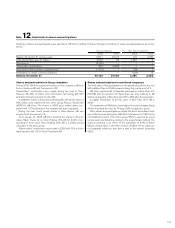

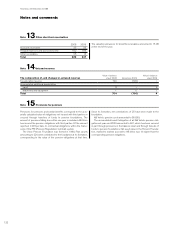

Notes to consolidated financial statements

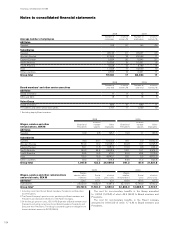

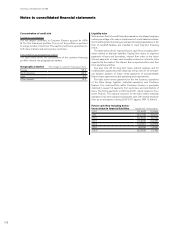

Below is a presentation of derivative instruments and options.

Outstanding derivative instruments for dealing with currency

and interest-rate risks related to financial assets and liabilities

Dec 31, 2008 Dec 31, 2009

Notional

amount Carrying

value Notional

amount Carrying

value

Interest-rate swaps

– receivable

position 47,441 2,752 64,162 3,560

– payable

position 85,980 (2,038) 100,460 (2,948)

Forwards and futures

– receivable

position 19,443 11 0 0

– payable

position 17,740 (32) 30,274 (3)

Foreign exchange derivative contracts

– receivable

position 32,671 1,608 16,165 172

– payable

position 30,022 (766) 15,424 (214)

Options purchased

– receivable

position 1,675 139 1,985 116

– payable

position 428 (26) 353 (3)

Options written

– receivable

position 42 013 0

– payable

position 1,147 (116) 2,572 (117)

Total 1,532 563

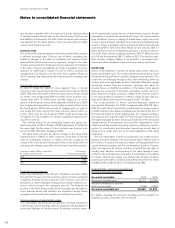

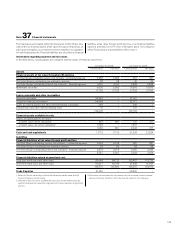

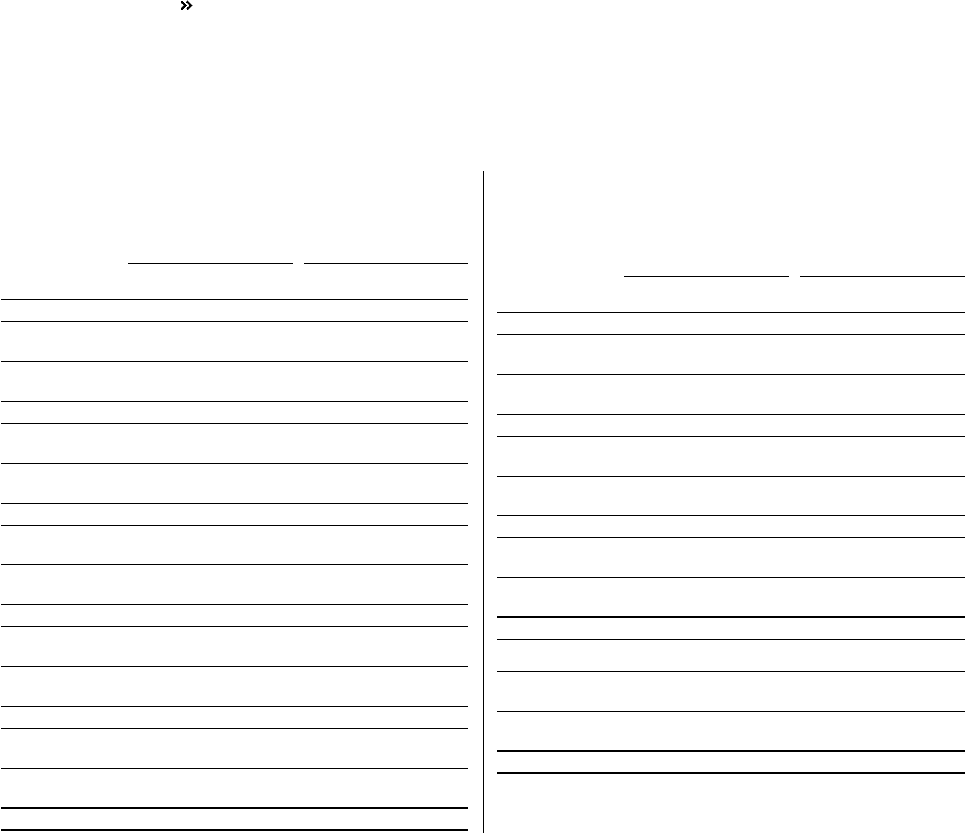

Outstanding forward contracts and options contracts for

hedging of currency risk and interest risk of commercial

receivables and liabilities

Dec 31, 2008 Dec 31, 2009

Notional

amount Carrying

value Notional

amount Carrying

value

Foreign exchange derivative contracts

– receivable

position 25,712 2,190 9,307 416

– payable

position 41,773 (4,710) 5,448 (281)

Options purchased

– receivable

position 3,142 90 1,222 51

– payable

position – – – –

Options written

– receivable

position – – – –

– payable

position 3,214 (506) 1,193 –

Subtotal (2,936) 186

Raw materials derivative contracts

– receivable

position 85 38 367 42

– payable

position 443 (93) 106 (58)

Total (2,991) 170

FINANCIAL INFORMATION 2009

112