Volvo 2009 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2009 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Declining air traffic

World airline passenger trafc decreased

sharply in the rst half of the year, and gradu-

ally leveled out towards the end of the year.

According to IATA, the airlines’ nancial prob-

lems increased and are expected to remain in

2010, even though the total losses are

expected to decrease somewhat.

Airbus and Boeing delivered 979 aircraft, an

increase of 14% compared to 2008, but the

order intake decreased sharply. At the end of

the year, the order backlog had declined from

7,429 to 6,863 aircraft.

Outcome 2009

Operations have been adapted to expected lower •

volumes, for instance through personnel reductions.

Volvo Aero has delivered according to agreed plans. •

The work to reduce lead times and lower product costs •

have continued, but is not completed.

The American aftermarket business has not turned •

for the better.

Efforts to develop components in composites has •

continued.

Ambitions 2010

Manage the continued development responsibility and •

supply test hardware for the new engine programs

Trent XWB and PWG1000G.

Increase productivity in carried-out investments, •

shorten lead times and reduce costs.

Continue to gain market share within engine services.•

Conduct a strategic overhaul of the American after-•

market business.

Ambitions 2009

Adjust operations to the expected downturn and •

lower volumes.

Continue working on improving productivity and lowering •

product cost.

Handle the development of components to the new •

engine programs Trent XWB and PW1000G.

Increase volumes and protability in the aftermarket •

business.

Continue to expand the customer offer of composites •

for cold structures.

Net sales by market

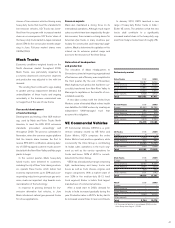

Volvo Aero, SEK M 2008 2009

Europe 3,580 3,942

North America 3,618 3,508

South America 59 34

Asia 240 205

Other markets 128 114

Total 7,625 7,803

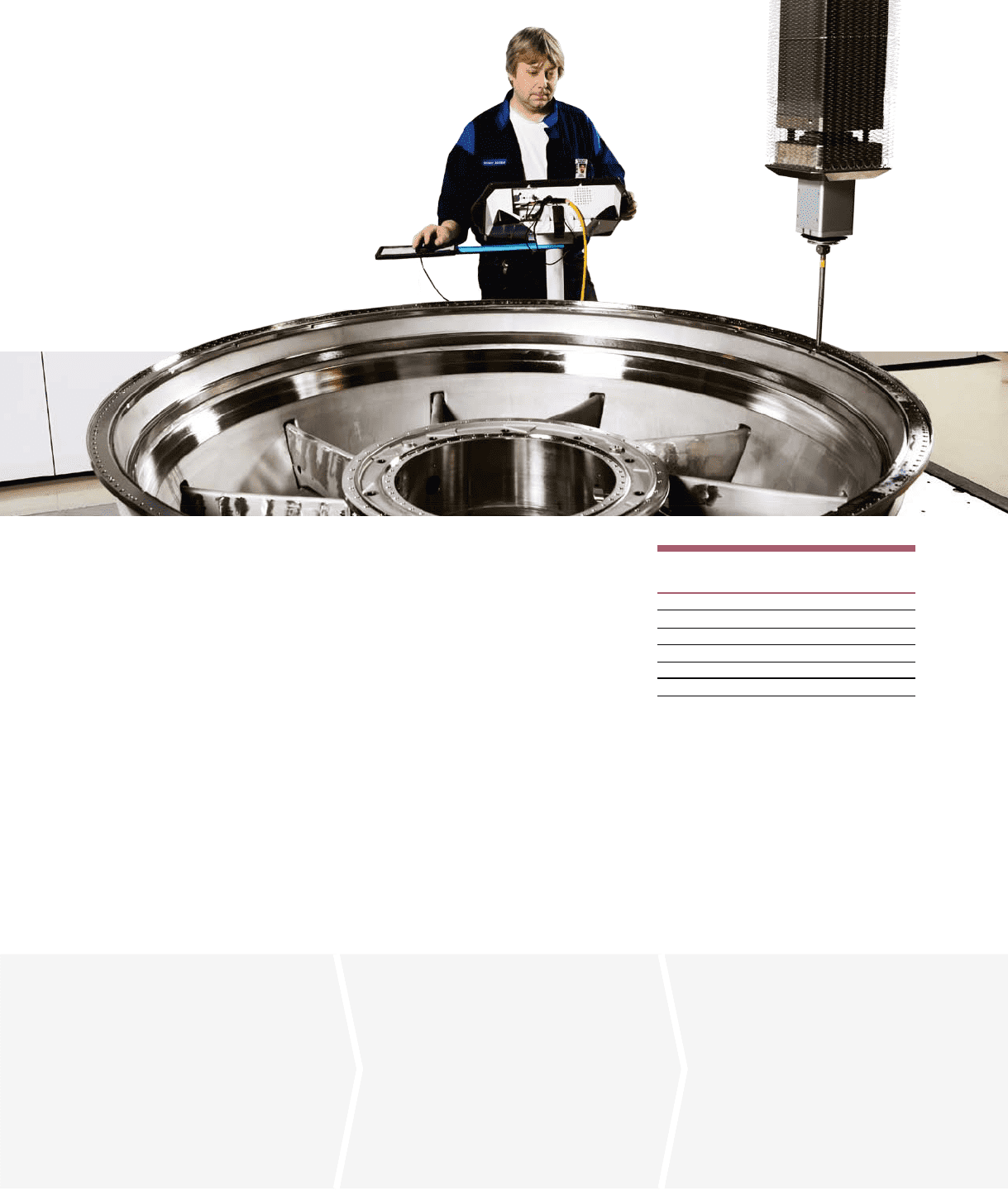

Lower profitability

Net sales increased by 2% to SEK 7,803 M

(7,625) and operating income amounted to

SEK 50 M (359). Operating margin declined

from 4.7% to 0.6%.

The lower protability is mainly attributable

to lower volumes as a consequence of the

downturn, in particular for new spare parts. It is

also an effect of lower prots in the American

aftermarket business. Delays in aircraft pro-

grams at Boeing and Airbus also had a nega-

tive impact.

During 2008 and 2009 staff reductions

have been made in Trollhättan, Sweden as well

as in Kongsberg, Norway, and Boca Raton,

Florida, USA.

49