Volvo 2009 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2009 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

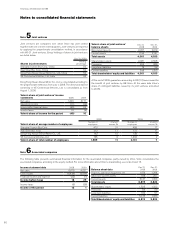

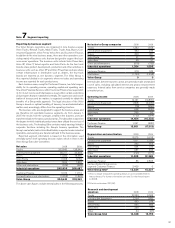

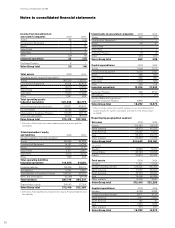

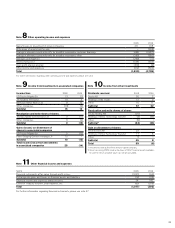

Notes to consolidated financial statements

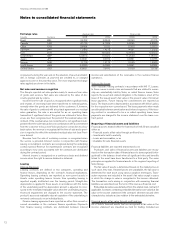

Note 2 Key sources of estimation uncertainty

Volvo’s significant accounting principles are set out in note 1, Account-

ing Principles and conform to IFRS as endorsed by the EU. The prep-

aration of Volvo’s Consolidated Financial Statements requires the use

of estimates, judgements and assumptions that affect the reported

amounts of assets, liabilities and provisions at the date of the financial

statements and the reported amounts of sales and expenses during

the periods presented. In preparing these financial statements, Volvo’s

management has made its best estimates and judgements of certain

amounts included in the financial statements, giving due consider-

ation to materiality. The application of these accounting principles

involves the exercise of judgement and use of assumptions as future

uncertainties and, accordingly actual results could differ from these

estimates. In accordance with IAS 1, preparers are required to provide

additional disclosure of accounting principles in which estimates,

judgments and assumptions are particularly sensitive and which, if

actual results are different, may have a material impact on the finan-

cial statements. The accounting principles applied by Volvo that are

deemed to meet these criteria are discussed below:

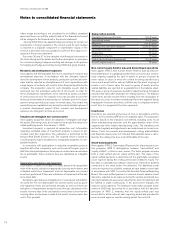

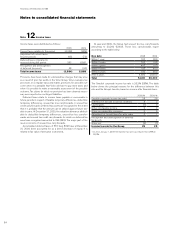

Impairment of goodwill, other intangible assets

and other non-current assets

Property, plant and equipment, intangible assets, other than goodwill,

and certain other non-current assets are amortized and depreciated

over their useful lives. Useful lives are based on management’s esti-

mates of the period that the assets will generate revenue. If, at the

date of the financial statements, there is any indication that a tangible

or intangible non-current asset has been impaired, the recoverable

amount of the asset should be estimated. The recoverable amount is

the higher of the asset’s net selling price and its value in use, esti-

mated with reference to management’s projections of future cash

flows. If the recoverable amount of the asset is less than the carrying

amount, an impairment loss is recognized and the carrying amount of

the asset is reduced to the recoverable amount. Determination of the

recoverable amount is based upon management’s projections of

future cash flows, which are generally made by use of internal business

plans or forecasts. While management believes that estimates of

future cash flows are reasonable, different assumptions regarding

such cash flows could materially affect valuations. Intangible and

tangible non-current assets amounted to 117,296 (126,657) whereof

23,827 (24,813) represents goodwill. For Goodwill and certain other

intangible assets with indefinite useful lives, an annual, or more

frequently if necessary, impairment review is performed. Such an

impairment review will require management to determine the fair value

of Volvo’s cash generating units, on the basis of projected cash flows

and internal business plans and forecasts. Overvalues differ between

the business areas and they are, to a varying degree, sensitive to

changes in the business environment. Volvo has since 2002 per-

formed a similar impairment review. No impairment charges were

required for the period 2002 until 2009. See note 14 for the alloca-

tion and impairment tests of goodwill.

Revenue recognition

Revenue from the sale of products is recognized when significant

risks and rewards of ownership have been transferred to external

parties, normally when the products are delivered to the customers. If,

however, the sale of products is combined with a buy-back agreement

or a residual value guarantee, as described below regarding residual

value risks, the sale is accounted for as an operating lease transaction

under the condition that significant risks of the products are retained

by Volvo. In certain cases Volvo enters into a buy-back agreement or

residual value guarantee after Volvo has sold the product to an inde-

pendent party or in combination with an undertaking from the cus-

tomer that in the event of a buy-back to purchase a new Volvo product.

In such cases, there may be a question of judgement regarding

whether or not significant risks and rewards of ownership have been

transferred to the customer. If it is determined that such an assess-

ment was incorrect, Volvo’s reported revenue and income for the

period will decline and instead be distributed over several reporting

periods.

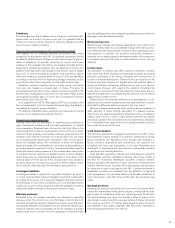

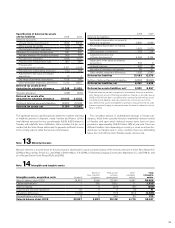

Residual value risks

In the course of its operations, Volvo is exposed to residual value risks

through operating lease agreements and sales combined with repur-

chase agreements. Residual value commitments amount to SEK

14,954 (16,422) at December 31, 2009. Residual value risks are

reflected in different ways in the Volvo consolidated financial statements

depending on the extent to which the risk remains with Volvo.

In cases where significant risks pertaining to the product remain

with Volvo, the products, primarily trucks, are generally recognized in

the balance sheet as assets under operating leases. Depreciation

expenses for these products are charged on a straight-line basis over

the term of the commitment in amounts required to reduce the value

of the product to its estimated net realizable value at the end of the

commitment. The estimated net realizable value of the products at the

end of the commitments is monitored individually on a continuing

basis. A decline in prices for used trucks and construction equipment

may negatively affect the consolidated operating income. High inven-

tories in the truck industry and the construction equipment industry

and low demand may have a negative impact on the prices of new and

used trucks and construction equipment. In monitoring estimated net

realizable value of each product under a residual value commitment,

management makes consideration of current price-level of the used

product model, value of options, mileage, condition, future price

de terioration due to expected change of market conditions, alterna-

tive distribution channels, inventory lead-time, repair and recondition-

ing costs, handling costs and overhead costs in the used product div-

isions. Additional depreciations and estimated impairment losses are

immediately charged to income.

The total risk exposure for assets under operating lease is reported as

current and non-current residual value liabilities. See notes 26 and 27.

If the residual value risk commitment is not significant, independent

from the sale transaction or in combination with a commitment from

the customer to buy a new Volvo product in connection to a buy-back

option, the asset is not recognized on balance. Instead, the risk

ex posure is reported as a residual value provision equivalent to the

estimated residual value risk. See note 25.

To the extent the residual value exposure does not meet the defin-

ition of a provision, the remaining residual value risk exposure is

reported as a contingent liability. See note 29.

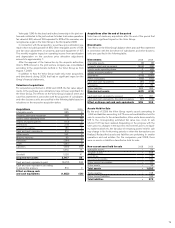

Deferred taxes

Under IFRS, deferred taxes are recognized for temporary differences,

which arise between the taxable value and reported value of assets

and liabilities as well as for unutilized tax-loss carryforwards. Volvo

records valuation allowances for deferred tax assets where manage-

ment does not expect such assets to be realized based upon current

forecasts. In the event that actual results differ from these estimates

or management adjusts these estimates in future periods, changes in

FINANCIAL INFORMATION 2009

76