Volvo 2009 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2009 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

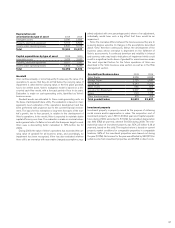

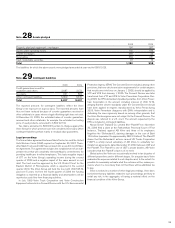

Instead Mack Trucks has an obligation to fund the newly established

fund over 5 years. As a result of the agreement the operating income

of Mack Trucks was charged by 877 (USD 110 M), whereof 1,194 con-

cerning settlement of post-employment benefits other than pensions

and 317 in reduced pension costs from a change in past service costs.

The obligation increased with the same amount. Interest on the obliga-

tion started accruing from October 1, 2009. By that, SEK 4,015 billion

(USD 525 M), formerly reported as obligation has been reclassified a

financial liability. Therefore the obligation decreased by 4,282, the plan

assets by 73 and unrecognized actuarial losses by 194. During 2009,

Volvo contributed 0 (0) to the American pension plans.

During 2009 Volvo has made extra contributions to the pension

plans in Great Britain in the amount of SEK 113 M (147).

In 2010, Volvo estimates to transfer an amount not exceeding SEK

1 billion to pension plans.

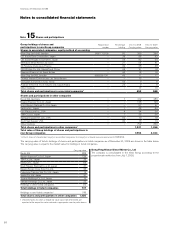

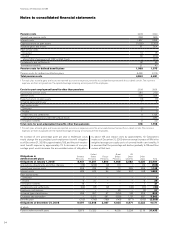

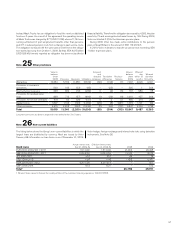

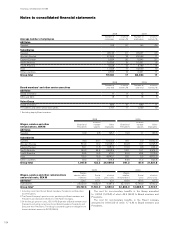

Note 25 Other provisions

Value in

balance

sheet

2008 Provisions Reversals Utili zations

Acquired

and

divested

companies Translation

differences Reclassi-

fications

Value in

balance

sheet

2009

Whereof

due

within 12

months

Whereof

due after

12 months

Warranties 10,354 5,762 (1,381) (6,519) (69) (193) (7) 7,947 4,926 3,021

Provisions in insurance

operations 509 149 (23) (95) –(35) –505 1504

Restructuring measures 368 682 (72) (262) 0(4) (5) 707 589 118

Provisions for residual value

risks 898 713 (57) (460) (1) (26) (6) 1,061 457 604

Provisions for service contracts 478 63 (24) (127) 0 2 73 465 214 251

Dealer bonus 1,897 1,743 (123) (1,904) (23) (8) (267) 1,315 1,191 124

Other provisions 4,515 2,228 (520) (2,233) (2) (40) (101) 3,847 2,109 1,738

Total 19,019 11,340 (2,200) (11,600) (95) (304) (313) 15,847 9,487 6,360

Long-term provisions as above is expected to be settled within 2 to 3 years.

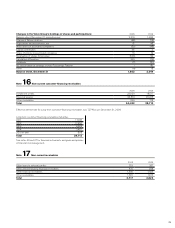

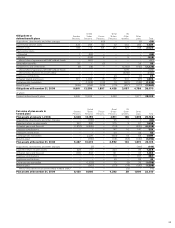

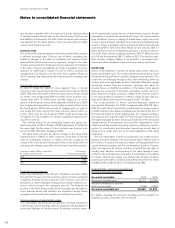

Note 26 Non-current liabilities

The listing below shows the Group’s non-current liabilities in which the

largest loans are distributed by currency. Most are issued by Volvo

Treasury AB. Information on loan terms is as of December 31, 2009.

Volvo hedges foreign-exchange and interest-rate risks using derivative

instruments. See Note 36.

Bond loans Actual interest rate,

Dec 31, 2009, % Effective interest rate,

Dec 31, 2009, % 2008 2009

EUR 2003–2009/2011–2017 1.51–9.92 1.51–9.92 21,903 26,428

SEK 2006–2009/2011–2017 0.83–8.53 0.83–8.53 12,183 16,174

JPY 2001/2011 3.10 3.10 86 79

USD 2009/2015 5.98 5.98 1,626 5,381

NOK 2009/2011–2012 4.25–5.04 4.25–5.14 –557

GBP 2009/2014 6.13 6.27 –572

Total1 35,798 49,191

1 Whereof loans raised to finance the credit portfolio of the customer financing operations 12,302 (17,787).

97