Volvo 2009 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2009 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

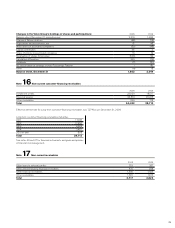

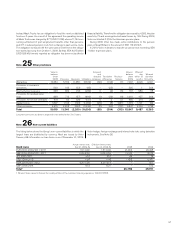

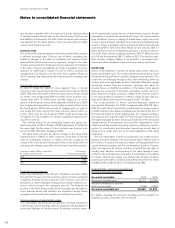

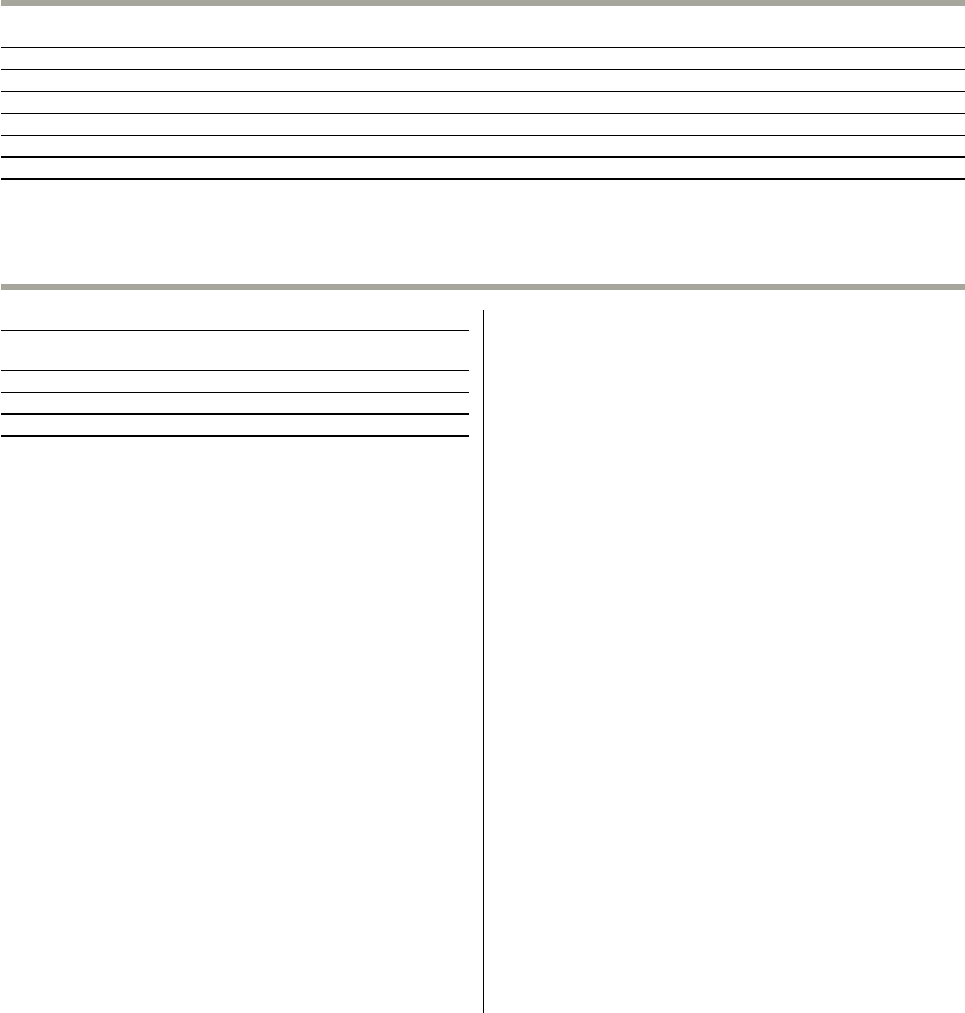

Note 28 Assets pledged

2008 2009

Property, plant and equipment – mortgages 190 297

Assets under operating leases 155 109

Chattel mortgages 369 25

Receivables 569 451

Cash, marketable securities 97 76

Total 1,380 958

The liabilities for which the above assets were pledged amounted at year-end to 658 (1,102).

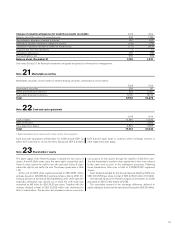

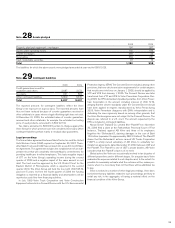

Note 29 Contingent liabilities

2008 2009

Credit guarantees issued for

customers and others 2,687 2,173

Tax claims 931 824

Other contingent liabilities 5,809 6,610

Total 9,427 9,607

The reported amounts for contingent liabilities reflect the Volvo

Group’s risk exposure on a gross basis. The reported amounts have

thus not been reduced because of counter guarantees received or

other collaterals in cases where a legal offsetting right does not exist.

At December 31, 2009, the estimated value of counter guarantees

received and other collaterals, for example the estimated net selling

price of used products, amounted to 3,832 (4,172).

Tax claims amounted to 824 (931) pertain to charges against the

Volvo Group for which provisions are not considered necessary. Other

contingent liabilities pertain mainly to residual value guarantees.

Legal proceedings

The former labor agreement between Mack Trucks, Inc. and the United

Auto Workers Union (UAW), expired on September 30, 2007. There-

after Mack Trucks and UAW have entered into a new 40-month Mas-

ter Agreement. The agreement includes the establishment of an inde-

pendent trust that will completely eliminate Mack’s commitments for

providing healthcare to retired employees. This had a negative impact

of 877 on the Volvo Group’s operating income during the second

quarter of 2009 and a negative impact of the same amount on net

debt. The trust must be approved by the U.S. District Court for the

Eastern District of Pennsylvania, which is expected in the second

quarter 2010. The Volvo Group will fund the trust with USD 525 M,

paid over 5 years. As from the fourth quarter of 2009 the funding

obligation is reported as a financial liability and amortizations will be

reported as cash flow from financing activities.

In July 1999 Volvo Truck Corporation and Volvo Construction

Equipment entered into a Consent Decree with the U.S. Environmental

Protection Agency (EPA). The Consent Decree included, among other

provisions, that new stricter emission requirements for certain engines

that would come into force on January 1, 2006, should be applied by

VTC and VCE from January 1, 2005. The Consent Decree was later

transferred from VTC and VCE to Volvo Powertrain Corporation. Dur-

ing 2008, the EPA demanded stipulated penalties from Volvo Power-

train Corporation in the amount, including interest, of USD 72 M,

alleging that the stricter standards under the Consent Decree should

have been applied to engines manufactured by Volvo Penta during

2005. Volvo Powertrain disagrees with EPA’s interpretation and is

defending the case vigorously based on, among other grounds, that

the Volvo Penta engines were not subject to the Consent Decree. The

dispute was referred to a U.S. court. The amount requested by the

EPA is included in contingent liabilities.

Nissan Diesel Thailand Co. Limited (the “Plaintiff”) on November

30, 2009 filed a claim at the Pathumthani Provincial Court of First

Instance, Thailand, against AB Volvo and three of its employees

(together the “Defendants”), claiming damages in the sum of Baht

10.5 billion (equivalent to approximately SEK 2.2 billion). The Plaintiff

claims that the Defendants’ actions caused UD Trucks Corporation

(“UDT”), a wholly-owned subsidiary of AB Volvo, to unlawfully ter-

minate two agreements dated December 27, 2002 between UDT and

the Plaintiff. The Plaintiff is one of UDT’s private dealers. AB Volvo

considers that the Plaintiff’s claim is of no merit.

Global actors like Volvo are occasionally involved in tax disputes of

different proportions and in different stages. On a regular basis Volvo

evaluates the exposure related to such disputes and, to the extent it is

possible to reasonably estimate what the outcome will be, makes pro-

visions when it is more likely than not that there will be additional tax

to pay.

Volvo is involved in a number of other legal proceedings. Volvo does

not believe that any liabilities related to such proceedings are likely to

entail any risk, in the aggregate, of having a material effect on the

financial condition of the Volvo Group.

99