Volvo 2009 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2009 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

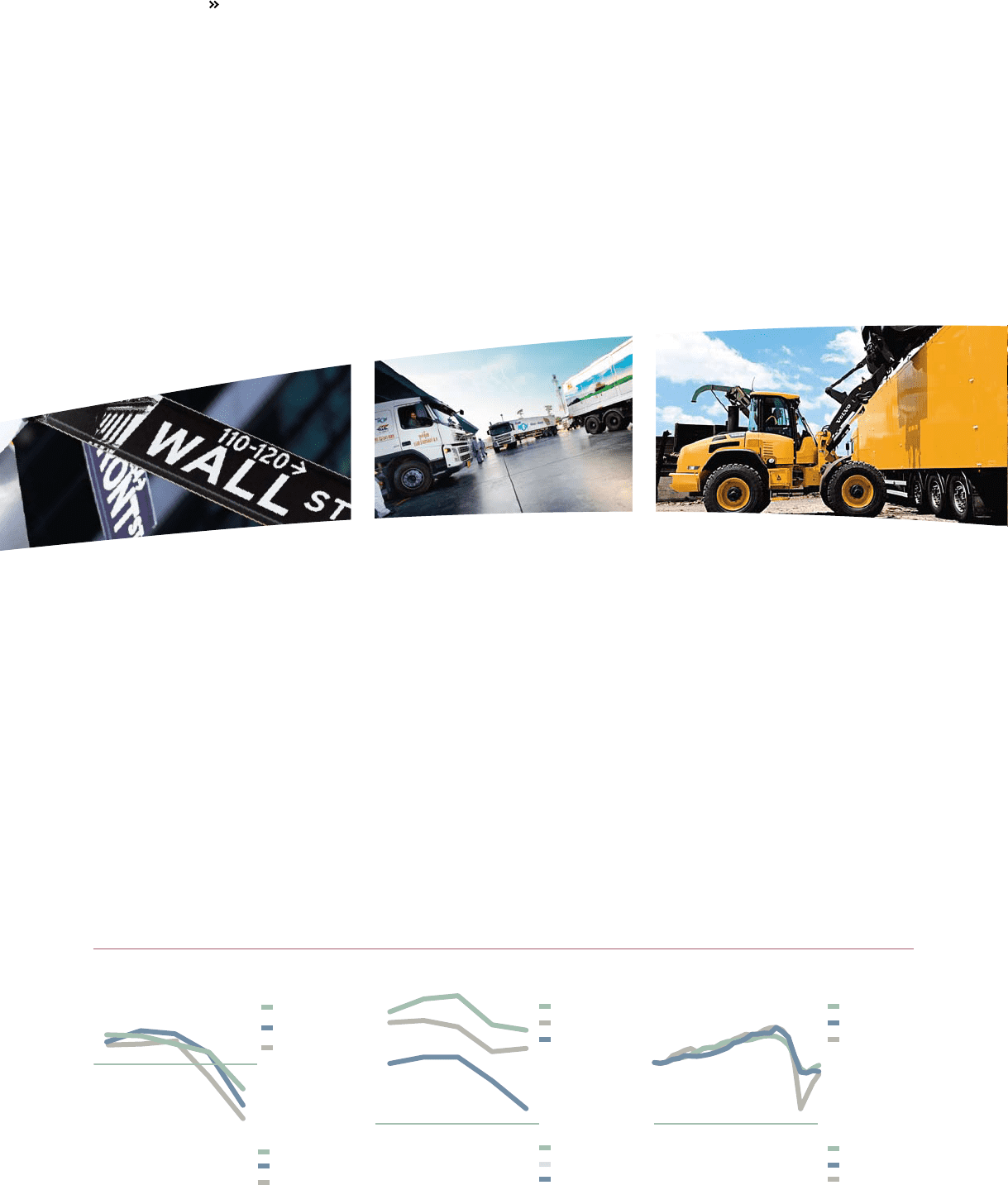

A GLOBAL GROUP 2009

USA

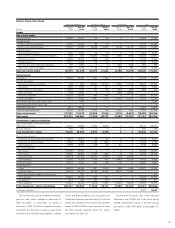

Annual GDP-growth

Source: Consensus

Economics

Europe

Japan

0908070605

(4.0)1.13.03.32.2

(2.4) %

(5.3)(1.2)2.32.01.9 %

%

1.22.02.82.9

China

India

Asia/Pacific*

Annual BNP growth

Source: Consensus

Economics

0908070605

8.7

9.211.911.610.4

7.0

6.79.09.69.4

1.4

%

%

%

4.06.26.25.6

* China, Hong Kong, South Korea, Taiwan, Indonesia,

Malaysia, Singapore, Thailand, Phillippines, Vietnam,

Australia, New Zealand, India, Japan, Sri Lanka

USA

Europe

Japan

Volume, Quarter 1

2003 =100

Sources: Federal Reserve (USA),

METI (Japan) och Eurostat

0908060503

%

%

%

04 07

99

96

94

103

103

99

113

114

117

111

112

114

109

106

108

105

103

105

101

101

103

After the substantial drop in demand during the second half of 2008, weak conditions

continued to characterize most of the Volvo Group’s markets in 2009. Never before in

the Group’s history had so many markets simultaneously been so severely affected by

the downturn, which is evident in the fact that the Group’s sales in a single year declined

by as much as 28% to SEK 218 billion.

2009 was a dramatic year

– with nancial crisis and very weak global economy

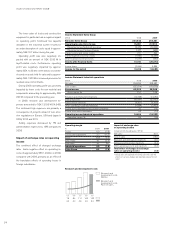

Lower global GDP

According to the International Monetary Fund’s

World Economic Outlook Update from January

2010, global GDP is expected to have declined

by 0.8% during 2009. At the same time, world

trade was down over 12%. According to Consen-

sus Economics, GDP in the EU dropped 4.0%,

the U.S. was down 2.4% and Japan 5.3%. The

economy in countries such as China, India and

Brazil fared signicantly better and continued to

grow during the year.

The GDP drop was signicant in large parts

of the world during the rst half of the year, but

most countries started to recover in the autumn.

The recovery was aided by low interest rates

and scal policies such as increased govern-

mental investments in infrastructure and tax

subsidies for certain types of investments.

Weak truck markets

Demand for transport capacity and therefore

for trucks is closely linked to the development

in GDP. The weak economic conditions in

Europe, North America and Japan, the Group’s

most important Asian market, in the rst half

of the year resulted in a signicant reduction in

the need for transportation and consequently

for the demand for new trucks. Toward the end

of the year a slow recovery began, but the

Group’s main markets were still on historically

low levels.

In Europe 29 (EU’s 27 member states, Nor-

way and Switzerland), registrations of heavy-

duty trucks decreased by 49% to 164,000

vehicles during 2009. The same levels have

not been seen since the middle of the 1990’s.

In North America, registrations dropped by

38% to 115,000 heavy-duty trucks, a level not

seen since the 1980’s. In Japan, registrations

of heavy-duty trucks fell by 43% to 18,700

vehicles, which corresponds to the levels of the

early 1960’s. The Chinese market for trucks

over 14 tons increased by 22% to 605,500

trucks. After a weak start, the Indian market

improved gradually during the year. However,

registrations of heavy-duty trucks in India

Economic growth in the U.S.,

Europe and Japan

Economic growth in Asia, % Industrial production in the U.S.,

Europe and Japan

18