Volvo 2009 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2009 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

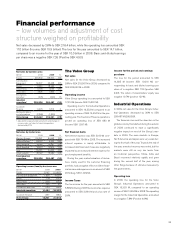

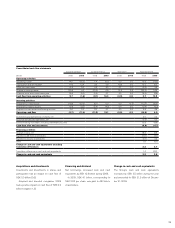

BOARD OF DIRECTORS’ REPORT 2009

Financial strategy – balancing the

markets’ demands and expectations

The purpose of Volvo’s long-term nancial

strategy is to ensure the best use of Group

nancial resources. A prerequisite for the

long-term competitive development of the

company is the availability of sufcient nan-

cial resources to secure investments, thereby

maintaining or improving competitiveness in all

business areas. The nancial resources are to

be used for organic growth, the nancing of

acquisitions and for maintaining a high level of

nancial exibility. Currently, the Group has a

considerable diversity in its business in terms

of geographic presence and products, which

together with a substantial aftermarket busi-

ness provide for making the company less

sensitive to business cycles.

The nancial strategy is based on:

balancing shareholders expectations on •

returns with creditors’ demands for reliable

security

a high degree of nancial exibility •

diversied access to nancing from the •

capital markets

enabling a customer nancing operation •

with attractive conditions for the Group’s

customers

strong and stable credit ratings •

favorable return to shareholders.•

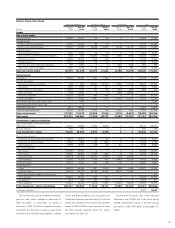

The goal concerning capital structure is

dened as the nancial net debt for the Indus-

trial operations and it shall under normal circum-

stances be below 40% of shareholders’ equity.

Measures to improve

the financial position

The dramatic downturn in demand for the

Group’s products after the crisis in the nan-

cial system has negatively affected the Volvo

Group’s nancial position during 2009. Finan-

cial net debt in the Industrial operations

increased during the year from 39,7% to

70,9% of shareholders’ equity. During the year,

the Group has carried out substantial meas-

ures to adapt the operations to the lower

demand and improve the nancial position.

The nancial readiness has improved

through the increase of liquid assets in relation

to sales. Furthermore, the maturity structure

on Group debt has been extended, which has

reduced the loans maturing in 2010 and 2011.

The work to release working capital contrib-

uted to a SEK 17 billion release of inventories

during 2009, which in the fourth quarter of

2009 helped break the negative trend in net

debt.

In order to further assist the goal to improve

the company’s nancial position, the Board of

Directors proposes that no dividend is to be

distributed for 2009.

Volvo strives for strong, stable credit

ratings

The Volvo Group has continual meetings with

the credit rating agencies Moody’s and Stand-

ard & Poor’s to update them on the company’s

development. These meetings contribute to

the credit rating agencies’ ability to assess the

Group’s future ability to repay loans. A high

long-term credit rating provides access to

additional sources of nancing and improved

access to the nancial market.

As a consequence of the weakened market

and the Volvo Group’s lower protability during

2009, the credit rating agencies lowered their

ratings. At the end of the year, Moody’s long-

term credit rating for AB Volvo was Baa2 with

stable outlook. The short-term rating was P-2.

Standard & Poor’s had a BBB long-term cor-

porate credit rating with negative outlook. The

short-term rating was A3.

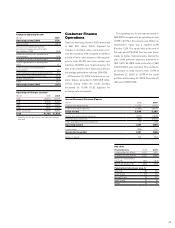

Funding

The turbulence on the global nancial markets

affects the availability of credit lines and loan

nancing, which may adversely affect custom-

ers, suppliers, distributors and the Volvo Group.

Volvo is working actively to achieve an appro-

priate balance between its short-term and

long-term borrowing, and to ensure nancial

preparedness in the form of credit facilities to

satisfy the future nancing requirements of

the Volvo Group.

During the year, the Group diversied its

funding sources through cooperation with the

European Investment Bank, the Nordic Invest-

ment Bank and Development Bank of Japan

and through the Group’s rst issue of a bond

loan in the U.S. At the end of 2009, the Volvo

Group had cash and marketable securities

equal to SEK 37.9 billion. In addition, the

Group had SEK 33.3 billion in unutilized credit

facilities.

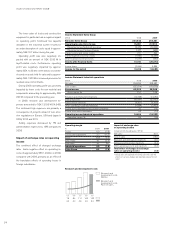

Financial strategy

– focusing on return and security

The purpose of Volvo’s long-term nancial strategy is to ensure the best use of Group

resources in providing shareholders with a favorable return and offering creditors reliable

security. The Volvo Group’s three nancial targets are: Growth, Operating Margin and

Capital Structure.

30