Volvo 2009 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2009 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

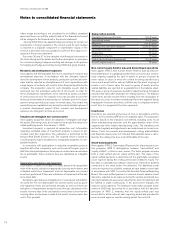

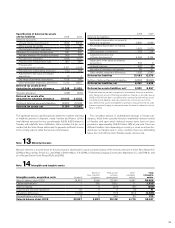

Volvo paid 1,845 for the direct and indirect ownership in the joint ven-

ture and contributed to the joint venture its Indian truck sales operations

fair valued at 530, whereof 234 equivalent to 50% of the overvalue, was

recognized as a gain in the Volvo Group in the third quarter 2008.

In connection with the acquisition, a purchase price allocation was

made which included goodwill of 855, other intangible assets of 564

and fair value adjustments on property, plant and equipment of 157.

The monthly negative impact on operating income from amortization

and depreciation on the purchase price allocation adjustments

amounts to approximately 7.

After the approval of the transaction by the requisite authorities,

Volvo’s 50% interest in the joint-venture company was consolidated

according to the proportionate method in the Volvo Group as from

August 1, 2008.

In addition to that, the Volvo Group made only minor acquisitions

and divestments during 2008, that had no significant impact on the

Group’s financial statements.

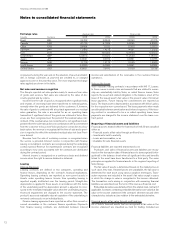

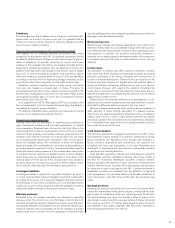

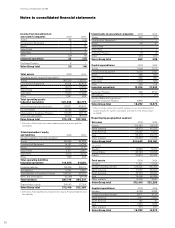

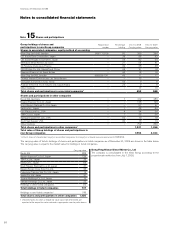

Valuation of acquisitions

For acquisitions performed in 2009 and 2008, the fair value adjust-

ments to the purchase price allocations have not been significant for

the Volvo Group. The effects on the Volvo Group’s balance sheet and

cash flow statement in connection with the acquisition of subsidiaries

and other business units are specified in the following table based on

valuations on the respective acquisition dates:

Acquisitions 2008 2009

Intangible assets 585 3

Property, plant and equipment 898 4

Assets under operating lease 019

Shares and participations (113) 0

Inventories 278 20

Current receivables 186 2

Cash and cash equivalents 819 0

Other assets 261 9

Minority interests 95 0

Provisions (284) 6

Loans (347) 0

Liabilities (499) (48)

1,879 15

Goodwill 1,028 41

Acquired net assets 2,907 56

Cash and cash equivalents paid (2,672) (56)

Cash and cash equivalents according

to acquisition analysis 819 0

Effect on Group cash

and cash equivalents (1,853) (56)

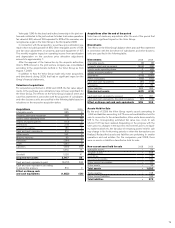

Acquisitions after the end of the period

Volvo has not made any acquisitions after the end of the period that

have had a significant impact on the Volvo Group.

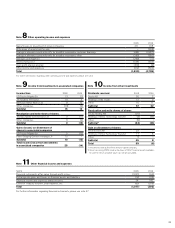

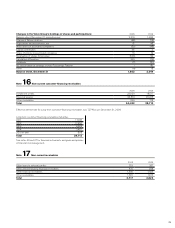

Divestments

The effects on the Volvo Group’s balance sheet and cash-flow statement

in connection with the divestment of subsidiaries and other business

units are specified in the following table:

Divestments 2008 2009

Intangible assets (3) (3)

Property, plant and equipment (445) (59)

Assets under operating lease 0(42)

Shares and participations 065

Inventories (513) (280)

Other receivables (90) (112)

Cash and cash equivalents (41) (116)

Provisions 21 80

Other liabilities 644 254

Divested net assets (427) (213)

Cash and cash equivalents received 577 321

Cash and cash equivalents, divested companies (41) (116)

Effect on Group cash and cash equivalents 536 205

Assets Held for Sale

By the end of 2009 the Volvo Group reports assets amounting to

1,692 and liabilities amounting to 272 as assets and liabilities held for

sale. In connection to the reclassification, Volvo wrote down assets by

515 to the corresponding estimated fair value less costs to sell,

whereof 147 has been realized. Depending on the progress with the

sales process, changes in the business environment, access to liquid-

ity, market outlook etc, the fair value of remaining assets held for sale

may change in the forthcoming periods or when the transactions are

finalized. Reclassified assets and liabilities are pertaining to smaller

operations and real estates. For the comparison year 2008, there

were no assets or liabilities classified as held for sale.

Non-current asset held for sale 2008 2009

Intangible assets –54

Tangible assets –618

Inventories –776

Accounts receivable –109

Other current receivables –111

Other assets –24

Total assets –1,692

Trade payables –108

Other current liabilities – 164

Total liabilities –272

79