Volvo 2009 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2009 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes and comments

Note 21 Personnel

Note 20 Financial risks and instruments

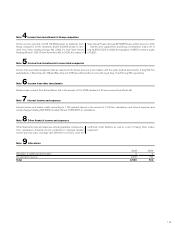

Wages, salaries and other remunerations amounted to 160 (227).

Social costs amounted to 87 (140) of which pension costs, 55 (95). Of

the pension costs 8 (32) pertained to Board members and Presidents.

The Company’s outstanding pension obligations to these individuals

amounted to – (1).

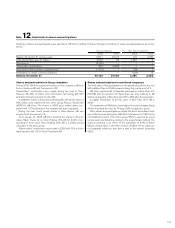

Volvo’s accounting policies for financial instruments are described in

note 1, note 36 and note 37 to the consolidated financial statements.

Hedging transactions in AB Volvo are carried out through Volvo Treas-

The number of employees at year-end was 190 (196). Information

on the average number of employees, wages, salaries and other remu-

nerations including option programs as well as Board members and

senior executives by gender is shown in note 34 to the consolidated

financial statements.

ury AB. The Parent Company has used interest-rate swaps to hedge

financial liabilities of Group companies. The swaps matured during

2009.

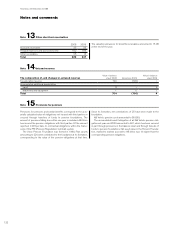

Absence due to illness 2008 2009

Total absence due to illness in percentage of regular working hours 1.5 1.2

of which, continuous sick leave for 60 days or more, % 33.5 21.4

Absence due to illness in percentage of regular working hours

Men, % 0.9 0.7

Women, % 2.1 1.8

29 years or younger, % 0.7 0.2

30–49 years, % 1.7 1.2

50 years or older, % 1.3 1.3

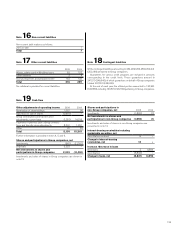

Outstanding derivative instruments for hedging of financial currency risks and interest rate risks

related to financial assets and liabilities

December 31, 2008 December 31, 2009

Notional amount Carrying value Fair value Notional amount Carrying value Fair value

Interest-rate swaps

– payable position 1,551 (1) (1) – – –

FINANCIAL INFORMATION 2009

124