Volvo 2009 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2009 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

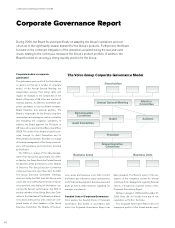

CORPORATE GOVERNANCE REPORT 2009

report for the period January 1 to June 30 and

the annual report. The auditors report their

ndings with regard to the annual report to the

shareholders through the audit report, which

they present to the Annual General Meeting. In

addition, the auditors report detailed ndings

from their reviews to the Audit Committee

twice a year and, once a year, to the full Board

of Directors.

When PwC is retained to provide services

other than the audit, it is done in accordance

with rules decided by the Audit Committee per-

taining to pre-approval of the nature of the serv-

ices and the fees.

Disclosure Committee

A Disclosure Committee was established in

2004. The Committee contributes to ensuring

that Volvo fullls its obligations according to

applicable legislation as well as to listing rules

to timely disclose to the nancial market all

share price sensitive information.

The Committee comprises the heads of the

departments Corporate Finance, Internal Audit,

Investor Relations, Corporate Legal, Business

Control and Financial Reporting. Chairman of

the Disclosure Committee is the company’s

Senior Vice President of Corporate Communi-

cations.

Outstanding share and share-price

related incentive programs

An account of outstanding share and share-

price related incentive programs is provided in

Note 34 Employees in the Group’s notes.

The Board’s report on the key aspects of

the company’s system for internal con-

trols and risk management regarding

financial reports

The Board is responsible for the internal con-

trols according to the Swedish Companies Act

and the Code. The purpose of this report is to

provide shareholders and other interested par-

ties an understanding of how internal control is

organized at Volvo with regard to nancial

reporting. The report has been prepared in

accordance with the Code and the guidance

issued by the Confederation of Swedish Enter-

prise and FAR SRS and is thus limited to in ternal

control over nancial reporting. This report is

included as a section in the Corporate Govern-

ance Report, but does not comprise a portion of

the formal annual report. This report has not been

reviewed by the company’s external auditors.

Introduction

Volvo primarily applies internal control principles

introduced by the Committee of Sponsoring

Organizations of the Treadway Commission

(COSO). The COSO principles consist of ve

interrelated components. The components are:

control environment, risk assessment, control

activities, information and communication and

follow-up.

Volvo has a specic function for internal con-

trol. The objective of the Internal Control func-

tion is to provide support for management

groups within business areas and business

units, that allows them to continuously provide

good and improved internal controls relating to

nancial reporting. Work that is conducted

through this function is based primarily on a

methodology, which aim is to ensure compli-

ance with directives and policies, as well as to

create good conditions for specic control

activities in key processes related to nancial

reporting. The Audit Committee is informed of

the result of the work performed by the Internal

Control function within Volvo with regard to

risks, control activities and follow-up on the

nancial reporting.

Volvo also has an Internal Audit function with

the primary task of independently verifying that

companies in the Group follow the principles

and rules that are stated in the Group’s dir-

ectives, policies and instructions for nancial

reporting. The head of the Internal Audit func-

tion reports directly to the CEO, the Group’s

CFO and the Audit Committee.

Control environment

Fundamental to Volvo’s control environment is

the business culture that is established within

the Group and in which managers and employ-

ees operate. Volvo works actively on communi-

cations and training regarding the company’s

basic values as described in The Volvo Way, an

internal document concerning Volvo’s business

culture, and the Group’s Code of Conduct, to

ensure that good morals, ethics and integrity

permeate the organization.

The foundation of the internal control pro-

cess relating to the nancial reporting is built up

around the Group’s directives, policies and

instructions, as well as the responsibility and

authority structure that has been adapted to the

Group’s organization to create and maintain a

satisfactory control environment. The principles

for internal controls and directives and policies

for the nancial reporting are contained in

Volvo Financial Policies & Procedures (FPP), an

in ternal book comprising all important instruc-

tions, rules and principles.

Risk assessment

Risks relating to the nancial reporting are eval-

uated and monitored by the Board through the

Audit Committee inter alia through identifying

what types of risks that typically could be con-

sidered as material and where they would typ-

ically occur. The annual evaluation of internal

control activities conducted by the Internal

Control and Internal Audit functions, are based

on a risk-based model. The evaluation of the risk

that errors will appear in the nancial reporting

is based on a number of criteria. Complex

accounting principles can, for example, mean

that the nancial reporting risks being inaccur-

ate for those posts that are covered by such

principles. Valuation of a particular asset or

liabil ity according to various evaluation criteria

can also constitute a risk. The same is true for

complex and/or changing business circum-

stances.

Control activities

In addition to the Board of AB Volvo and its

Audit Committee, the Boards and management

groups of Group companies constitute the over-

all supervisory body.

60