Volvo 2009 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2009 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

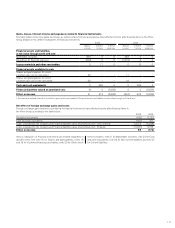

Notes to consolidated financial statements

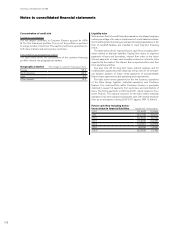

Concentration of credit risk

Customer concentration

The ten largest customers in Customer Finance account for 4.8%

(4.7) of the total asset portfolio. The rest of the portfolio is pertinent

to a large number of customer. This way the credit risk is spread across

both many markets and among many customers.

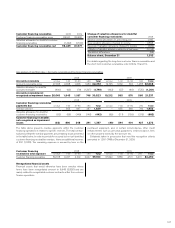

Concentration by geographical market

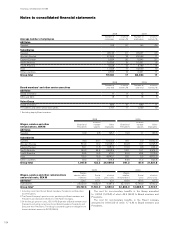

The table below shows the concentration of the customer financing

portfolio divided into geographical markets.

Geographical market Percentage of customer financing portfolio

Europe 53.4

North America 26.4

Asia 6.0

Other markets 14.2

Liquidity risks

Volvo assures itself of sound financial preparedness by always keeping a

certain percentage of its sales in liquid assets. A sound balance between

short- and long-term borrowing, as well as borrowing preparedness in the

form of overdraft facilities, are intended to meet long-term financing

needs.

The table below shows expected future cash-flows including deriv-

atives related to financial liabilities. Capital flow refers to expected

payments of loans and derivatives. Interest flow refers to the future

interest payments on loans and derivatives based on interests rates

expected by the market. The interest flow is reported within cash flow

from operating activities.

See also note 26 for long-term loans maturity analysis and for

credit facilities granted but not utilized as well as note 31 for contract-

ual duration analysis of future rental payments of noncancellable

finance lease agreements and operating lease agreements.

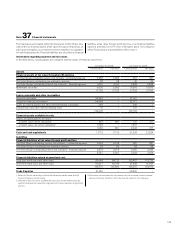

The table below shows payments for the two business operations

of the Volvo Group together, Industrial operations and Customer

finance. The credit portfolio within Customer Finance is principally

matched in respect of payments from customers and amortization of

loans. The future payments in 2010 and 2011 mainly relates to Cus-

tomer Finance. The maturity structure for the loans within Industrial

operations has been advanced during the year with limited amortiza-

tions as a consequence during 2010-2011 (approx. SEK 12 billion).

Future cash-flow including deriva-

tives related to financial liabilities Capital flow Interest flow

2010 (51,493) (5,586)

2011 (23,735) (4,597)

2012 (22,836) (4,105)

2013 (10,463) (3,235)

2014 (19,831) (2,089)

2015 (8,085) (1,285)

2016– (20,435) (1,148)

FINANCIAL INFORMATION 2009

108